Credit cards

Credit cards

-

The revelation Thursday that Wells Fargo employees were opening accounts for customers without their consent is sparking doubt about the accuracy of the reported growth in the credit card business. The scandal also casts in a harsh new light on Wells strategy of building a large credit card operation through its branch network.

September 9 -

Alliance Data Systems in Plano, Texas, has reached an agreement to provide credit card programs for Williams-Sonoma, the high-end kitchenware retailer.

September 8 -

New, stricter regulations on loans to active-duty service members take effect on Oct. 3. Heres a guide for getting ready.

September 2 -

Green Dot Corp. has tapped one of its board members, Mary Dent, to take the helm of its banking unit.

August 31 -

Citigroup mistakenly sent emails to some active Costco Wholesale members telling them their wholesale club membership had lapsed and that their cards would be canceled, bringing a fresh headache to the new partnership.

August 22 -

The regional bank has consolidated all of its digital operations under a single leader. Find out what he thinks about customer expectations, bots, fintechs and the coming convergence of digital banking.

August 18 -

Some observers are concerned that borrowers in energy-dependent regions, in an effort to compensate for pay cuts, are becoming overleveraged. But lenders say they are being prudent.

August 16 -

ICBA Bancard has bought an agent bank portfolio from Fifth Third Bancorp in Cincinnati that carries about $98 million in credit card receivables.

August 11 -

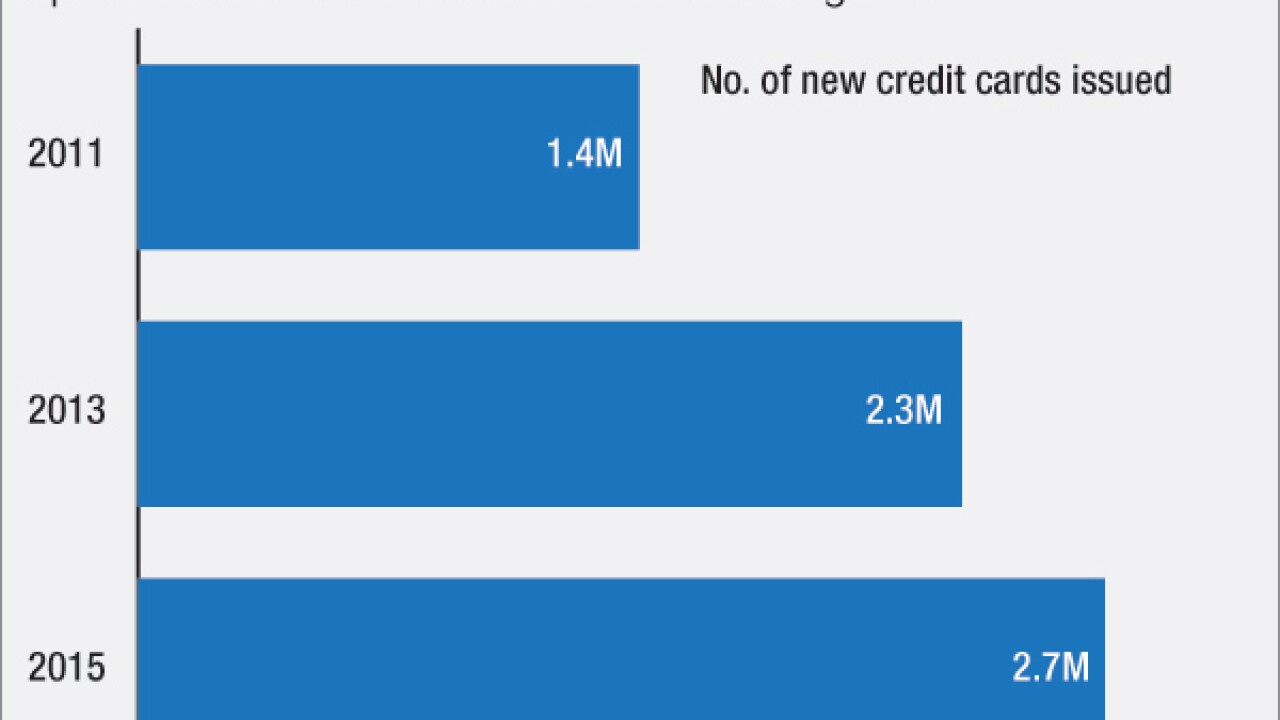

The impressive loan growth in the second quarter is surprising in an economy that grew by 1.2% in the second quarter and by only 0.8% in the first quarter.

