-

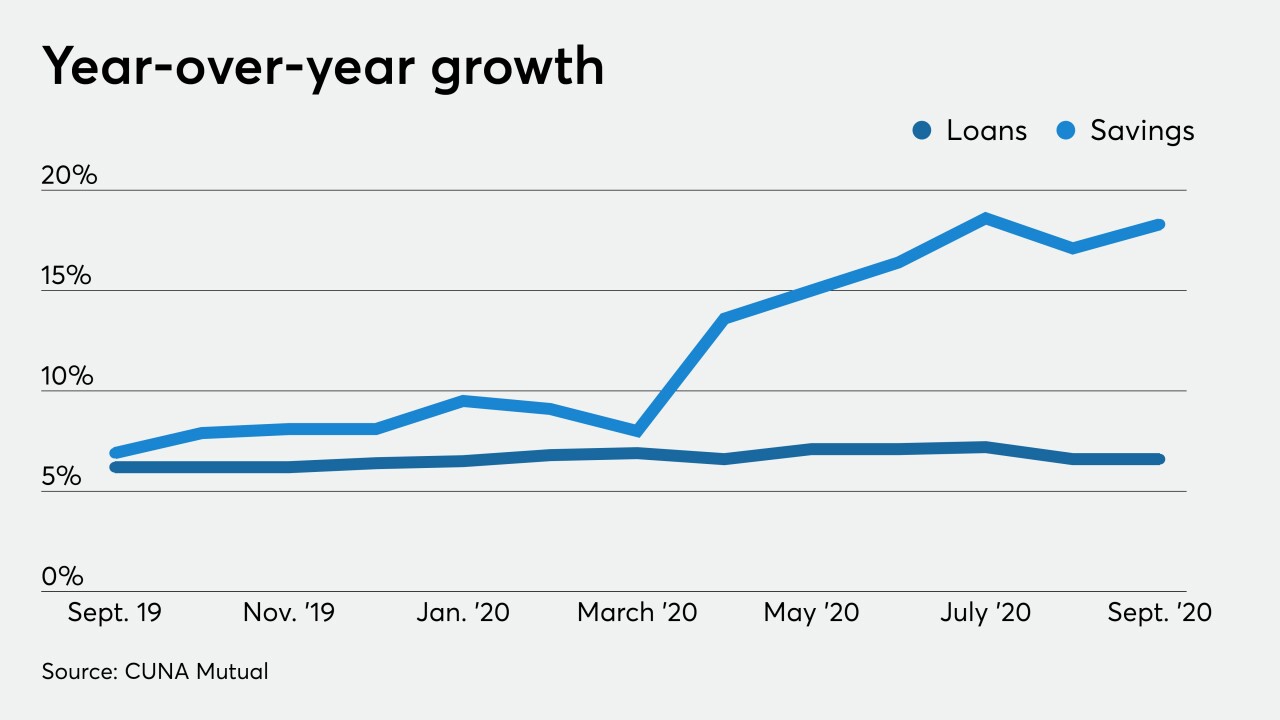

From dealing with a flood of deposits to working with examiners virtually, credit unions were forced to quickly adapt to a new normal after the pandemic hit. Here's a look at some of the biggest changes and challenges they faced.

December 31 -

The revamp of the brokered deposits framework offers relief to banks and their partners that saw the prior rule as outdated. Meanwhile, new standards for industrial loan company parents aim to clarify the bank chartering process for fintechs and other nontraditional firms.

December 15 -

On Sep. 30, 2020. Dollars in thousands.

December 14 -

The agency's principals are scheduled to meet Dec. 15 to vote on a new definition for brokered deposits and on regulatory standards for industrial bank parents.

December 11 -

Credit quality has remained strong at credit unions, but there are hints that some of them — especially the smallest ones — could report lackluster earnings well into next year, according to the National Credit Union Administration's latest intel on industrywide finances.

December 8 -

The Massachusetts company, which had a big second-quarter loss after writing down the goodwill tied to past acquisitions, will sell eight branches to Investors Bancorp and shutter 16.

December 2 -

Current economic conditions are greatly tied to controlling the spread of the coronavirus. To survive this volatile situation, financial institutions must be resilient.

November 24 Bonneville Power Administration

Bonneville Power Administration -

Year to date Jun. 30, 2020. Dollars in thousands.

November 23 -

The company's latest report predicted there could be sustained economic pressures well into next year tied to rising coronavirus cases.

November 20 -

Technology imperatives, weak loan demand and the need for increased efficiency could put pressure on dozens of regional banks to join forces with rivals.

November 17