Earnings

Earnings

-

Executives at the Tennessee banks are using the biggest bank merger in a decade to aggressively recruit lenders and clients in Southeastern markets.

April 16 -

The Peoria, Ill.-based institution also saw increases in lending and net worth.

April 16 -

Bank of America's Brian Moynihan had a lot to brag about in discussing 1Q results but faced questions about what he would do if economic growth slows and rates hold steady for a prolonged period. Other bank chief executives have gotten, or will get, similar questions this earnings season.

April 16 -

The Los Angeles bank reported a 5% decline in net income despite strong loan growth as deposit costs rose and fee income fell.

April 16 -

The Dallas regional assured analysts that it has ample sources of liquidity to fund its expected loan growth.

April 16 -

Montgomery County Employees Federal Credit Union is now operating as SkyPoint Federal Credit Union.

April 16 -

Citi, Goldman, BofA earnings rose despite flat revenues; benchmark would be based on rates set on the American Financial Exchange.

April 16 -

Net interest income at the bank's consumer unit rose nearly 10%. But first quarter could be the last hurrah for that catalyst at BofA and other banks as the Fed pauses its rate-tightening cycle.

April 16 -

The bank’s CFO says it has enough liquidity to meet loan demand in the short term, but how long can it keep its loan-to-deposit ratio below 100%?

April 15 -

Citigroup's return on tangible common equity rose in the first quarter, but stubbornly high expenses and costly technology investments may make it hard for the bank to hit its targets for this year and next.

April 15 -

Citigroup, Goldman earnings surprise to the upside; cost cuts fueled the bank’s 14% earnings growth.

April 15 -

The bank's profits rose 2% despite a decline in revenue.

April 15 -

The San Francisco bank is under pressure from investors to get out from under a Fed-imposed asset cap and to hire a new permanent CEO. But executives said Friday that thoroughness is more important than speed.

April 12 -

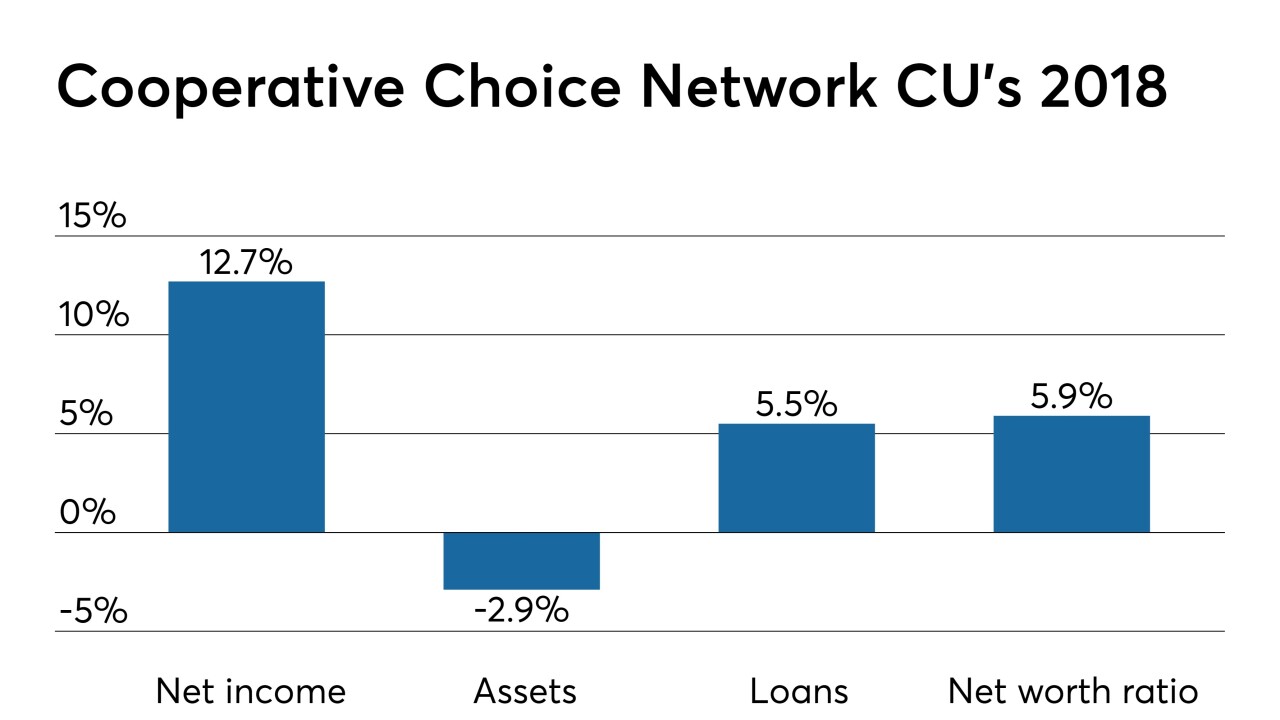

The Illinois-based credit union, which recently announced an expanded field of membership, saw loans rise by nearly 7% in 2018.

