-

Quantitative investors, starved for trading signals that can be spun into gold, are pressuring the finance firms they work with to grant them access to proprietary information.

August 8 -

The selling of anonymized customer data may be legal, but it raises ethical questions about the use and protection of that information.

June 8 -

The Spanish bank is opening its APIs to outside developers as Bank of America tests a new data-sharing model with aggregators.

May 24 -

Through the bank’s new API, small-business customers can feed their bank data into Xero’s cloud accounting technology.

May 10 -

Access to banking information ensures advisors can perform holistic planning, fintech firms say.

April 5 -

The battle over screen scraping seems to be subsiding into a series of agreements between banks and fintechs using open APIs.

April 4 -

The bank and cloud accounting platform will offer services to mutual customers via API.

February 15 -

By partnering with Intuit, Wells Fargo is continuing its journey toward API-based data sharing, and away from screen scraping.

February 3 -

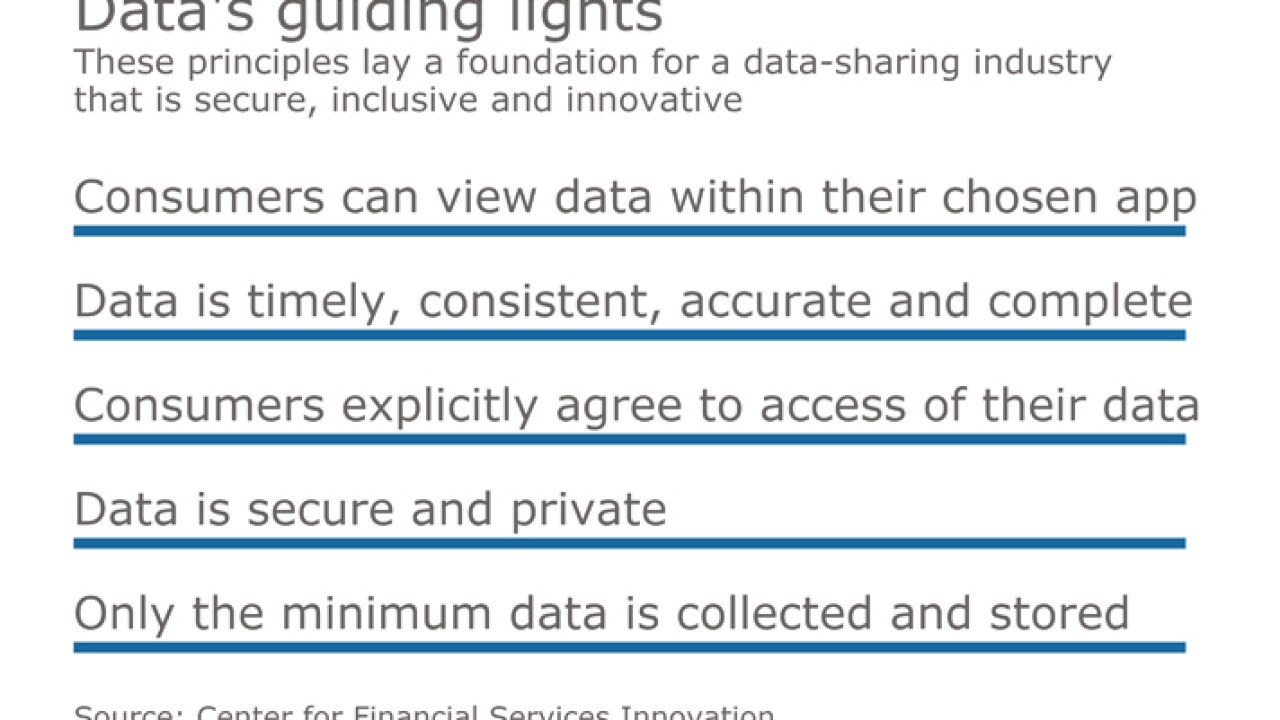

Big banks increasingly are developing application programming interfaces to make their customers’ data available to third parties. But discrete deals between banks and third parties would be a bad outcome for consumers and the industry as a whole.

January 27

-

The deal points a way forward, not only to resolve the debate over screen scraping and ownership of customer data but to redefine banks' value proposition.

January 25