-

On Sep. 30, 2018. Dollars in thousands.

April 1 -

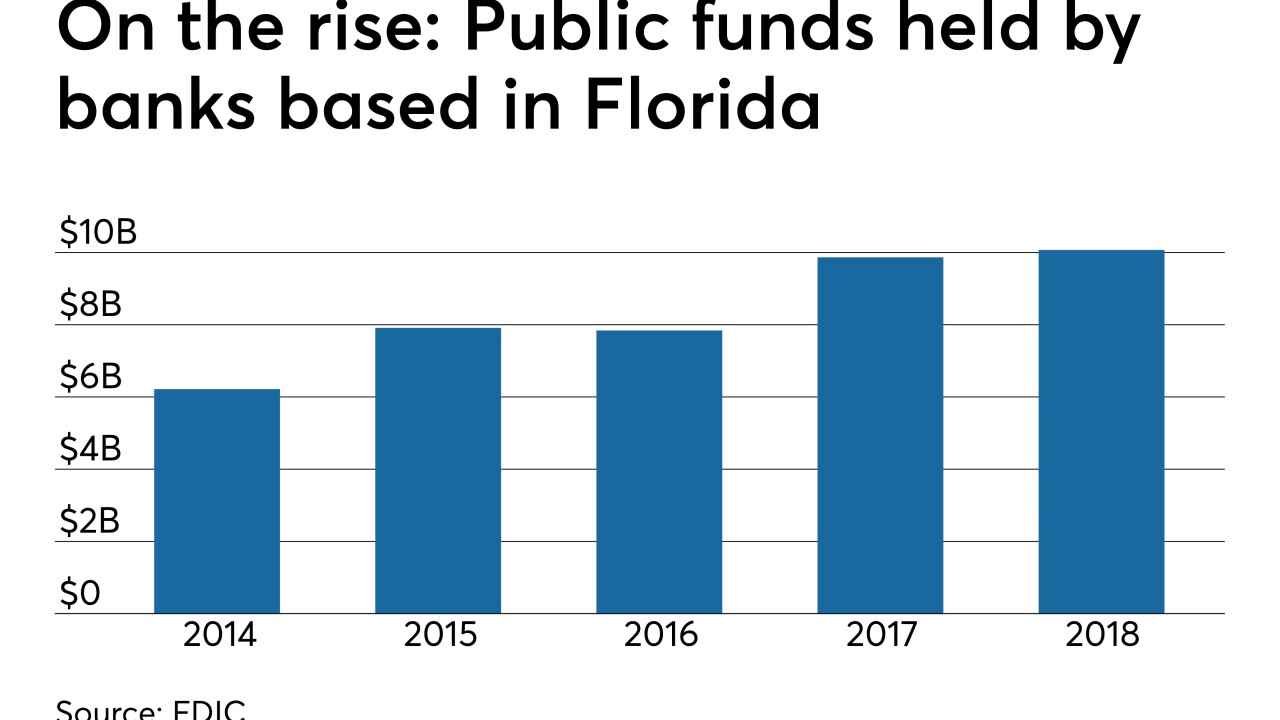

Credit unions in Arkansas and Florida argue that allowing the industry to take deposits from cities and other public entities would help with funding and control for risk.

April 1 -

The Scarborough, Maine-based credit union also posted a more than 4 percent uptick in membership.

March 28 -

State law bars credit unions from accepting deposits from cities, counties and other government entities. Florida banks say it should stay that way unless tax advantages for credit unions are removed, but credit unions counter that banks are trying to stifle competition.

March 22 -

Big banks’ edge lies in their sizable presence in faster-growing cities, not any unfair structural or regulatory advantages, according to a new report by the Bank Policy Institute, which represents large financial services companies. Community banks beg to differ.

