-

EU banks will soon start sharing customer account data with all third parties their customers approve. Very few U.S. banks have latched on to this concept. Here’s why.

December 20 -

An ex-regulator’s stern warning about the risks of sharing consumer information with fintechs has prompted debate over common security standards for banks and nonbanks, better data tracking and new liability insurance products.

December 5 -

Readers react to the CFPB director shake-up, applaud honorees of American Banker’s annual banker awards and weigh in on the heated financial data debate.

December 1 -

The CFPB's data-sharing guidance was widely applauded, but mistrust remains between banks and aggregators. Advocates want regulators to take action.

November 28 -

The most important policy question facing banking, brokerage and insurance companies is putting a framework in place that very quickly defines data ownership rights across the financial value chain.

November 27

-

Some fintechs argue that banks are selectively working with only certain third parties in sharing information and violating the spirit of the CFPB’s data-sharing principles.

November 20 -

Following in the footsteps of Chase, Wells Fargo and others, Fidelity is launching an application programming interface to let third-party apps access customer data — as long as the customers grant permission.

November 14 -

Readers chime in on the idea of a state-backed bank to serve the cannabis industry, data-sharing between banks and fintechs, whether community banks can just focus on tech laggards, and more.

November 9 -

Guidance from the CFPB and reduced friction between banks, fintechs and data aggregators are easing bank-fintech partnerships at Wells Fargo, Capital One and others.

November 6 -

The Consumer Financial Protection Bureau made it clear that consumers own their financial data and can share it with apps of their choice. Now it’s up to the industry to resolve thorny issues on liability and accountability.

October 23 Center for Financial Services Innovation

Center for Financial Services Innovation -

Both banks and fintech are satisfied for now with the CFPB's nonbinding principles on data-sharing. But the statement may lay the groundwork for future regulation.

October 20 -

The nonbinding guidance, which followed a nearly yearlong inquiry about industry practices, said consumers should have greater ability to obtain information about their financial data, among other principles.

October 18 -

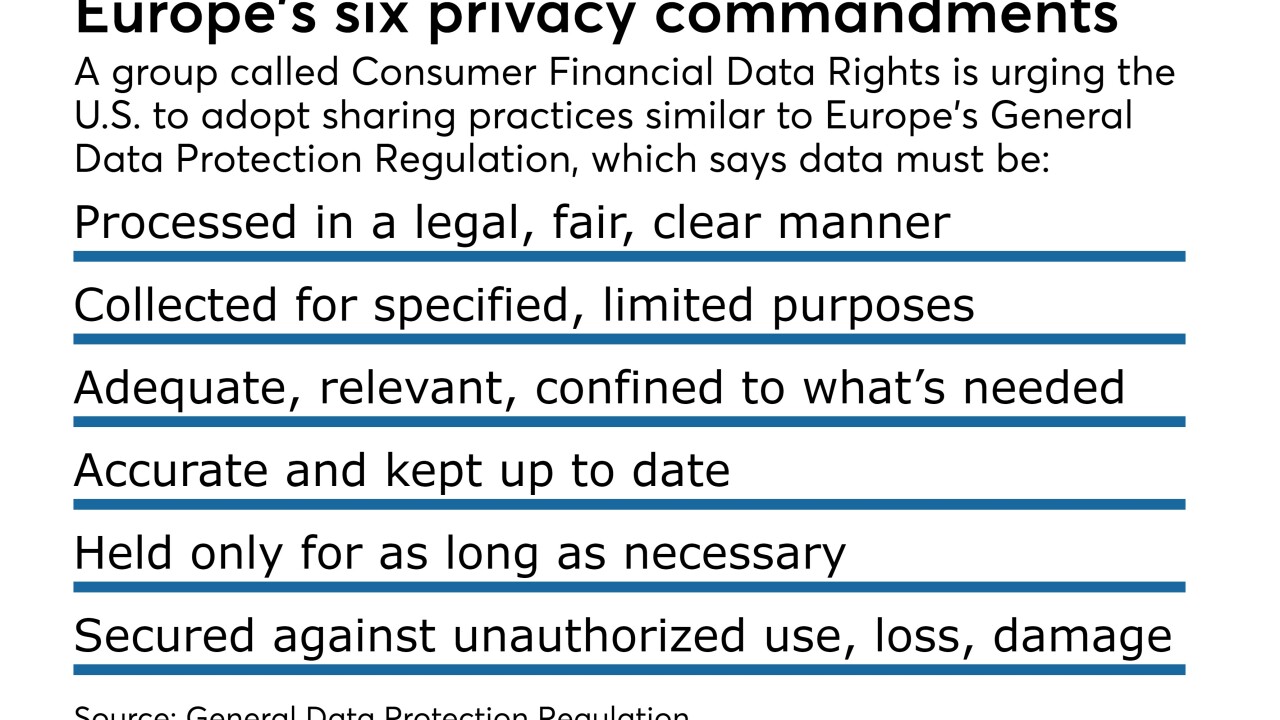

The Consumer Financial Data Rights group, representing aggregators and fintechs, says banks still aren’t forking over enough customer data. The group is meeting with bank regulators and trying to get consumers to petition regulators on its behalf.

August 15 -

Quantitative investors, starved for trading signals that can be spun into gold, are pressuring the finance firms they work with to grant them access to proprietary information.

August 8 -

The selling of anonymized customer data may be legal, but it raises ethical questions about the use and protection of that information.

June 8 -

The Spanish bank is opening its APIs to outside developers as Bank of America tests a new data-sharing model with aggregators.

May 24 -

Through the bank’s new API, small-business customers can feed their bank data into Xero’s cloud accounting technology.

May 10 -

Access to banking information ensures advisors can perform holistic planning, fintech firms say.

April 5 -

The battle over screen scraping seems to be subsiding into a series of agreements between banks and fintechs using open APIs.

April 4 -

The bank and cloud accounting platform will offer services to mutual customers via API.

February 15