Read on for highlights of all of this year's winning entries, and click the link with each item to read the full story.

Branch modernization

Management hoped that the change would help increase business, address the future needs of members and ensure it was adapting to a changing financial marketplace. The result lowered costs and increased member satisfaction.

To read more,

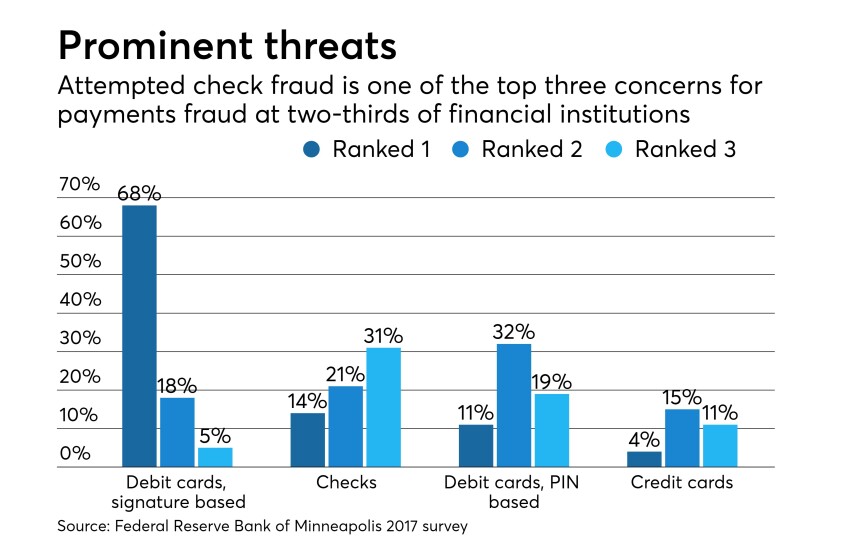

Fraud reduction

For more,

Deposit growth

For more,

Voice banking

For more,

Growth strategies

For more,

Branching

For more,

Digital efficiencies

For more,

Lending

For more,

Improved hiring proceses

The Dallas credit union’s go-to source for finding employees was posting vacant positions on its online job board, but that process was slow and costly. To make the process more dynamic, the $1.4 billion-asset institution has implemented a multifaceted approach for hiring, including a new style of interviewing candidates. Managers now screen prospective candidates, speeding up the process. Additionally, CUTX developed a new curriculum for its managers that included a full day of training that involved different departments. This gives leaders from different departments a chance to get to know each other and collaborate

For more,

Cybersecurity

For more,

Efficiencies

For more,

Boosting online engagement

For more,

Member acquisition

For more,