-

Panelists: Renée D. Brown, CMO, Retail Financial Services, TIAA; Steven Dorval, President, John Hancock Personal Financial Services; Matt Fellowes, CEO, United Income; Roger Lee, CEO and Co-Founder, Human Interest

July 11 -

These teens and early 20-somethings are hardworking, frugal, prudent, debt averse and fiercely opposed to fees — much like their great-grandparents who grew up during the Depression.

July 9 -

These teens and early 20-somethings are hardworking, frugal, prudent, debt averse and fiercely opposed to fees — much like their great-grandparents who grew up during the Depression.

July 6 -

The leader of an Ohio mutual is urging his peers to follow the lead of credit unions by forming groups to share technology and collaborate on lending and deposit gathering.

July 5 -

Consumer advocates are urging local governments and courts to consider a person’s ability to pay before assessing fines and fees for such infractions as unpaid traffic tickets. Such changes could help low-income households avoid bankruptcy — and perhaps even make them more bankable.

July 5 -

Turnover of chief risk officers is on the rise as CEOs look to add executives whose experience goes far beyond assessing credit risk. Sometimes they are promoting from within, but often they are poaching talent from rival banks.

July 2 -

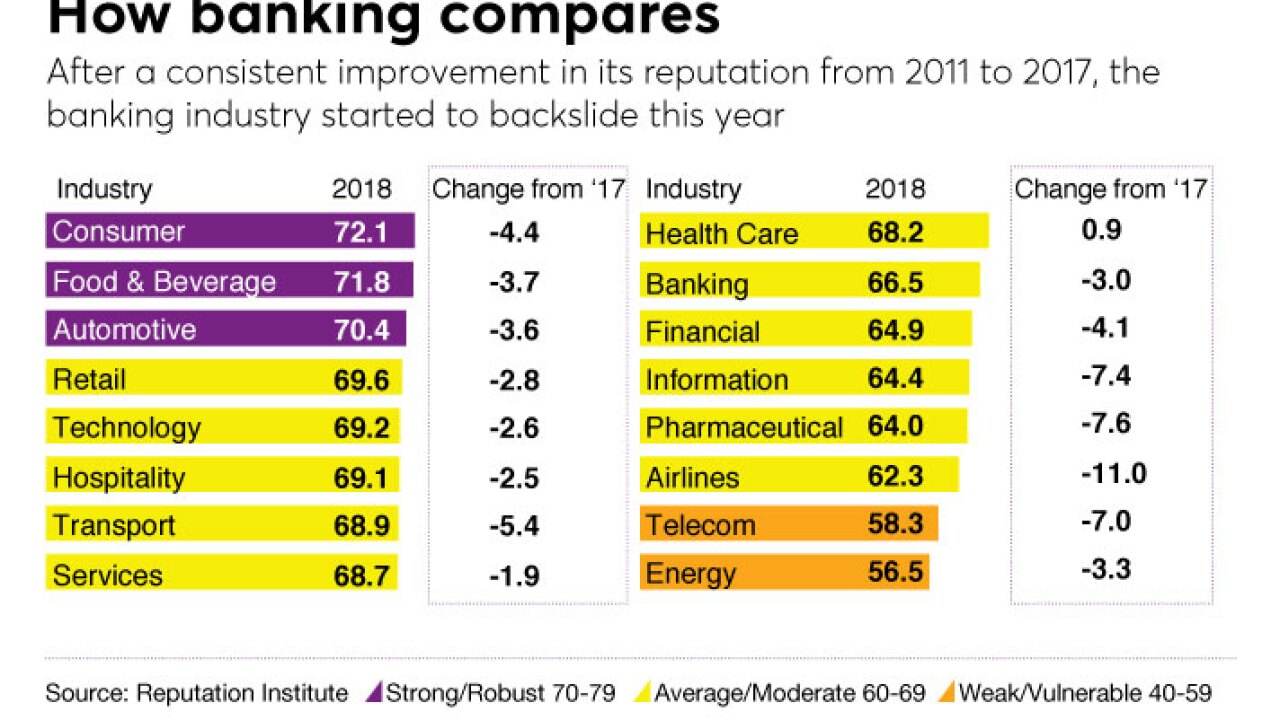

USAA reigns, Wells Fargo, well, doesn't. Here's a look at the highs and lows in this year's survey, as well as the trends that drove the results.

July 1 -

As data breaches mount in the "Equifax era," CFOs have a broad vision of enterprise data that can prove helpful in mitigation, according to Lauren Ruef, a research analyst for Nvoicepay.

June 29 Nvoicepay

Nvoicepay -

The bank's Finn app is attracting users by removing complexity from mobile banking.

