Credit cards

Credit cards

-

Bank chiefs should brace for a barrage of questions about economic uncertainty, if JPMorgan Chase's experience after releasing fourth-quarter results is any indication. Double-digit increases in loans and profits were not enough to stave off questions about the odds of recession, energy risks and adequacy of reserves.

January 14 -

Many emerging innovators want to incorporate digital advances into the incumbent financial services sphere, not necessarily leapfrog banks.

January 12 -

Consumers increasingly fell behind on their payments in several loan categories in the third quarter as economic growth cooled.

January 12 -

Following a new blueprint, card issuers are seeing returns on assets above 4% for the first time since before the financial crisis. How long the good times last will depend partly on how well the U.S. economy weathers turmoil in China and other markets.

January 11 -

The Seattle-based tech giant, in its latest foray into the financial services business, has begun offering installment loans to British consumers.

January 6 -

Consumer credit is better than ever before, even as Americans households have started levering up. But the big question for banks looking to re-commit to consumer lending is how.

January 5 -

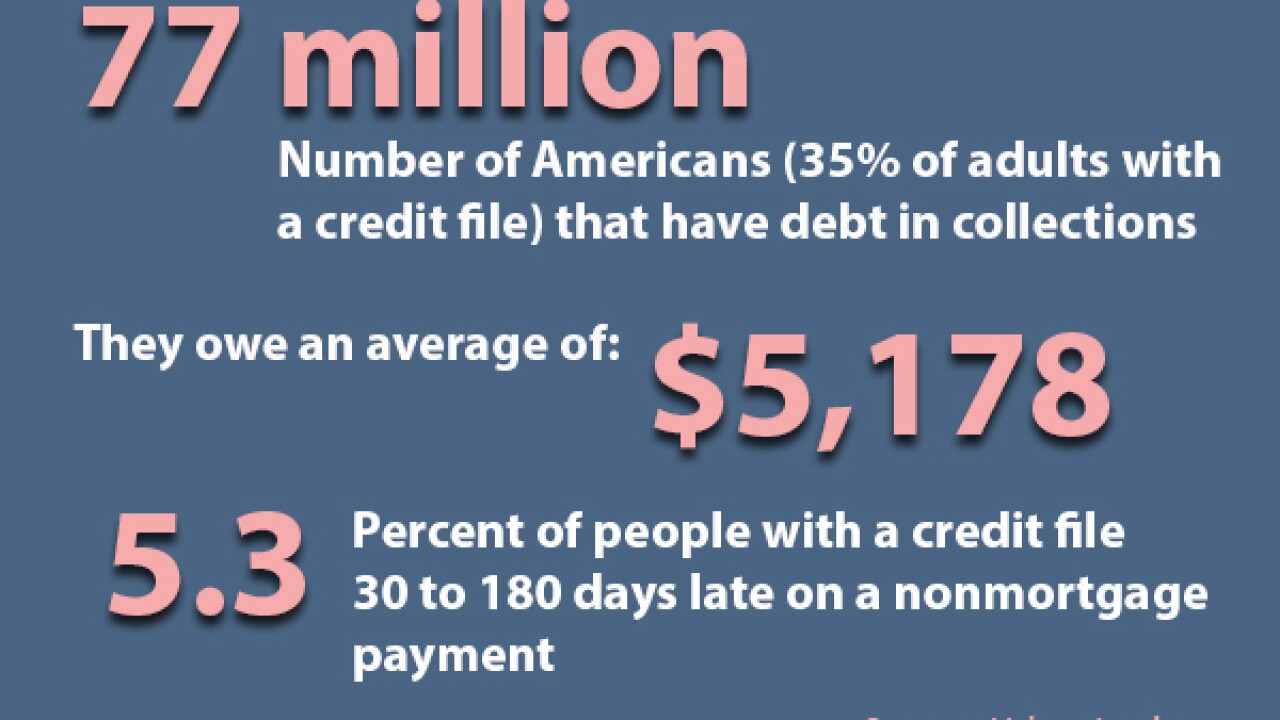

As debt collection abuse cases rise in prominence and regulators ponder new rules, it's time to give the idea of a national debt registry a closer look.

December 31 -

Despite increased investment and development in the consumer payments space around mag stripe, EMV and contactless payments solutions, there is still a huge concern when it comes to data theft.

December 30 -

Far from the madding crowd, the GE spinoff Synchrony runs an innovation lab in Stamford, Conn., that is buzzing with pragmatic projects and a culture that promotes collaboration and quick execution of new ideas.

December 29 -

WASHINGTON The Bancorp Bank in Wilmington, Del., has agreed to pay $4.3 million on charges brought by the Federal Deposit Insurance Corp. that the prepaid card issuer deceived consumers.

December 23 -

Dave Seleski founded Stonegate in 2005 and the decade since has built it into one of Florida's best-performing banks through a combination of prudent lending and opportunistic buying. Now he's got his sights set on Cuba and playing a key role in bringing that country's economy into the 21st century.

December 15 -

Branches using technology to issue cards on the spot leads to increased card usage, so banks should aim to maintain instant issuing capability with the EMV conversion.

December 14 -

Eileen Serra, 61, the chief executive of the Chase Card Services unit, will step down in January and become an adviser to the company on growth initiatives, according to a memo Wednesday from Gordon Smith, JPMorgan's CEO of consumer and community banking.

December 9 -

Eileen Serra is stepping down as chief executive officer of JPMorgan Chase's credit-card business and will be replaced by Kevin Watters, who is currently head of mortgage banking.

December 9 -

WASHINGTON More than 442,400 consumers were affected by the Oct. 12 glitch that froze RushCard users' funds after a payment processor switch, the company told lawmakers.

December 7 -

The debate over whether signatures or PINs are a stronger security feature overlooks the fact that neither is the most important defense against fraud.

December 7 -

In a report assessing the impact of a 2009 reform law, the agency cited concerns on debt collection, deceptive rewards programs and so-called deferred interest products.

December 3 -

A federal appeals court has ruled that Visa and MasterCard were coerced by law enforcement into cutting ties with a website that runs sex-related ads. The decision is a powerful statement in the debate over how far government officials can go in enlisting financial institutions as their deputies.

December 2 -

Auto-loan, commercial-mortgage-backed and other securitizations use what is known as the swaps curve to price floating-rate deals. But pricing volatility is causing some to ask whether the market should go back to Treasuries after a 15-year hiatus.

November 25 -

The Bank for International Settlements acknowledges that people may have legitimate reasons to prefer an anonymous payment system.

November 25