Credit cards

Credit cards

-

The auto lender’s acquisition of Fair Square Financial would diversify its consumer product lineup. The pandemic derailed its last effort to buy a card company.

October 21 -

U.S. consumers have been more punctual than ever before in paying back debts as the economy rebounds from the pandemic.

October 14 -

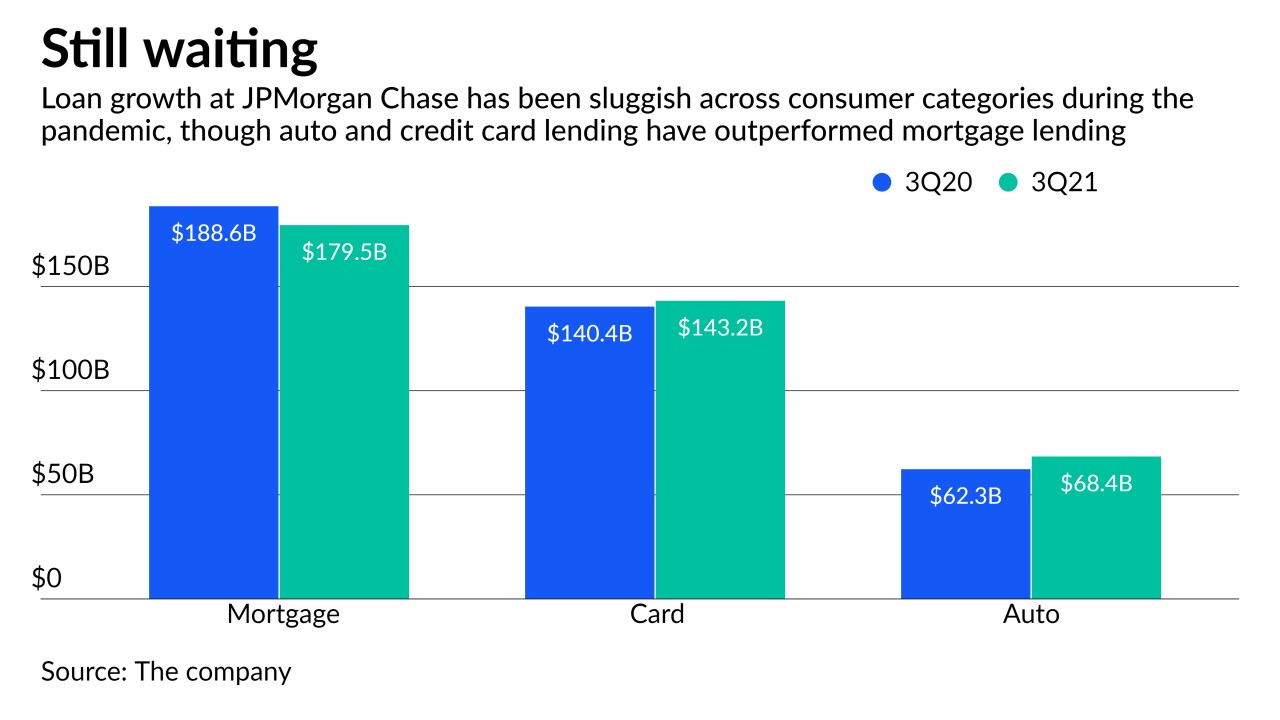

Spending on cards continued to increase during the third quarter, while loan balances rose slightly and payment rates began to return to more normal levels. A top company executive expressed confidence that loan growth will pick up but said, “It’s going to take time.”