April 12 -

2018 was mixed bag for credit unions in the Wolverine State, with membership and lending still seeing positive numbers but down from previous years.

April 12 -

The San Francisco bank has roughly doubled its assets in the last five years without the benefit of an acquisition.

April 12 -

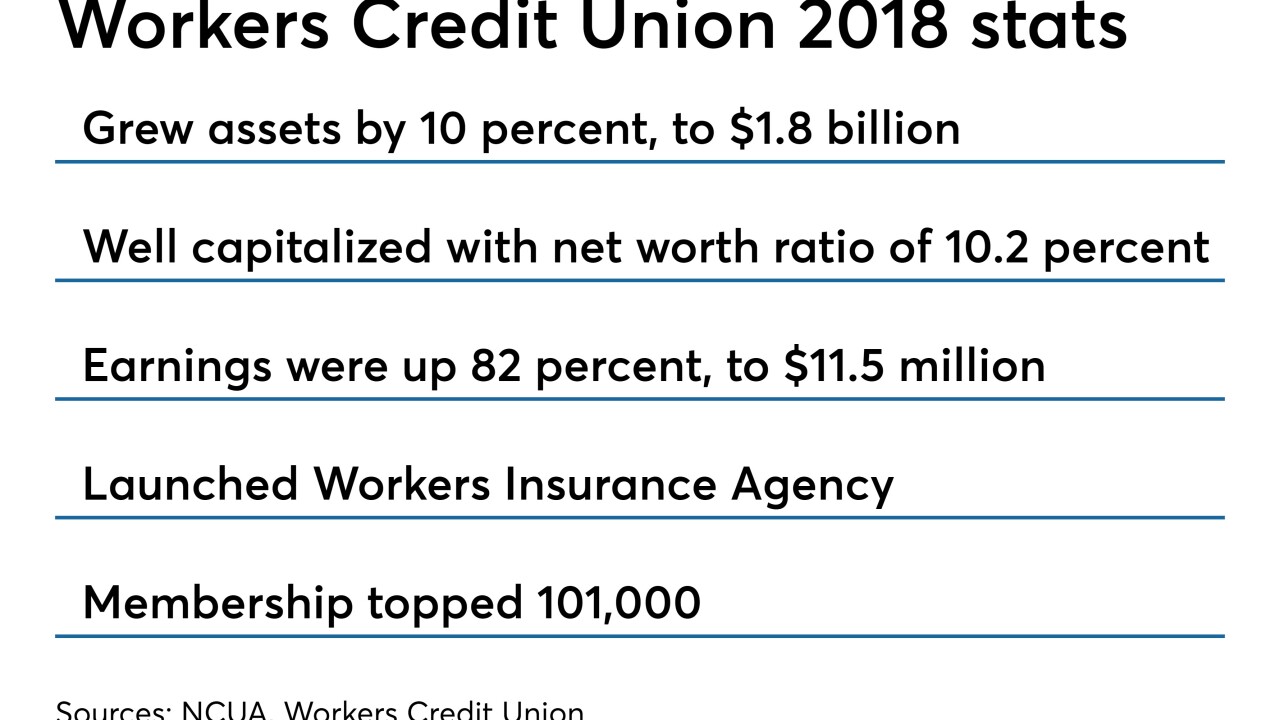

The Fitchburg, Mass.-based institution also started an insurance agency and upgraded its mobile banking last year.

April 12 -

The Pittsburgh company more than doubled its provision for loan losses during the first quarter to keep pace with growth in its loan portfolio.

April 12 -

Wells Fargo & Co. investors who stuck with the bank through a bumpy few months are being rewarded with the best first quarter in five years.

April 12 -

Bank's profits grow 5% on earnings growth; Citi's number 2 exec retirement shows the difficulty retaining a host of top executives.

April 12