-

The top Republican and Democrat on the Senate Banking Committee are asking for stakeholders to weigh in on data collection issues as lawmakers consider legislative responses to recent breaches.

February 13 -

A security breach that left 24 million mortgage documents unprotected on a server is rekindling concerns about the risks posed by fourth parties.

February 13 -

The emails were disguised as being sent from BSA executives at other institutions and claimed that a member’s transfer was halted due to suspected money laundering.

February 13 -

The quest to implement a broadly accepted digital ID solution may take years, but Jumio is hoping to get headway with a new authentication service leveraging video selfies.

February 12 -

The automaker's finance arm joins Avant, OnDeck Capital and SoFi in the system, which is designed to help verify loan applicants' identities.

February 12 -

Citigroup's venture capital arm is investing in technology that provides real-time analysis of millions of consumers' card transactions.

February 12 -

As another possible shutdown looms, concerns about furloughed workers’ credit histories have shifted the reform discussion away from data security.

February 11 -

OnApproach was launched in 2005, while Trellance was launched just two years ago as a division of CSCU

February 11 -

The bank and card program provider is starting to use AI in many areas, but it's also trying to build paths forward for employees whose jobs will be affected.

February 11 -

The bank says it has restored access, but it hasn’t explained how a fire-suppression system at one facility could cause a nationwide outage across all of its channels, or how its system as a whole could have been left so vulnerable to the incident.

February 8 -

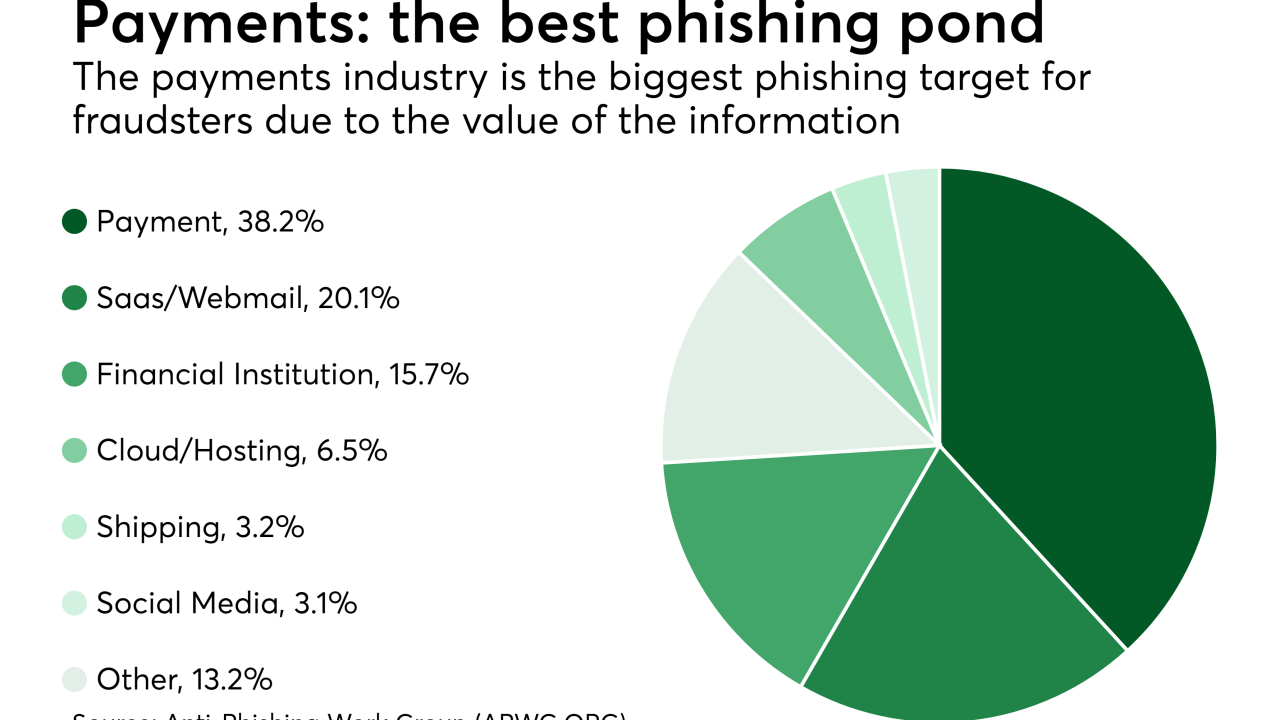

Today phishing scams have become so elaborate that they can take a variety of forms, including a phony job interview.

February 7 -

It’s past time for every organization handling sensitive data to lock down their security, and to stop relying personally identifiable information to verify users, writes Ryan Wilk, vice president of customer success for NuData Security.

February 7 NuData Security

NuData Security -

Swift is showing more swagger in its rivalry with Ripple thanks to progress it has made with a multifaceted payments-tracking technology called GPI.

February 7 -

Swift is showing more swagger in its rivalry with Ripple thanks to progress it has made with a multifaceted payments-tracking technology called GPI.

February 6 -

The U.S. car rental industry has frustrated many young adults for years with special restrictions and credit checks for customers under who try to pay with a debit card. But big data is bringing some relief.

February 5 -

Banks are a primary market to be pursued by Blue Hexagon, which received $31 million in venture capital.

February 5 -

Steve Boms, executive director of the Financial Data and Technology Association, says open banking standards are needed for U.S. banks and fintechs to follow.

February 5 -

Policymakers need to update banking regulations to minimize the risks posed by technology companies entering financial services, a well-known policy analyst says in a new paper.

February 4 -

The payment systems within these games are conducive to various types of fraud, including account takeovers, that can result in crippling chargeback claims, according to Suresh Dakshina, president of Chargeback Gurus.

February 1 Chargeback Gurus

Chargeback Gurus -

Criminals are going to get smarter, but banks can implement a modern authentication solution to meet unique use cases and security requirements without sacrificing user convenience, writes Mike Byrnes, senior product manager at Entrust Datacard.

February 1 Entrust Datacard

Entrust Datacard