-

Second-quarter figures from the credit union regulator paint a grim picture for many states across a variety of key earnings metrics.

September 17 -

The plan would encourage more risk-taking by big banks, which would put the industry and taxpayers in harm’s way, write former CFPB Director Richard Cordray and Camden Fine, onetime head of the Independent Community Bankers of America.

September 11 Consumer Financial Protection Bureau

Consumer Financial Protection Bureau -

The company and its global peers have seen their profitability hurt by half a decade of negative interest rates, which effectively make banks pay for holding clients’ cash.

September 9 -

A pandemic-driven surge in bank deposits helped drive the agency's insurance reserves below their statutory minimum.

September 9 -

A new report from the National Credit Union Administration shows how hard the industry was hit during the second quarter as businesses closed and consumer spending dropped.

September 8 -

A New York CDFI is halfway to its $100 million fundraising goal for a fund that would put deposits in Black-owned banks and make loans to key businesses or projects. It hopes the moves will improve availability of capital and access to mainstream financial products.

September 4 -

Why PayPal just deposited $50 million in tiny Optus Bank; ex-Bank of America employees allege 'extreme pressure' to sell credit cards; the Citi snafu may bring fresh scrutiny to custodial banks; and more from this week's most-read stories.

August 28 -

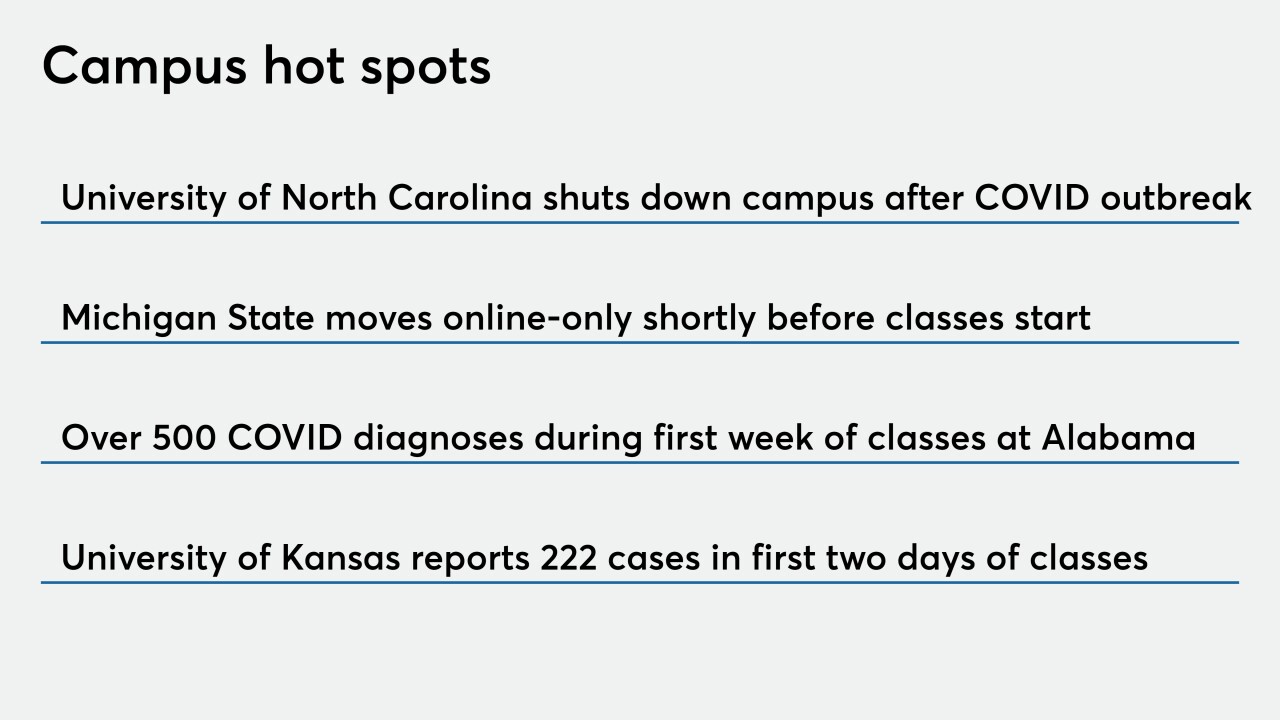

Institutions serving colleges and universities traditionally see membership surge in the fall, but are now planning for a decline as classes move online.

August 27 -

Whether the number of deals for 2020 can come close to last year's record-setting level will come down to one question: Can community banks generate strong enough profits in the second half to justify their independence?

August 25 -

Credit unions added more than $176 billion to savings balances in the first half of the year, according to new analysis from Callahan & Associates.

August 18 -

On Mar. 31, 2020. Dollars in thousands.

August 17 -

This isn’t the first time the industry has faced an influx of funds amid a slowdown in lending, but this instance could prove harder to manage than in the past.

August 17 -

As more consumers do business online, some deposits are being unfairly categorized as brokered, inviting burdensome regulatory scrutiny.

August 7 American Bankers Association

American Bankers Association -

Lawmakers don't appear ready to relax requirements yet, but they may do so in future legislation in hopes of spurring more bank lending.

August 3 -

Year to date Mar. 31, 2020. Dollars in thousands.

August 3 -

Lexicon Bank in Las Vegas, whose chairman was a professional gambler, is actively courting poker players to open deposit accounts for their tournament winnings.

July 30 -

The company's latest Credit Union Trends Report attributed the increase to rises in deposits and capital, along with a decline in borrowing.

July 29 -

Peoples Bank in Arkansas once used brokered deposits to fund more loans to underserved borrowers. It could do so again if Congress loosens restrictions, says CEO Mary Fowler.

July 22 Peoples Bank

Peoples Bank -

The company said the acquisition should lower its funding costs and shore up its net interest margin.

July 21 -

The new consumer deposit product will provide customers a snapshot of the carbon impact of their purchases and offer other incentives to entice the environmentally conscious.

July 20