October 13 -

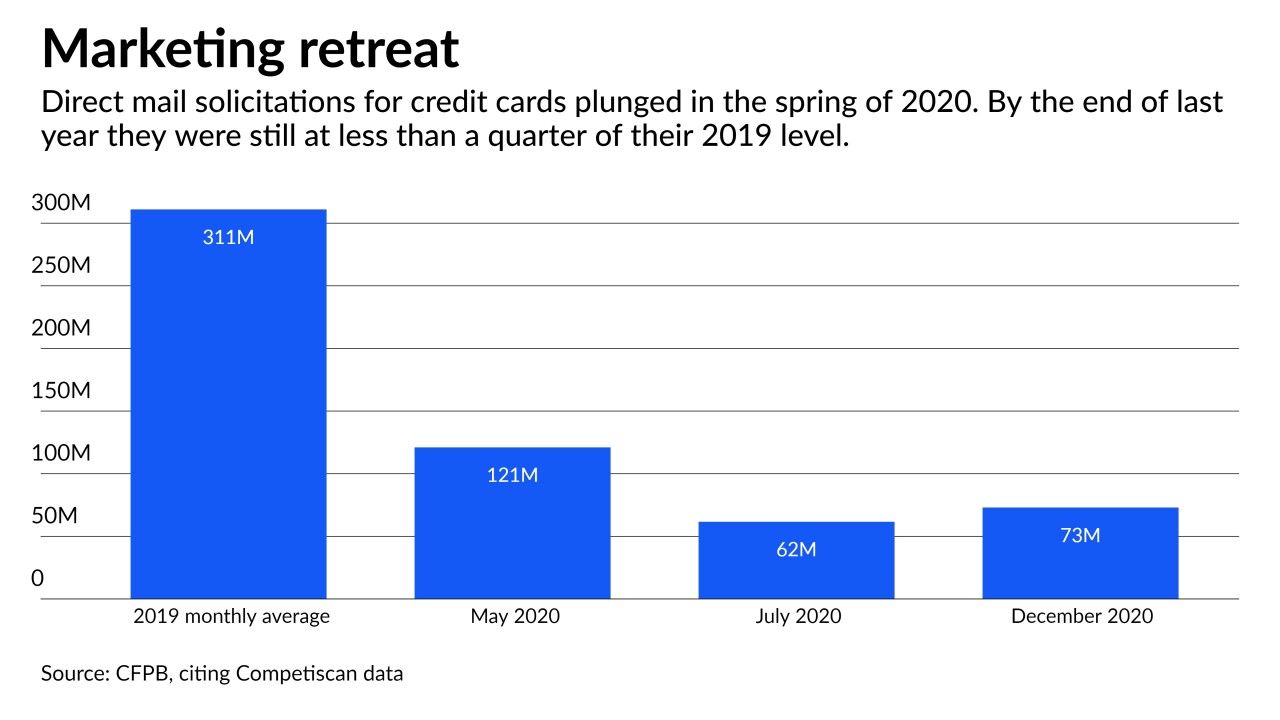

Banks generally did not curtail loans to existing cardholders last year despite mass unemployment, according to new research by the Consumer Financial Protection Bureau. The results contrasted with what happened during the Great Recession.

October 1 -

Several company leaders will relocate to Atlanta as part of the expansion, and the office will focus on technology and client services.

September 29 -

The second of three credit cards announced in June, Reflect rewards consumers who don't miss payments by extending the 18-month promotional period for its 0% annual percentage rate to 21 months.

September 29 -

Bilt Rewards, which offers a loyalty program and credit card that converts rent into reward points, raised $60 million from investors including Mastercard and Wells Fargo, giving the startup a $350 million valuation.

