-

The agency announced it was rescinding seven policy statements issued last year meant to help companies combat fallout from COVID-19 but that the bureau's current chief said came at the expense of consumers.

March 31 -

Jordan Summers, formerly the Detroit bank's chief fiduciary officer, succeeds Robert Sajdak as CEO. Sajdak recently retired after leading Credit Union Trust since its 2018 launch.

March 31 -

Although the Federal Housing Administration's insurance fund is "well above" its legal minimum, HUD Secretary Marcia Fudge said the mortgage agency has no plans to cut prices.

March 30 -

The full Senate could deadlock on Rohit Chopra’s nomination as the Banking Committee did. If that happens, Vice President Kamala Harris is expected to cast the decisive vote in his favor.

March 30 -

The banking and credit union industries opposed the Illinois Community Reinvestment Act, but they were largely shut out of a process that moved quickly amid a nationwide reckoning on racial inequality.

March 30 -

The federal banking and credit union agencies want input about how financial institutions use artificial intelligence for credit underwriting and other purposes, and about whether additional regulatory guidance is needed.

March 29 -

A recent statement by acting Director Dave Uejio is the clearest signal that the agency plans to revive strong underwriting standards that the Trump administration eliminated.

March 29 -

The abrupt shutdown of retail a year ago led to a rise of digital shopping — and fraud. And the most tech-savvy consumers may be the most vulnerable, according to TransUnion data.

March 26 -

Lawmakers approved a bill that will allow the Paycheck Protection Program to remain open until May 31. It was originally set to expire on March 31.

March 25 -

Complaints to the Consumer Financial Protection Bureau jumped 54% to 542,300 in 2020. Concerns about credit reports have long outnumbered those in other categories and jumped significantly as a share of the total from 2019.

March 24 -

Two banking bills signed by Gov. J.B. Pritzker carry implications for payday lenders, auto title lenders, credit unions and nonbank mortgage lenders. Pritzker, a Democrat, said the bills will address racial-equity gaps in the state.

March 23 -

Early in the pandemic, Michigan's Astera Credit Union realized that if it could not support touchless transactions, its members were likely to go elsewhere.

March 22 -

The legislation easily passed the House in 2019 but was never considered in the Senate. Observers see a more promising path forward this time.

March 18 -

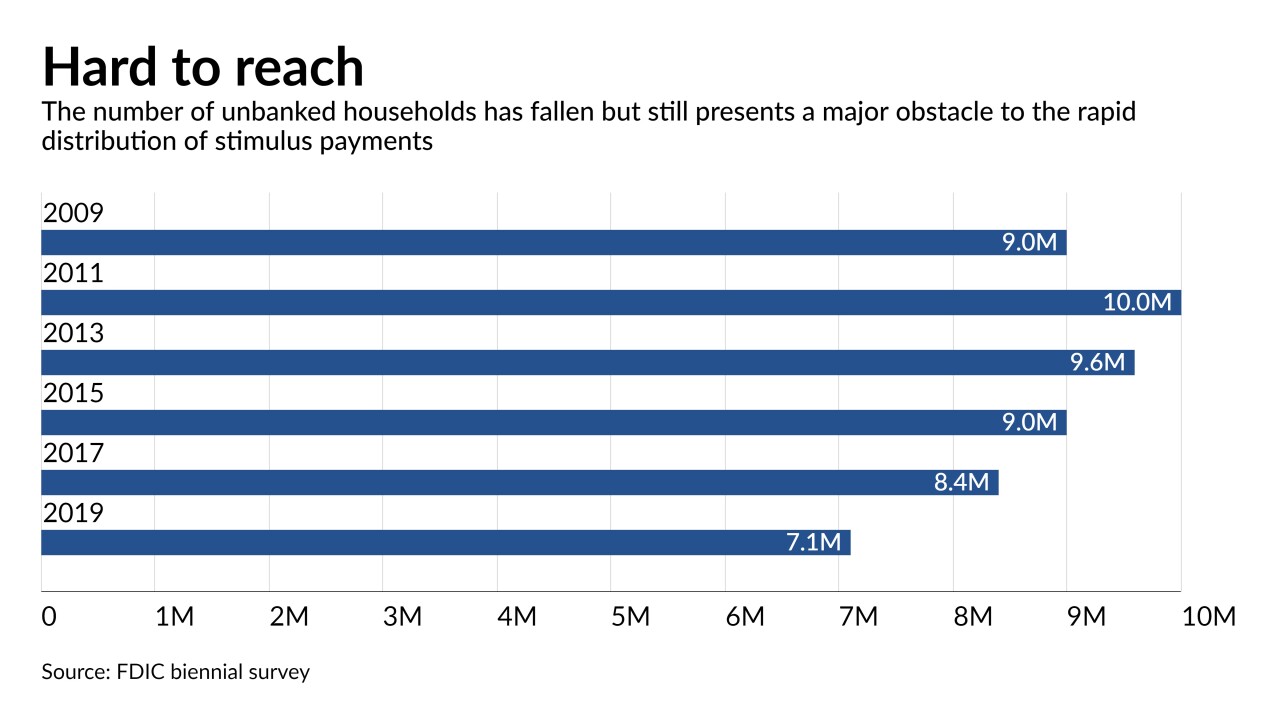

The IRS, FDIC and more than 70 banks and credit unions are urging consumers to open affordable accounts so they can receive their Economic Impact Payments quickly and safely. Many people have signed up, but millions lack accounts and will be harder to serve.

March 17 -

Seven years after regulators issued guidance to financial institutions, a small Michigan credit union was ordered to stop opening new accounts for marijuana businesses.

March 16 -

With a steady stream of Senate hearings held on the racial wealth gap and inequities in the financial system, the new chairman has set a consumer-focused agenda that leans further left than even past Democratic chairs.

March 15 -

In its final days, the Trump administration imposed limits on Fannie Mae and Freddie Mac’s holdings of mortgages with loan-to-value ratios above 90% and certain other characteristics. Critics say the changes were unnecessary and disproportionately penalize borrowers of color.

March 11 -

The legislation would extend the Paycheck Protection Program for two months and give the Small Business Administration more time to remedy persistent system glitches that have delayed the processing of thousands of loan applications.

March 11 -

Legislators expressed concerns that thousands of pending applications are stuck in limbo just weeks before the Small Business Administration is legally required to stop accepting them.

March 10 -

With national banks awaiting federal decisions on marijuana banking policy, smaller institutions can capitalize on local laws. That’s the theory Chicago Ventures is putting to the test with a $5 million investment in AeroPay, which banks with Partner Colorado Credit Union.

March 10