Digital banking

Digital banking

-

It’s still primarily a commercial bank, but the branding campaign — CIT’s first in a dozen years — is designed to appeal to the group driving its torrid deposit growth: retail savers.

December 7 -

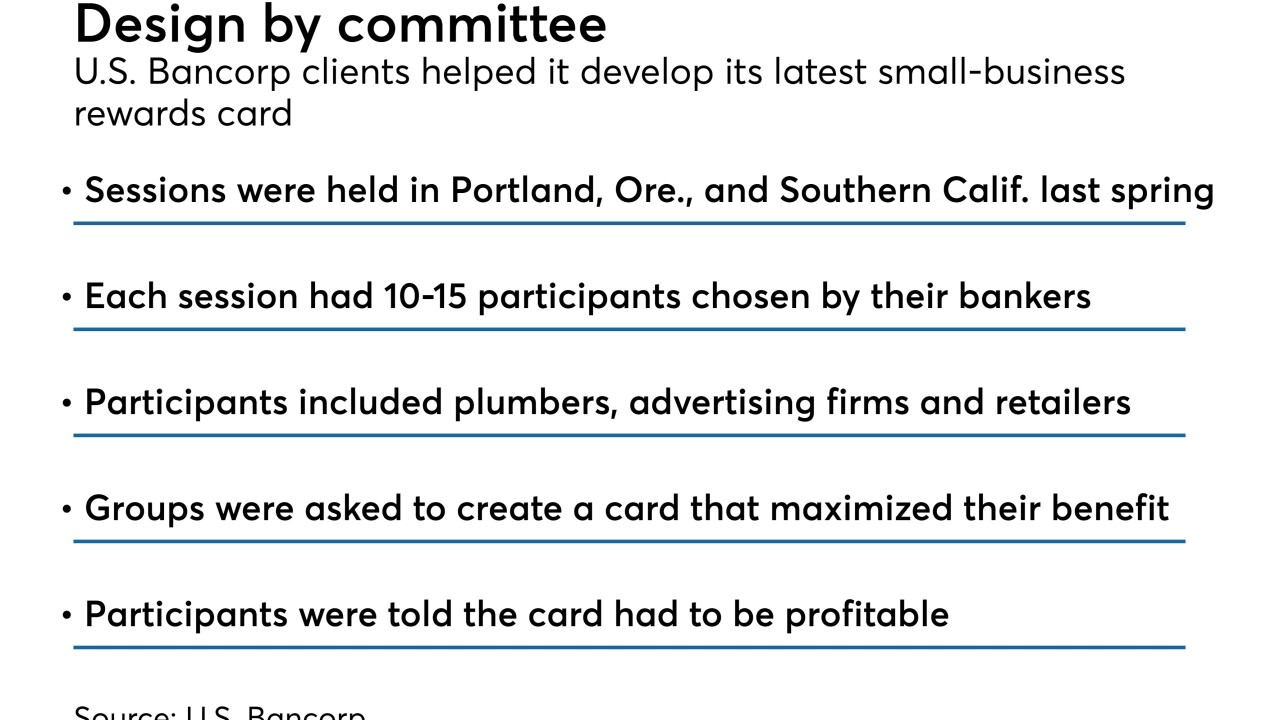

The regional bank is working with customers to help develop and launch new products, including a small-business credit card.

December 7 -

Not only did cardholders buy more in the days surrounding Black Friday, but more consumers completed digital transactions.

December 6 -

Michael Hanley, former head of digital for the World Economic Forum, and Anthony Thomson, the creator of Atom Bank, share their thoughts on the future.

December 5 -

The Chicago bank's new partnership with AutoGravity mirrors others struck this year by JPMorgan Chase and U.S. Bank with providers of mobile apps that bundle the car-buying and lending processes.

December 5 -

The online lender has acquired NextGenVest, which uses AI and text messaging to advise high school and college students about getting loans. CommonBond’s goal is to better understand the distinctly different demographic group rising behind millennials.

December 4 -

The company, which helps banks develop high-tech products and services, has agreed to buy Gro Solutions after recently completing its deal for Cloud Lending.

December 3 -

To convince skeptical bankers about the benefits of distributed ledger technology, some suggest it needs to be separated from the volatile digital currency it underlies.

November 30 -

Readers weigh in on consumers taking on more debt, President Trump's criticism of the Federal Reserve and Zions CEO Harris Simmons as Banker of the Year.

November 29 -

Building alliances with startups is the most affordable route for community banks that want to offer innovative services, but industry officials cautioned that they must be balanced with smart internal investments, too.

November 29 -

He will take over as CEO from Carlos Torres Vila, who becomes chairman at year-end. Still unknown: who will run the company's U.S. bank once Genç moves up.

November 28 -

Proponents of real-time payments systems say banks must embrace them given consumer demand for more immediacy and transparency, even if criminals will try to exploit them.

November 28 -

In a world where most financial matters can be handled with a few taps on an app, debt collection appears stuck in the last century.

November 28 -

Date, now a venture capitalist, worked with the lending software company's CEO, Dan O'Malley, at Capital One in the 2000s.

November 28 -

Through timely investments, opportunistic dealmaking and a laser focus on employee engagement, Turner has Wilmington, Del.-based WSFS on the cusp of becoming a regional power.

November 27 -

Nexos National Bank would be led by Gordon Baird, a former Citi executive. A former New York banking commissioner is set to join the proposed bank's board.

November 26 -

Minorities are still charged more for mortgages when all other applicable credit factors are equal — both in person and online, according to a new study by the University of California, Berkeley.

November 26 -

Traditional institutions shouldn’t just develop stand-alone online banks on top of existing infrastructure. They’d be best served building these “parallel” banks from the ground up.

November 26 -

Unlike online lenders, banks are focusing primarily on consumers with solid credit scores. But unsecured loans to prime borrowers have a limited track record, so it’s hard to predict how they’ll perform when the economy inevitably weakens.

November 22 -

From digital assistants and new branching strategies to revamped hiring processes and improved cybersecurity, these are the winners of the 2018 Best Practices Awards.

November 21