-

This is the second consecutive year the credit union has returned dividends to members.

January 20 -

As President-elect Trump and the new Congress proceed on tax reform, there is one exemption in particular that needs to be closed, shut and buried.

January 20 Florida Bankers Association

Florida Bankers Association -

Initial regulatory steps toward giving credit unions access to alternative sources of capital could add to bankers' concerns that their tax-advantaged rivals are expanding beyond their mission.

January 19 -

On Sept. 30, 2016. Dollars in thousands.

January 18 -

On Sept. 30, 2016. Dollars in thousands.

January 18 -

On Sept. 30, 2016. Dollars in thousands.

January 18 -

NCUA is teaming up with the CFPB to offer guidance related to new Home Mortgage Disclosure Act requirements.

January 18 -

Credit unions in Arizona and Texas recently topped major asset milestones – Hughes Federal Credit Union, Tucson, Ariz., said it surpassed $1 billion in total assets, while Texell Credit Union, Temple, Texas, now has more than $300 million in assets

January 18 -

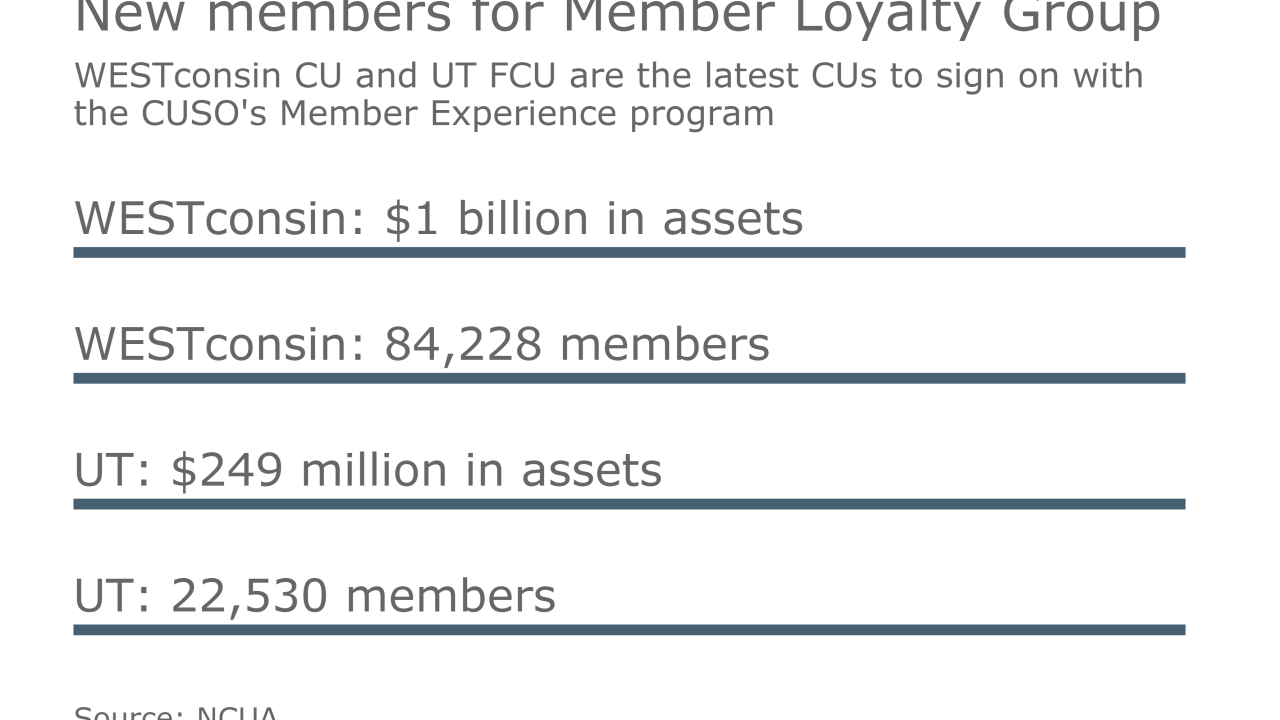

WESTconsin CU and UT FCU have selected Member Experience, which uses Net Promoter Score methodology to improve members’ experiences and drive growth.

January 17 -

The hurdles for bank-to-CU conversions are in almost all cases too big to for for-profit institutions to overcome and still operate responsibly.

January 11

-

As the new Congress and administration take shape, the credit union trade association is ramping up lobbying efforts even as it celebrates a major milestone.

January 11 Caltech Employees Federal Credit Union

Caltech Employees Federal Credit Union -

Advia Credit Union in Parchment, Mich., has agreed to buy Peoples Bank in Elkhorn, Wis.

January 10 -

2016 was very good to these financial services executives, who succeeded where others failed, sold their businesses for large sums, felt the love of regulators or could finally breathe a sigh of relief.

January 5 -

The migration has been slow, but COOP Financial Services says there's momentum for adoption and usage. There are also signs that card fraud risk is improving.

December 22CO-OP Financial Services -

The National Credit Union Administration acted appropriately, within its legal authority, when issuing its member business lending rule.

December 21

-

A federal judge heard arguments from ICBA and NCUA on whether to dismiss the banking group's legal challenge to the credit union regulator's changes to the member business lending rule. A decision on the dismissal could come as early as January.

December 16 -

The National Credit Union Administration rule expanding member business lending introduces new risks and lacks legal basis.

December 15 Calvert Advisors LLC

Calvert Advisors LLC -

Already defending itself against a lawsuit challenging its member business lending rule, the credit union regulator now must grapple with a challenge to field-of-membership regulations. Some observers suggest the scope of the legal approach is unprecedented.

December 8 -

The American Bankers Association has filed a lawsuit against the National Credit Union Administration, arguing that the regulator's new field-of-membership rule go too far.

December 7 -

The Independent Community Bankers of America has asked a federal judge to reject a motion by the National Credit Union Administration petitioning for the dismissal of a lawsuit filed by the ICBA that challenges recent revisions to the agency's member business lending regulation.

November 17