March 20 -

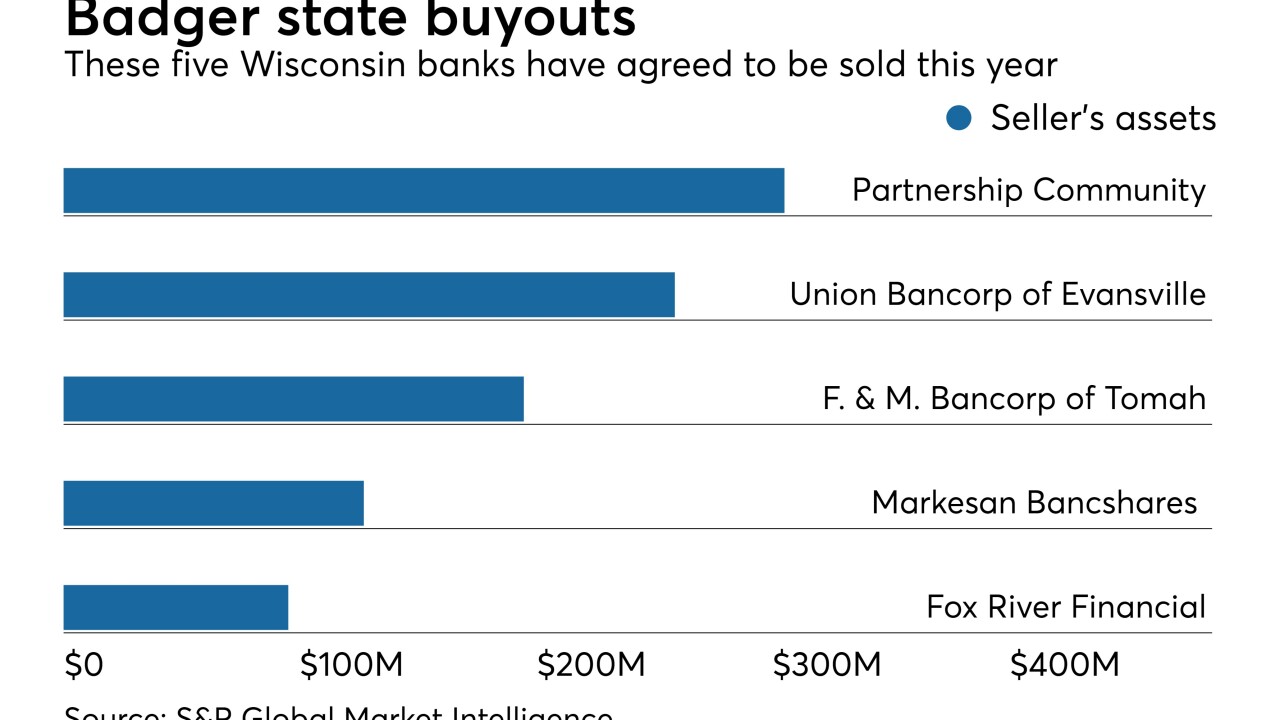

The small Wisconsin city features a vibrant economy, low employment and a growing population, but banks that want to buy their way into the market have their work cut out.

March 14 -

The FDIC should consider limiting its toughest restrictions on brokered deposits to problem banks.

March 12 -

Credit unions need to be thinking about pressure on net interest margins and declining revenues.

March 12 Credit Union National Association

Credit Union National Association -

Its move into new states will allow the nation’s largest bank to pursue the loan and deposit business of more state and local governments.

March 7 -

For years Carter Bank in Virginia had resisted technology of all kinds — even ATMs. But a leadership change, rising rates and a thirst for low-cost deposits finally led to a change in philosophy.

March 6 -

Concerns about an economic slowdown, rising deposit prices and cybersecurity abound, a survey found.

March 5 -

A legal memo conducted on behalf of the trade group says the agency’s policy goes beyond statutory intent and places undue restrictions on healthy banks.

March 4 -

The answer depends who you ask, but an analysis of deposit and loan trends offers some insight.

March 1 -

Aspiration, Wealthfront and SoFi have all begun offering high-yield savings accounts during the past few weeks.

February 28 -

Readers weigh legislative proposals on pot banking, consider JPMorgan's new digital coin, debate the Federal Deposit Insurance Corp.'s brokered deposit rules and more.

February 21 -

The agency’s effort is a good first step to updating brokered deposit rules, but regulators excluded several important considerations in their advance notice of proposed rulemaking.

February 20 Jones Waldo Holbrook & McDonough

Jones Waldo Holbrook & McDonough -

Year to date Sep. 30, 2018. Dollars in thousands.

February 19 -

Flaws in testing may be real source of Wells Fargo's tech failure; BB&T-SunTrust deal throws talent and deposits up for grabs, threatens banking's middle tier; what JPMorgan Chase's JPM Coin means for Ripple and Swift; and more from this week's most-read stories.

February 15 -

"You can't meet customers at the headquarters," CEO Kevin Cummings tells his senior executives.

February 15 -

Since the collapse of IndyMac in 2008, the agency has frequently helped to shield depositors over the $250,000 insurance limit from losses. But it’s a policy that was never formalized, and it remains to be seen whether the agency’s new head, Jelena McWilliams, will follow it.

February 14