Credit cards

Credit cards

- PSO content

Bank Hapoalim Ltd.’s credit-card unit may be valued at about $1 billion as the lender prepares to divest the business to comply with new Israeli regulations, according to people with knowledge of the matter.

January 3 -

Capital One Financial in McLean, Va., is facing regulatory delays as it looks to buy a credit card business from outdoor equipment chain Cabela's.

January 3 -

In another move that furthers India's movement away from cash, police in Pune plan to initiate a cashless policy by the end of the first week of January.

December 28 -

The wheels are already turning on one of the biggest fleet card portfolio flips in North America, with South Portland, Maine-based WEX Inc. poised to take over in 2018 as the issuer of Chevron and Texaco fleet cards, replacing FleetCor Technologies, which is looking to make up revenue growth elsewhere.

December 28 -

Opposition is lining up against the Consumer Financial Protection Bureaus arbitration plan. A Republican-controlled Congress is expected to overturn a final rule even as industry groups file lawsuits to stop it from going into effect. Some attorneys think the arbitration rulemaking is already dead on arrival.

December 22 -

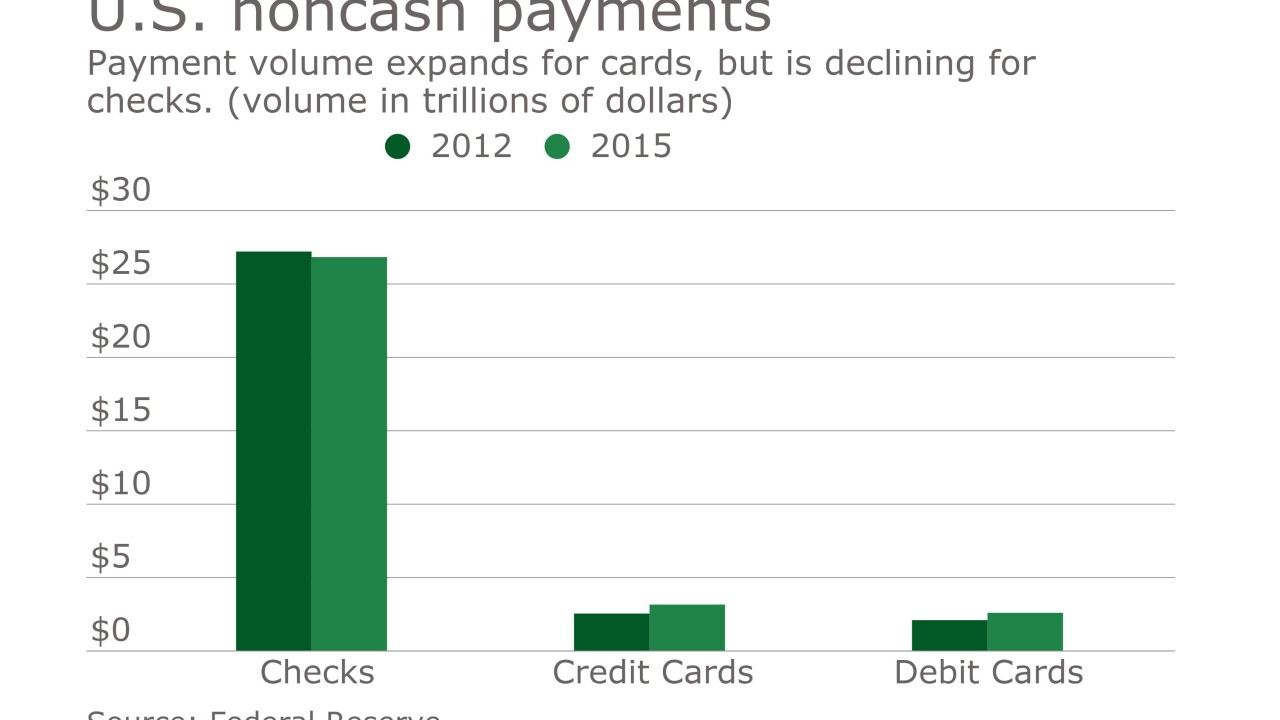

A new analysis from the Federal Reserve shows checks as one of the few non-cash payment types to decline, while many others are on the rise.

December 22 -

A Danish company called Cardlay has closed a $4 million funding round to deploy its white label card management solution to banks.

December 21 -

President-elect Donald Trump has threatened retaliatory tariffs on China if they cheat on their trading obligations. A good place to start would be Chinas payment card market.

December 21 -

Lloyds Banking Group Plc agreed to buy Bank of America Corp.’s MBNA credit-card business in the U.K. for 1.9 billion pounds ($2.4 billion) in cash, marking its first major deal since being rescued by British taxpayers eight years ago.

December 20 -

Lloyds Banking Group Plc agreed to buy Bank of America Corp.'s MBNA credit-card business in the U.K. for 1.9 billion pounds ($2.4 billion) in cash, marking its first major deal since being rescued by British taxpayers eight years ago.

December 20