-

Household debt is higher than ever, and delinquencies in credit cards and unsecured personal loans are edging upward. Bruce Van Saun, chairman and CEO of Citizens Financial, shares his views on the market and the business opportunities there.

May 10 -

About 175 million Americans now have access to a credit card, and the delinquency rate has gone up along with that, but an expert at TransUnion, which issued the data Tuesday, said the underlying metrics suggest there is no cause for alarm — yet.

May 8 -

Late-payment rates at banks declined in nine out of the 11 consumer loan categories tracked by the American Bankers Association, including credit cards, auto loans and personal loans.

April 4 -

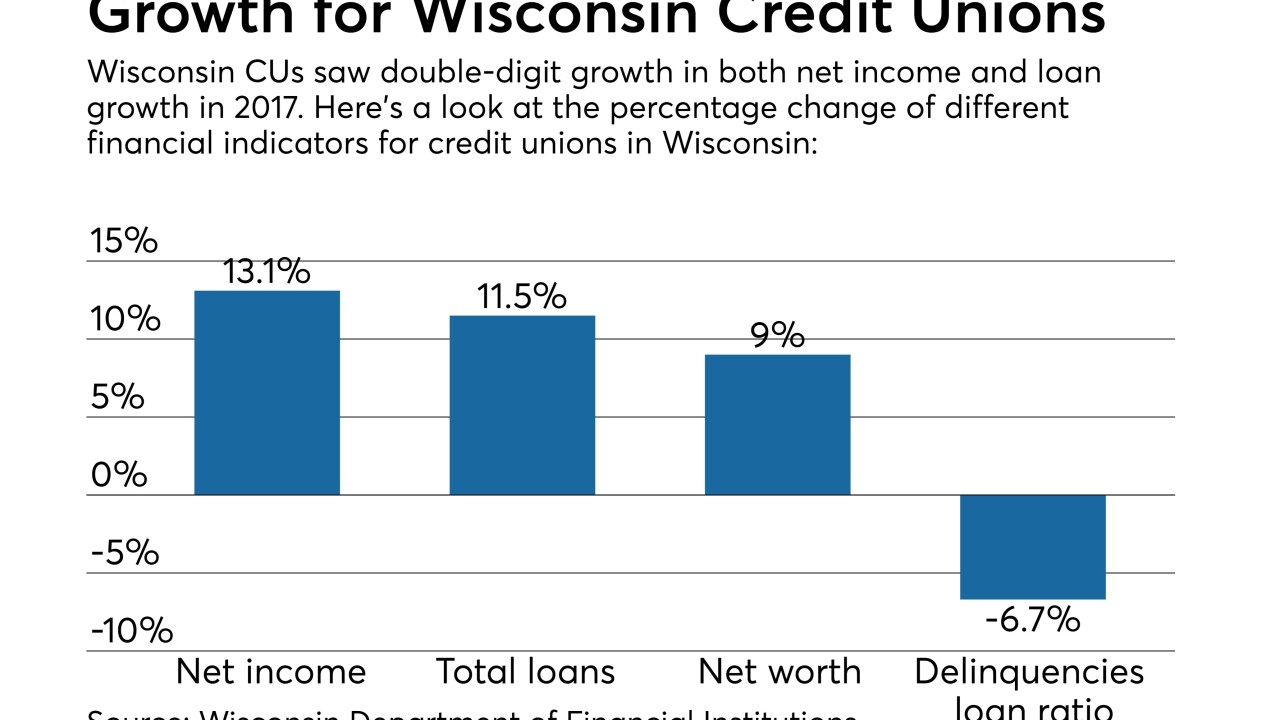

While some key indicators dropped in the year ending Dec. 31, 2017, credit unions in many states continue to thrive, with several new states jumping to the head of the pack for various growth measurements.

March 22 -

Credit unions saw strong gains in membership, loans and more in 2017, though the industry continued to shrink, with 200 fewer credit unions in operation than at the end of 2016.

March 8 -

On top of a banner year for lending, delinquency rates in the state are at historic lows.

February 14 -

The Stamford, Conn.-based credit card issuer saw improvement in late payments by its customers, but the pace of loan growth also slowed during the fourth quarter.

January 19 -

The late-payment rate on loans frequently used to consolidate credit card debt hit its highest level in more than four years.

January 9 -

Fannie Mae's serious delinquency rate climbed to a high not seen since March 2017, but remained lower than it was 12 months prior.

January 2 -

The long-running slide in mortgage payments 60 or more days past due will continue next year, and perhaps even longer as borrowers benefit from favorable economic conditions.

December 13 -

Text analysis holds the promise of improving lenders’ ability to evaluate which borrowers will repay, but it also carries substantial risks.

October 31 -

The new tool tracks both serious and general delinquencies down to a county level and features interactive charts and graphs.

October 30 -

Automated payments, IVR and emerging innovation are necessary to jolt payment performance, writes David Yohe, vice president of marketing at BillingTree.

October 11 BillingTree

BillingTree -

Balances 90 days past due are noticeably higher in 2017, new N.Y. Fed data shows. Though the trend has a lot to do with positives like economic expansion and easier access to credit, officials say it deserves careful attention.

August 15 -

As the CFPB prods banks to improve their debt collection processes, tech firms are applying artificial intelligence, chatbots and self-service portals to create a more enlightened approach.

July 11 -

Synchrony Financial and Alliance Data Systems are particularly vulnerable to recent shifts in Americans’ shopping habits, according to new research from Moody’s Investors Service.

June 28 -

The $201 million-asset CU has seen delinquencies rise from just $1.2 million at the end of 2015 to nearly $11 million at the end of March 2017.

June 26 -

Some executives are shrugging off recent defaults as isolated incidents, but others say states’ uneven embrace of the Affordable Care Act, as well as potential changes to the law itself, have escalated the risks in lending to health firms.

May 4 -

Some investors have raised questions about the credibility of the firm’s leadership since credit card issuer announced that its loss reserves would surge this year.

May 3 -

The weakening car-loan market poses a big challenge for the Detroit-based lender, but it also could also present an opportunity, since other big banks are sharply reducing their exposure.

April 27