-

Christine Duhaime, an anti-money-laundering attorney in Toronto, lays out the reasons banks should become early experts (and assist) in initial coin offerings. She also lays out the risks, especially in the wake of the SEC’s report suggesting some ICO tokens are really securities.

August 1 -

Startups and open-source software projects have raised $1.3 billion this year through initial coin offerings. The real boom may still lie ahead, fears of a bubble notwithstanding.

July 28 -

The federal agency's investigative report concludes that crowdsales of blockchain tokens known as initial coin offerings may need to comply with securities laws.

July 25 -

A new blockchain network that promises to compete with Ethereum is taking the token sale trend to the next level.

July 13 -

It’s not speed, which will steadily if not exponentially increase in the near term. It’s the centralists that are holding onto their roles as reconcilers of data.

July 11 Financial InterGroup Advisors

Financial InterGroup Advisors -

Using technology from the blockchain startup Ripple, the U.K.'s central bank completed a successful proof of concept—and reaffirmed its goal of integrating with distributed ledgers.

July 10 -

Just as we call letters "snail mail," in the future people may consider bank transfers snail money.

June 21 -

Readers chime in on the GSE conservatorships, bitcoin’s future, regulatory relief for regional banks, a recent Supreme Court ruling on debt collection, and more.

June 16 -

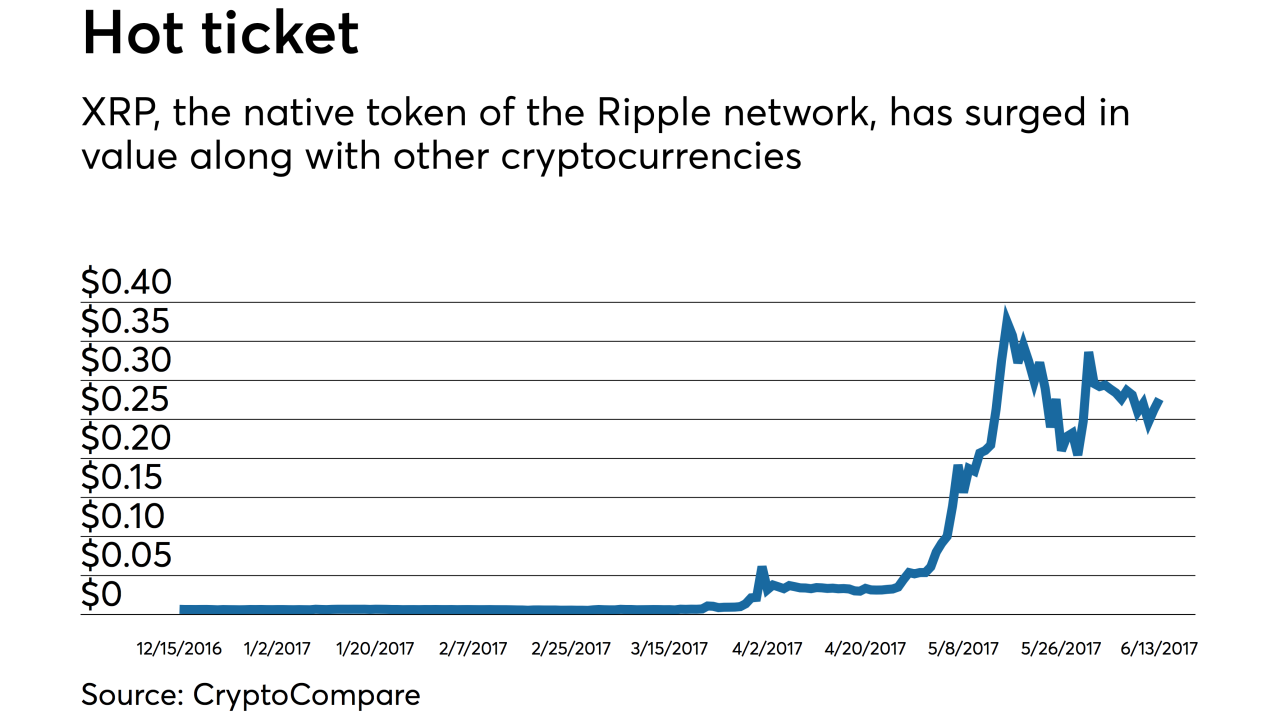

Most fintech startups fall into one of two camps: those that want to compete with banks and those that want to save banks from themselves. Ripple is the rare exception that wants to do both.

June 14 -

Private companies incorporated in Delaware could start issuing and tracking shares of stock on a distributed ledger this summer.

June 13 -

The consortium joins a growing list of cross-industry groups exploring uses for distributed ledger technology.

May 26 -

The money will be used to hire more people. It is also a morale boost for the group, which has suffered some high-profile recent defections.

May 23 -

The creators of a top "altcoin" are building privacy features for JPMorgan's blockchain platform.

May 22 -

The roughly $2 million investment comes as banks keep joining (and in some cases, leaving) various distributed ledger projects as they try to pick the winners in a young field.

May 11 -

Sovrin, a new blockchain for the creation and management of digital identities, may help credit unions save money and fight fraud while returning power to individuals.

May 2 -

Blockchain technology requires major change in people and processes and smaller banks need to prepare, according to Joe Dewey, an attorney at Holland & Knight and author of a new book about distributed ledger technology.

May 2 -

The bank has quit the R3 consortium, whose tech decisions were at odds with its own.

April 28 -

The global messaging network Swift and its fintech challenger, Ripple, have been vying for bankers’ hearts and minds for more than a year. Whoever prevails, their latest moves could bring needed change to how international banking is done.

April 26 -

The blockchain-based platform, set to launch later this year, promises to make gold trading around the world faster, more transparent and safer.

April 12 -

Five banks and the tech firms R3 and HQLAX are using distributed ledger technology to make it easier to transfer liquid securities and collateral.

April 6