-

The San Diego bank is struggling to renegotiate a partnership with the tax preparation firm to address caps on interchange fees.

March 3 -

The specific impetus for the Federal Trade Commission's inquiry into Visa and Mastercard's debit transaction routing processes is not entirely clear, but it likely stems from the effect that advanced payments technology has had on Durbin amendment compliance.

January 15 -

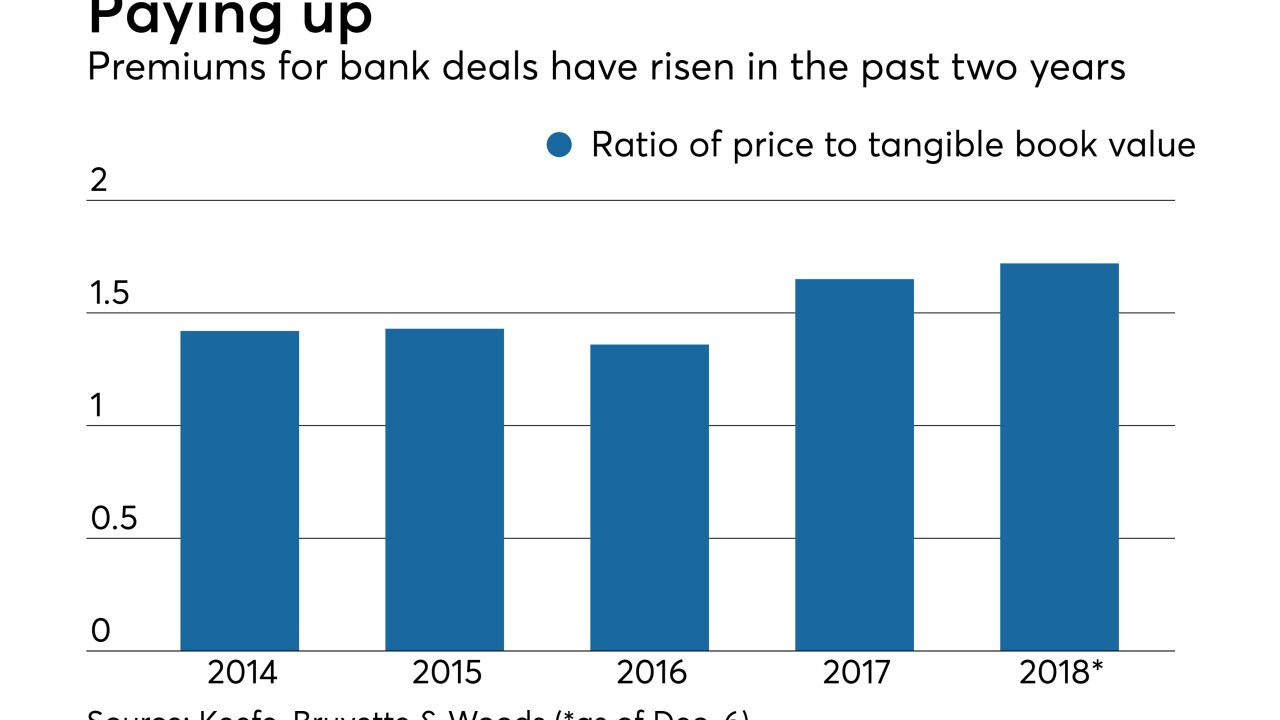

A big splash by Fifth Third, a bid by WSFS to reinvent itself and some bold long-distance expansions highlighted a year where deal activity held steady but premiums rose.

December 23 -

BankMobile will remain part of Customers for at least two years after regulatory snags derailed a plan to transfer the unit to a Florida bank.

October 16 -

Customers Bancorp said Flagship Community Bank has temporarily withdrawn its application with the FDIC to acquire the digital bank.

August 10 -

Renasant is requiring Brand Group to sell $55 million in classified loans before closing the deal, while attaching an incentive for the seller to get as much as possible for those sales.

March 29 -

The biggest legacy of the current regulatory relief effort may be the increasing focus on whether organizing banks in supervisory buckets by asset size makes sense. Yet the bill deals with just one of the two big asset thresholds in the law.

March 26 -

Limited organic growth opportunities and rising premiums for bigger deals are fueling more sales of banks with $1 billion to $10 billion in assets.

March 9 -

The California company has agreed to buy Grandpoint Capital, a business bank in Los Angeles, for $641 million.

February 12 -

Walmart is the first major merchant to add Fiserv’s Accel signature debit service following the debit network’s recent expansion of routing options, in a move to cut costs for card acceptance.

February 5 -

The South Carolina company also provided a timeline for heightened regulation tied to crossing the $10 billion asset threshold.

January 23 -

The company sold securities in the fourth quarter to stay below $10 billion in assets and avoid a cap on interchange fees.

January 4 -

The acquisition is expected to boost WesBanco’s presence in Huntington, W.Va., and provide a bridge to its existing operations in Charleston, W.Va., and southeastern Ohio.

November 14 -

The Montana company agreed to buy Inter-Mountain Bancorp in an all-stock deal valued at $173 million. The company has lined up nine bank acquisitions in the last five years.

October 27 -

Financial institutions should consider personalized campaigns and offers designed to convert customers to their debit or credit card, writes Bob Koehler, executive vice president of project management for SRM.

October 26 SRM

SRM -

Banking lobbies are still opposed to the Durbin Amendment, which would hurt a free market, writes Mark Horwedel, CEO of the Merchant Advisory Group.

August 22 CMSPI

CMSPI -

Size matters in the credit union industry, and in most cases, the biggest have a serious advantage. But reaching this particular threshold doesn’t come cheap.

August 8 ALM First Financial Advisors

ALM First Financial Advisors -

A headquarters move to Boston, a core system with plenty of headroom and a CEO who admires big acquirers like M&T and the old Banknorth: All the signs are there of an ambitious bank with a plan.

June 23 -

The Trump administration is stepping away from the government’s 7-year legal fight with Amex that centers on retailers’ right to encourage the use of particular cards. The decision is good news for issuers of credit and debit cards, though it is hardly the last word on the case.

June 7 -

The Trump administration is stepping away from the government’s 7-year legal fight with Amex that centers on retailers’ right to encourage the use of particular cards. The decision is good news for issuers of credit and debit cards, though it is hardly the last word on the case.

June 7