-

Tens of millions of consumers diligently pay their rent, utilities and other bills every month yet have no credit history. Supplementing traditional credit scoring with such data will promote equity and upward economic mobility, says the CEO of Experian North America.

July 2 Experian North America

Experian North America -

Kikoff, whose investors include Golden State Warriors' star Stephen Curry, provides applicants with a no-fee $500 revolving line of credit they can use to purchase personal finance books and courses from its online store. The company then reports this payment activity to some credit bureaus.

June 30 -

Democrats are pushing for a public-sector alternative to the three main credit bureaus, but Republicans argue that the government is ill-equipped to safely handle consumer data and produce accurate reports.

June 29 -

In a 5-4 ruling, the Supreme Court said that a majority of plaintiffs in a class action were not entitled to damages because the credit reporting company did not share faulty information with banks, landlords or other third parties.

June 25 -

Policymakers need to stop attacking credit bureaus and take action against credit repair firms that use dubious tactics to wipe bad debt from consumers' credit reports. Such schemes both impair banks' ability to accurately underwrite loans and further hurt real victims of identity theft.

June 23

-

A growing number of companies like Klarna, Sezzle and Circle let consumers split large purchases into smaller transactions paid over time. But they say they need to offer more than one product to set themselves apart and build customer loyalty.

June 18 -

Thousands of Americans volunteered to check the accuracy of their credit reports and many discovered mistakes, according to new research from Consumer Reports. The results provide fresh ammunition to critics of the major credit bureaus, Equifax, Experian and TransUnion.

June 10 -

Only 0.9% of mortgage borrowers are currently at least 90 days delinquent. That figure could rise as high as 3.8% once pandemic-related deferrals lapse — still well below the 6% mark reached after the Great Recession, according to research by the New York Fed.

May 19 -

Five payments of $20 seems less detrimental to a wallet than a one-time $100 fee, says Four's Chaim Lever.

May 14 Four

Four -

Despite strong payment volume and revenue, Affirm's earnings suffered due to stock compensation and an adjustment on its purchase of PayBright in January.

May 10 -

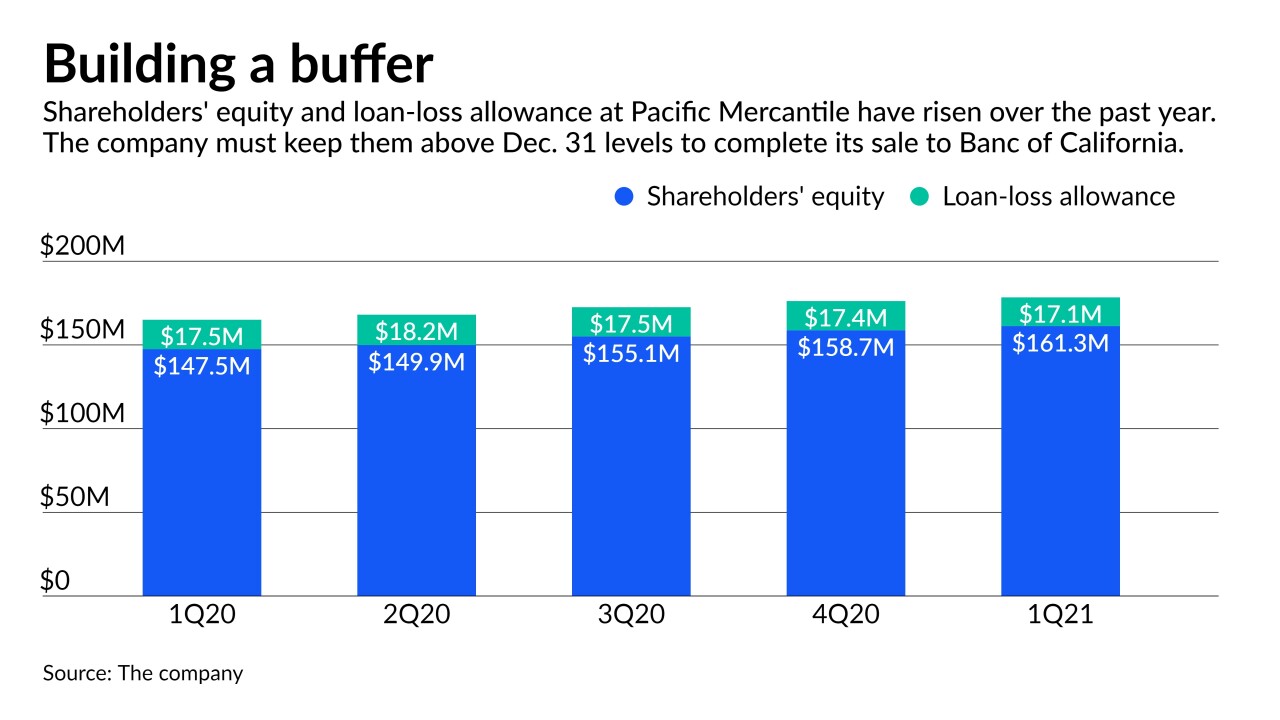

About 13% of Pacific Mercantile Bancorp's loans are tied to high-risk sectors such as entertainment and food services. The company must build shareholders' equity or its loan-loss allowance above last year's levels to make sure the sale goes through.

May 6 -

Some say Equifax, Experian and TransUnion are too slow to investigate grievances, prompting more complaints to the Consumer Financial Protection Bureau. But the big three say other forces are at work.

April 30 -

Kerry Killinger, former CEO of Washington Mutual, says the asset bubbles and increased consumer debt that contributed to his company's failure are reappearing.

April 30 -

The Texas company kept allowances steady, citing lingering concerns over the pandemic and commercial real estate. Yet it plans to open 25 offices in Dallas after a similar expansion in Houston drove asset and customer growth.

April 29 -

The new feature allows users to add thin-file spouses and teens on one account.

April 20 -

The new feature allows users to add thin-file spouses and teens on one account.

April 20 -

Variables unique to the past year, such as the effect of government stimulus, are not fully considered in typical credit scores. For a more complete picture, the industry should accelerate a digital transformation in scoring models.

April 7 Publicis Sapient

Publicis Sapient -

Without the application of tested safeguards, using such data can run the risk of worsening the very problems of credit access that we seek to solve.

April 5 FICO

FICO -

Complaints to the Consumer Financial Protection Bureau jumped 54% to 542,300 in 2020. Concerns about credit reports have long outnumbered those in other categories and jumped significantly as a share of the total from 2019.

March 24 -

To drive the recovery we need to move beyond traditional data and models to incorporate new transaction and payment information that is more timely, more insightful, and more inclusive, FinRegLab's Melissa Koide and FICO's Larry Rosenberger write.

March 22 FinRegLab

FinRegLab