-

The financial services sector would benefit from companies banks included submitting dedicated disclosures on the impact of climate change.

May 19

-

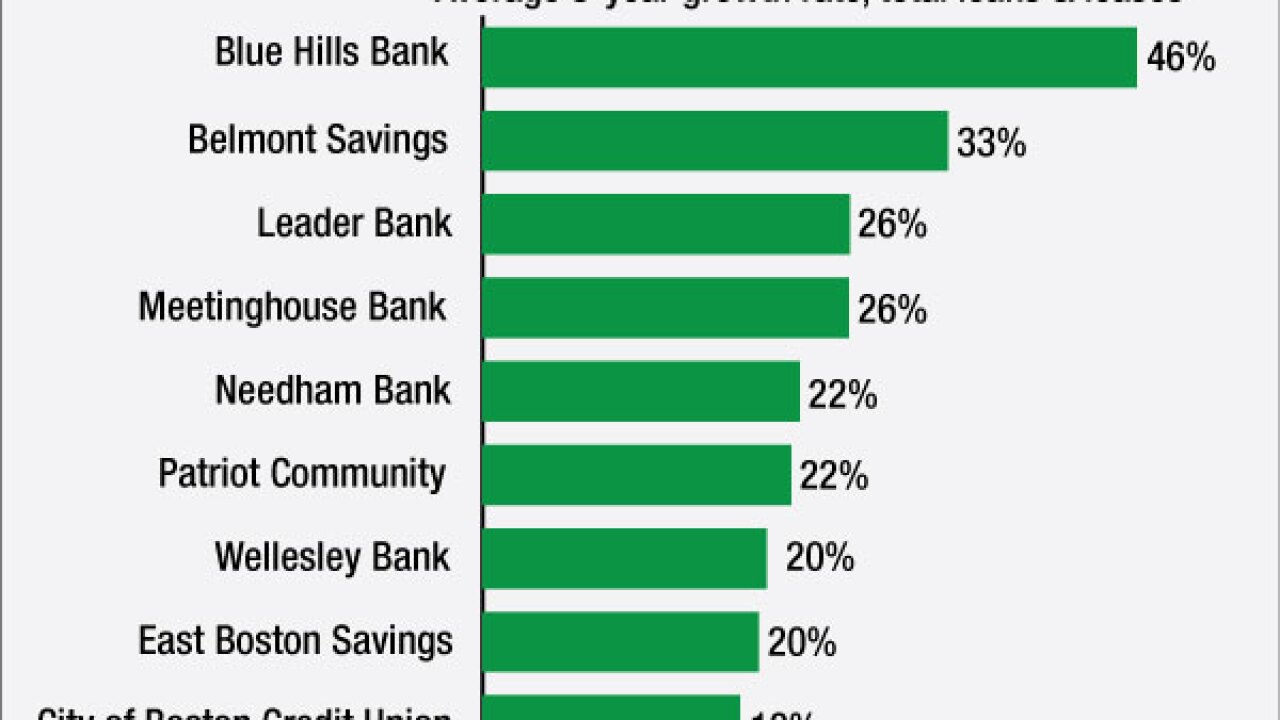

Loan growth at several Boston banks, including many former mutuals, is higher than the national average. Still, bankers are closely watching for any indication that a bubble is forming.

May 6 -

Shares in Bank of the Ozarks slid Wednesday after an investor known for shorting stocks warned about risk in the company's construction portfolio. The stock recovered some by the end of trading, and several analysts said the concerns are unfounded.

May 4 -

At least one banker has gone public with expectations that the OCC will force his institution to hold more capital. More could soon follow.

May 3 -

Two St. Louis-area investors have been indicted on charges they defrauded the failed Excel Bank on real estate loans.

April 20 -

Signature Bank in New York reported record profits in the first quarter as strong loan, asset and deposit growth more than offset increased expenses and deterioration in its portfolio of taxi-medallion loans.

April 20 -

Several small and midsize banks generated large year-over-year loan growth despite a belief by some outsiders that a slowdown was looming. Bankers may have to spend coming months assuring investors that they can keep booking loans while adequately managing risk.

April 19 -

Dime Community Bancshares has agreed to sell its headquarter building in Brooklyn for $12.3 million.

April 18 -

Enterprise Bancorp in Lowell, Mass., has purchased the site of a former hotel that recently burned to the ground and plans to put a new branch there.

March 30 -

ChoiceOne Financial Services in Sparta, Mich., will begin work on remodeling its bank's headquarters in May.

March 22 -

Unity Bancorp in Clinton, N.J., has bought its corporate headquarters building for $4.12 million.

March 16 -

United Security Bancshares in Thomasville, Ala., has agreed to buy a three-acre parcel near Birmingham, Ala., for a new executive office and retail branch.

March 11 - Rhode Island

Citizens Financial Group will build a new office complex in Johnston, R.I., and consolidate about 3,200 workers at the location.

March 9 -

Market volatility and new regulatory burdens are thinning the ranks of commercial mortgage lenders that underwrite loans for securitizations. Activity is slowing down as a result, and it is unclear if banks and insurers will fill the void, especially outside the largest cities.

March 4 -

There's nothing like the threat of a corporate relocation to prod government economic development officials into action.

February 22 -

There is concern that a decline in condo pricing could create loan problems similar to those that cropped up before the financial crisis. Bankers in the area, however, believe foreign investors would take the biggest hit.

February 16 -

In an interview, Comptroller Thomas Curry expressed concern about eroding loan standards and the potential for crippling cyberattacks. But he also argued that the industry is much stronger than it was a decade ago.

February 11 -

Competition among lenders for commercial mortgages has driven down interest rates, margins and underwriting standards, and now it's helped drive one lender out of the business.

February 11 -

The Current Expected Loss Credit model will help to quantify bankers' intuition and can be built with readily available data.

January 20

-

The Federal Reserve's interest rate increase has commercial real estate debt and equity financing players even more upbeat about their prospects in 2016.

January 7