-

This is the first time the agency has had a vice chairman since 2014.

December 18 -

The spending plan passed in a party-line vote, but board member Todd Harper's objections indicate he could push for closer oversight if President-elect Joe Biden elevates him to the chairmanship.

December 18 -

The rule change will allow credit unions to raise more capital to help their members, not line the pockets of investors, as bank lobbyists claim.

December 18 National Association of Federally-Insured Credit Unions

National Association of Federally-Insured Credit Unions -

Credit union trade groups said the regulator’s spending plan indicates the agency isn't listening to feedback and needs to make further cuts while providing more support for de novos.

December 17 -

First Technology FCU, led by a former banker, stands ready to raise fresh capital by issuing subordinated debt. But first it must wait for a rule change from the National Credit Union Administration that's drawing fierce opposition from the banking industry.

December 16 -

Tonia Clark will leave Las Colinas FCU to take the helm of $116 million-asset Allied.

December 16 -

The regulator is expected to finalize a rule this week allowing credit unions to issue subordinated debt to outside institutional investors. That's bad public policy, the American Bankers Association writes.

December 16 American Bankers Association

American Bankers Association -

Columbus Metro Federal Credit Union members will have access to more products, including commercial loan services, and 14 branches with the merger.

December 15 -

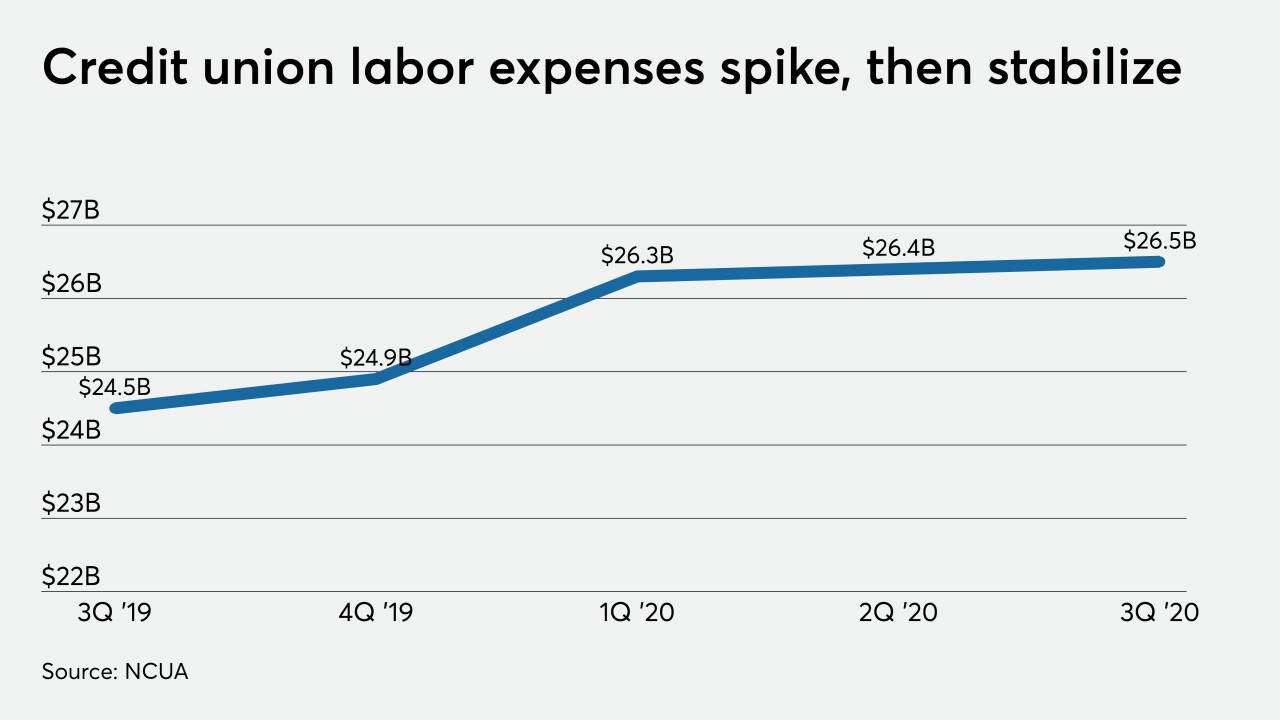

Some credit unions that gave bonuses to front-line staff at the onset of the coronavirus outbreak may be too cash-strapped to offer similar payouts during this latest surge.

December 15 -

Hauptman said dealing with the economic fallout from the coronavirus was a top priority for the agency, along with aligning incentives and expanding the use of technology in the industry.

December 14