-

Year to date Sep. 30, 2018. Dollars in thousands.

February 19 -

Flaws in testing may be real source of Wells Fargo's tech failure; BB&T-SunTrust deal throws talent and deposits up for grabs, threatens banking's middle tier; what JPMorgan Chase's JPM Coin means for Ripple and Swift; and more from this week's most-read stories.

February 15 -

"You can't meet customers at the headquarters," CEO Kevin Cummings tells his senior executives.

February 15 -

Since the collapse of IndyMac in 2008, the agency has frequently helped to shield depositors over the $250,000 insurance limit from losses. But it’s a policy that was never formalized, and it remains to be seen whether the agency’s new head, Jelena McWilliams, will follow it.

February 14

-

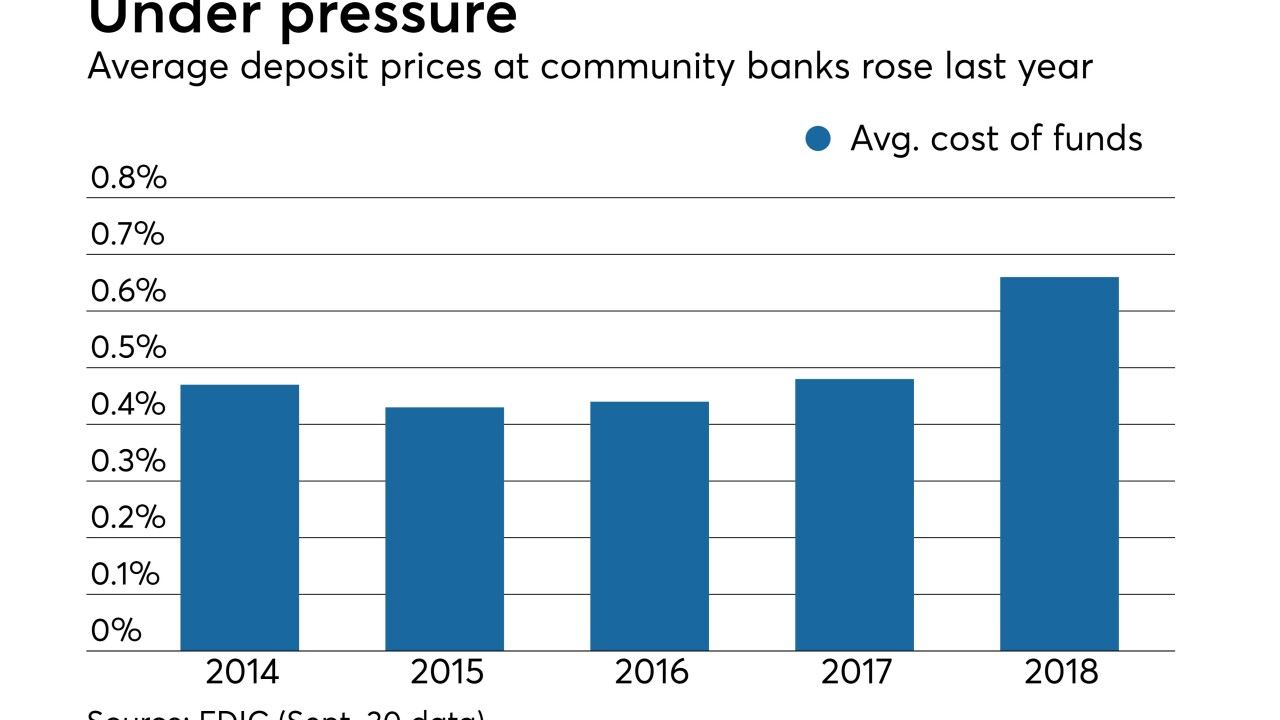

Banks and credit unions are experimenting with ways to maximize margins in an environment where the yield curve is flat, depositors want them to pay up and they fear the Fed could actually cut rates.

February 13 -

Why now? Will it work? How will their rivals respond? The megadeal between the two East Coast regionals offers up plenty of grist for speculation.

February 7

-

Banks spend heavily on marketing to win deposits, push digital; Wells Fargo bends to critics in its latest response to scandals; FDIC review of brokered deposits has big implications for branches; and more from this week's most-read stories.

February 1 -

Banks that gather deposits through branches generally pay lower deposit premiums than those that solicit deposits online. So what happens if long-standing restrictions on brokered deposits are relaxed?

January 30 -

More than half of the new depositors the online bank added in the fourth quarter are millennials.

January 30 -

At banks of all sizes — from the $7.2 billion-asset WSFS Financial to the $373 billion-asset Capital One — marketing budgets ballooned in the fourth quarter.

January 29