June 28 -

Disruptive upstarts. Glitches galore. Open banking adoption. Financial institutions are being challenged on multiple fronts — here’s a look at how they’re coping.

June 28 -

Credit unions can apply for their share of approximately $2 million in Community Development Revolving Loan Fund grants between July 1 and Aug. 18.

June 26 -

Startups such as BREAUX Capital are trying to reach consumers historically underserved and underrepresented in financial services.

June 25 -

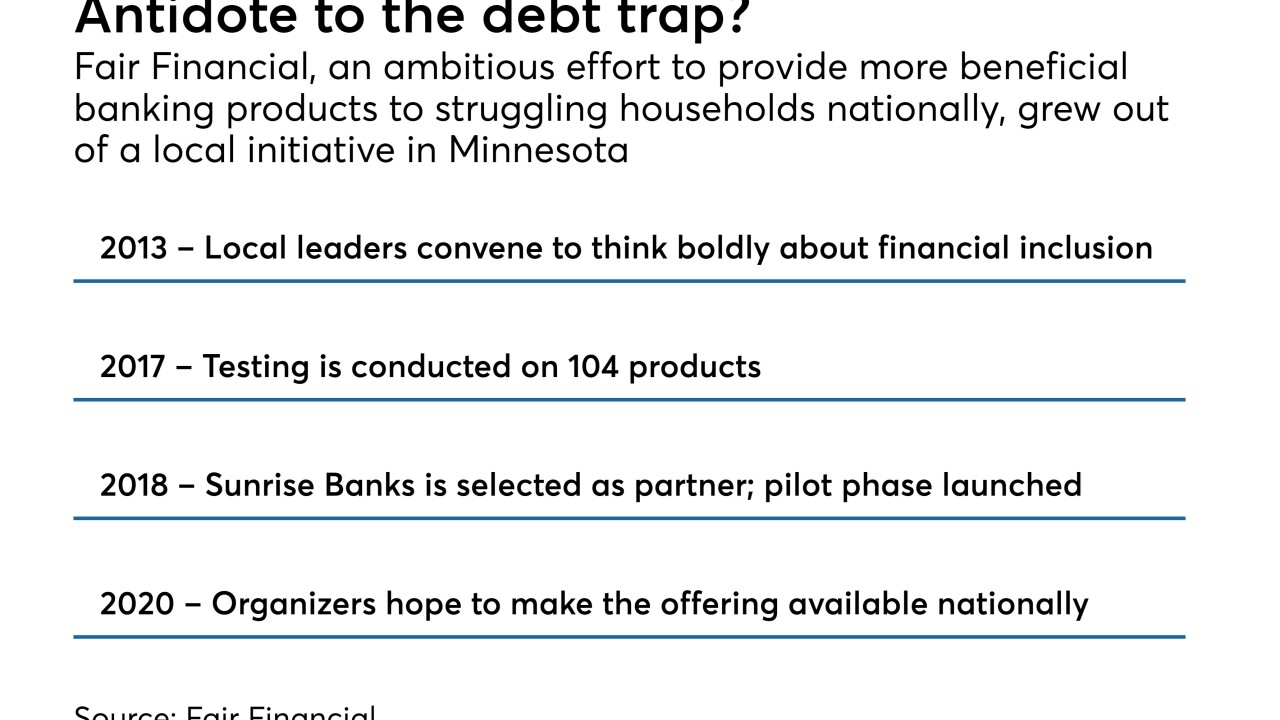

Fair Financial, a digital banking platform developed by a Twin Cities nonprofit in partnership with a local bank, launched a pilot program this week. By 2020, it plans to serve 5,000 customers across the country.

June 22 -

In focus testing for its digital-only app, Finn, Chase learned users wanted a standalone brand that still offered some traditional features, such as paper checks.

June 22 -

The sharing economy, declining cash usage, mobile banking and more will all have a major impact on how credit unions do business less than a decade from now, according to one analyst.

June 21 -

Several leaders have retired after spending years preparing their banks for the regulatory milestone.

June 20 -

Even with the decline, the nation's largest bank still employs a higher percentage of black employees in the U.S. than its rivals.

June 14 -

The Israeli-owned company, which spent the last half-decade addressing stagnation, is open to acquisitions or going public.

June 14 -

MyBucks plans to give away entry-level smartphones, loaded with the company's financial technology, to encourage mobile payments, mobile banking and broader access to digital services in Africa, where financial innovation often moves quickly.

June 13 -

Subscribing to simplification at the expense of nuance is hugely counter-productive, and will alienate both existing and potential customers, writes Elina Mattila, executive director at Mobey Forum.

June 12 Mobey Forum

Mobey Forum