August 4 -

Banco do Brasil, the largest bank by assets in South America, wants to make more of a name for itself in the United States. It expects a new online banking platform to help draw mainstream consumers, and says an expansion from South Florida into the Northeast is likely.

July 31 -

Despite the hurdles facing technology giants in offering payments services, they remain keenly interested in the sector and more traditional service providers should stay on alert.

July 26 -

Now is the time to correct the mistakes of interchange price controls that harm consumers and community financial institutions to the benefit of merchants.

July 25 -

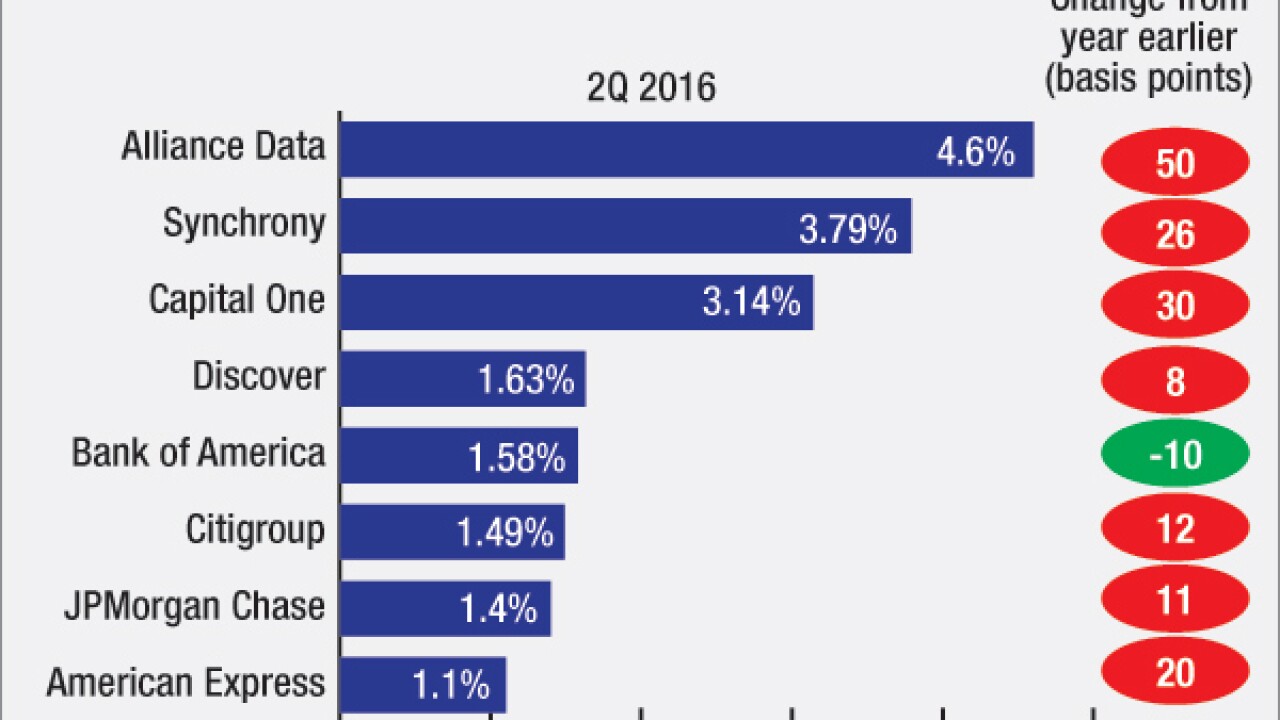

Some big banks are venturing further down the risk spectrum after a long period of unusually strong credit performance.

July 22 -

Synchrony Financial enjoyed strong loan growth in the second quarter, but gains in interest income were more than offset by a larger provision for losses.

July 22 -

Profits rose by 9% at Capital One Financial during the second quarter thanks to strong growth in the firm's credit card and commercial banking businesses.

July 21 -

Visa Inc., the world's largest payments network, posted fiscal third-quarter profit that beat analysts' estimates as customer card spending accelerated. The company said it will buy back as much as $5 billion of its shares.

July 21 -

American Express Co., the biggest U.S credit-card issuer by purchases, said second-quarter profit rose 37 percent as customers increased spending and the company booked a $1 billion gain from the sale of its Costco Wholesale Corp. portfolio.

July 20 -

Amalgamated Bank and Banco Popular, financial institutions with niche appeal, are rolling out national online platforms, calling into question what it means to be a community bank today.

July 20 -

Profits rose nearly 3% at Discover Financial Services in the second quarter thanks to solid loan growth and a one-time tax benefit.

July 19 -

Keefe Bruyette & Woods and Nasdaq have launched an index that tracks fintech companies.

July 19