September 21 -

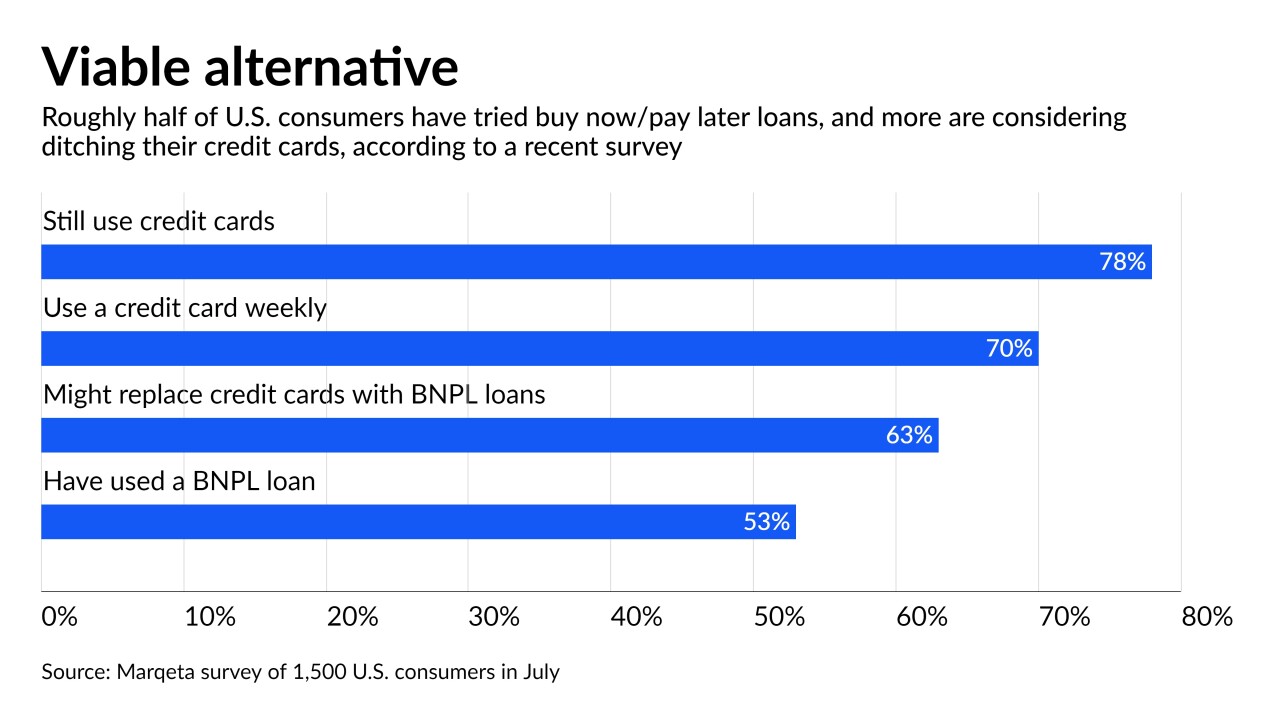

More than a third of installment borrowers are delinquent, according to new research. Fintechs and the banks that are following them into the market are willing to tolerate the credit risk — for now — because of BNPL’s rapid growth and the fee income from merchants.

September 17 -

Executives at JPMorgan Chase, Capital One and U.S. Bancorp all spoke this week about plans to take on upstarts that offer interest-free financing on consumer purchases. The increased competition figures to result in tighter margins across the category.

September 16 -

Capital One Financial will test a new buy now/pay later service as consumers flock to the options that let them split up a purchase and pay it off over time.

September 13 -

JPMorgan Chase is acquiring the Infatuation, a restaurant-guide company that owns Zagat, as the bank seeks to expand its consumer offerings to credit card users and other customers.

September 9 -

Merchants will be able to offer the interest-free installment product starting in October. One of Synchrony’s retail partners, Amazon, announced a buy now/pay later partnership with Affirm last month.

September 9 -

The market for short-term installment credit is growing among millennials and Gen Z consumers who distrust credit cards. Banks are letting a golden opportunity slip away.

September 8 -

Earlier this summer, bankers sounded upbeat about Americans’ purchasing patterns, particularly in connection with loan growth in the credit card business. But more recent data suggests that the delta variant is taking a toll on consumer confidence.

September 3 -

The Toronto-based bank will take over the account from Capital One, which is ending its deal with the membership-only retail chain.

September 2 -

The move is part of CEO Jes Staley’s broader strategy to beef up the British bank’s U.S. consumer business and strengthen relationships with retailers who may eventually need investment banking services.

August 27 -

The bank, which issues the Voyager card, and Mastercard are collaborating on U.S. Bank’s first-ever fleet credit card accepted on multiple networks.

August 24 -

Customers have been particularly frustrated with midsize issuers for failing to adjust their rewards programs to reflect changing behavior and generally being less responsive than large issuers, according to a new report from J.D. Power.

August 19 -

Holders of the card, issued by Synchrony Financial, receive 3% cash back on medical visits, veterinarian bills, gym fees and certain other health-related expenses.

August 16 -

JPMorgan Chase revamped the rewards on its popular Sapphire cards as the fight to win affluent customers continues to escalate.

August 10