Digital banking

Digital banking

-

Visa's Digital Commerce App is allowing banks to develop their own mobile wallets. Many of its clients are larger community banks that may not otherwise have the resources to develop such a product internally.

June 13 -

Nonbanks now set the digital banking experience bar, but in less than a decade large banks will have swallowed them up and will have become digital financial superstores.

June 13 -

Fintech companies are asking a federal regulator to create a specialized charter that would allow them to comply with federal rules instead of facing a state-by-state licensing framework.

June 10 -

Umpqua Holdings in Portland, Ore., has found a bank partner to join in its bid to bring new banking technologies to market.

June 10 -

The federal agency expressed skepticism about industry-developed standards Thursday, suggesting that there is currently no way to enforce the rules or punish bad actors.

June 9 -

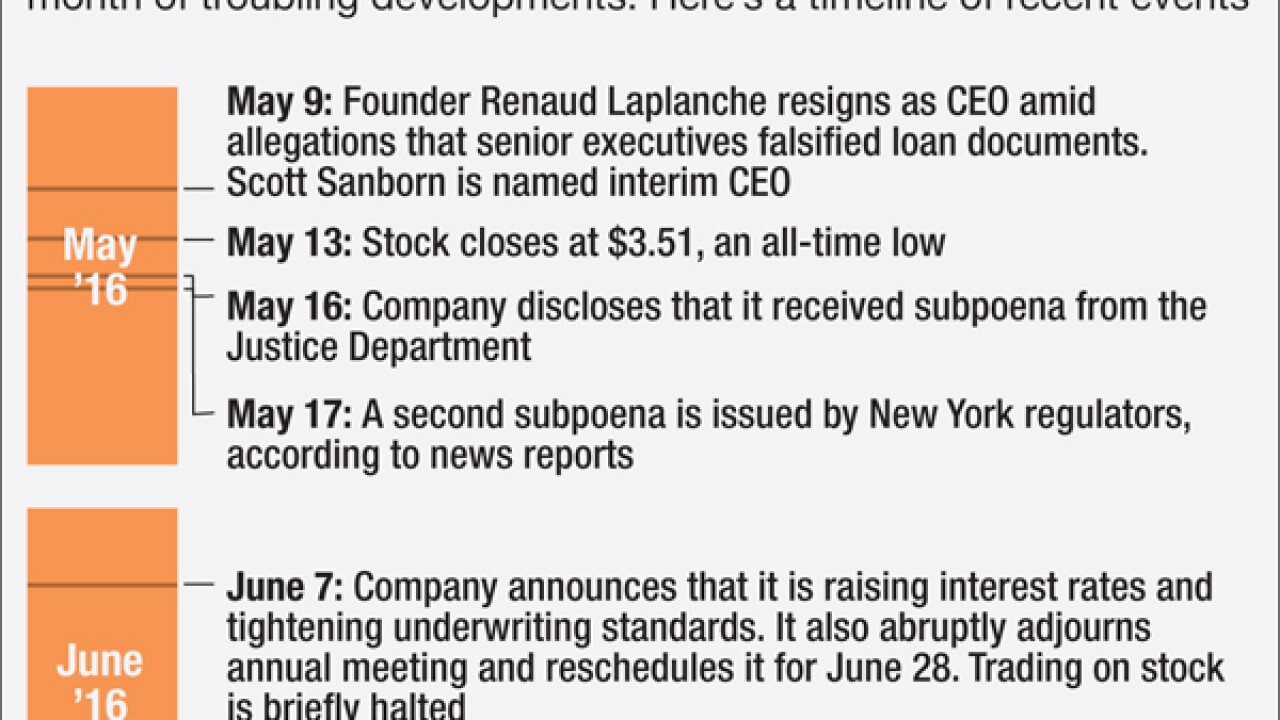

With its very survival at stake, the San Francisco-based marketplace lender is balancing key priorities that are sometimes in conflict with each other.

June 8 -

PNC Financial Services Group has been named the official bank of the University of Kentucky, its 50th such partnership with a college or university.

June 8 -

Throw Cathy Bessant of Bank of America a question about a hot tech topic, and she's got answers. Blockchain? She loves it but is still waiting for its use case. Patents? The law is making us be aggressive. Swift? A call to action. And that's just the start.

June 8 -

Associated Banc-Corp in Green Bay, Wis., has promoted Brent R. Tischler to the newly created position of director of retail banking.

June 6 -

Deutsche Bank Chief Executive Officer John Cryan said Germany's largest lender is abandoning plans for a new digital bank in the U.S., led by Henry Ritchotte, just months after it was announced.

June 6 -

In late April, blockchain evangelist Blythe Masters told a crowd in the London Docklands that banks could solve many of their problems if they embraced the transaction-processing technology.

June 6 -

The bank, which operates in 12 states, is bringing customers in the door even as it cuts its retail square footage by half. The lure? The offer of a financial "checkup" that tens of thousands of people have accepted.

June 3 -

The engineers on Arjun Sirrah's team are on a first-name basis with customer service staff. Those relationships help Darien Rowayton Bank's student lending arm competes with fintech companies.

June 3 -

The regional bank has extensively studied the viability of such platforms, but has been unable to develop a plan to fits its risk appetite.

June 3 -

Well-established tech giants like Amazon and Google pose a more formidable threat to banks than the thousands of startups populating the fintech market.

June 3 -

The CEOs of banks that operate only online argued Thursday that their model is the way of the future. Not so fast, responded the heads of some of the nation's largest banks.

June 2 -

As its digital consumer executive, Carrie Sumlin is tasked with making sure Ally Bank offers its customers top-notch digital services since it doesn't have any branches.

June 2 -

The 'decentralised apps' tied to blockchain bring increased transparency, automation and security to traditional payment systems. This can create a domino effect that leads to a reduction in operational costs, accounting expenses, and friction which can benefit the business and pass savings on to customers.

June 2 -

Suresh Ramamurthi has launched a new payment system for healthcare providers and APIs that let other companies create their own faster-payment products all at a tiny bank in rural Kansas.

June 1 -

By allowing commercial clients to authenticate via an eye scan, Wells Fargo is making a burdensome task simple. Secil Watson, head of wholesale Internet solutions, is pushing the bank to make digital banking easier for commercial clients.

May 31