Earnings

Earnings

-

Banks are testing the waters on paying depositors lower interest rates, and analysts expect they're due for a bigger breather when the Fed takes action. It's a welcome shift for banks, after competition for deposits forced them to pay up.

August 9 -

The prepaid card firm and banking-as-a-service provider extended its contract with its largest BaaS client in Q2 despite a July consent order from the Federal Reserve.

August 8 -

The stock swoon of early August, however, raises red flags and could delay an anticipated rise in loan demand for banks in need of stronger interest income, analysts caution.

August 8 - Yahoo Finance Feed

During a market rally following Monday's correction, MoneyLion was left behind despite beating analyst expectations and issuing a positive outlook.

August 6 -

The bank technology company has a payments unit but reports most of its revenue comes from sources other than transaction processing.

August 6 -

After a bloodbath that wiped out several trucking companies, a new U.S. Bank report on the industry signals its fortunes may be turning. The rebound, if sustained, may end the bleeding in bank loans to the sector.

August 1 -

Afterpay co-founder Nick Molnar will lead a centralized sales structure, part of a larger organizational change as the firm battles firms like PayPal and Stripe to reach merchants.

August 1 -

The Kansas City, Missouri-based regional bank said it is making progress on its pending purchase of Heartland Financial USA in Denver. The deal is expected to close during the first quarter of 2025.

July 31 -

The banking holding company's new type of private security, launched last year, also reached $3 billion in loans sold last month.

July 31 -

CEO Michael Miebach told analysts that a court's dismissal of an earlier agreement on interchange charges is disappointing, and he hopes to avoid a trial.

July 31 -

The Hammond, Louisiana, company, which announced changes to its business strategy, cut 71 jobs and reduced its dividend to 8 cents per share.

July 30 -

Election speculation about policy change at Fannie Mae has boosted its stock slightly this year. It's also profitable, but there's much more to consider.

July 30 -

CEO Alex Chriss contends the payments company can get a boost from greater access to mobile payment technology while competing against the technology giant on other fronts.

July 30 -

The store-branded credit card company revised its revenue guidance upward on the assumption that the CFPB's late-fee cap won't take effect before 2025. Still, Bread is moving ahead with plans to make up some of the revenue that it stands to lose from the contested rule.

July 26 -

First Foundation in Dallas recently got a $228 million capital injection led by Fortress Investment Group. Now it's announced plans to pivot away from its heavy focus on multifamily loans, which lost value as interest rates rose.

July 26 -

The San Antonio-based bank is in the midst of a yearslong expansion effort spanning Houston, Dallas and Austin — all of which are fueling loan growth.

July 25 -

The Raleigh, North Carolina-based bank grew loans and deposits in the second quarter as it won back business from former customers of the failed Silicon Valley Bank. First Citizens bought the remains of SVB last spring.

July 25 -

Third-party origination operations are also going to Mr. Cooper in the $1.4 billion deal, in which the seller cited interest in improving its capital position.

July 25 -

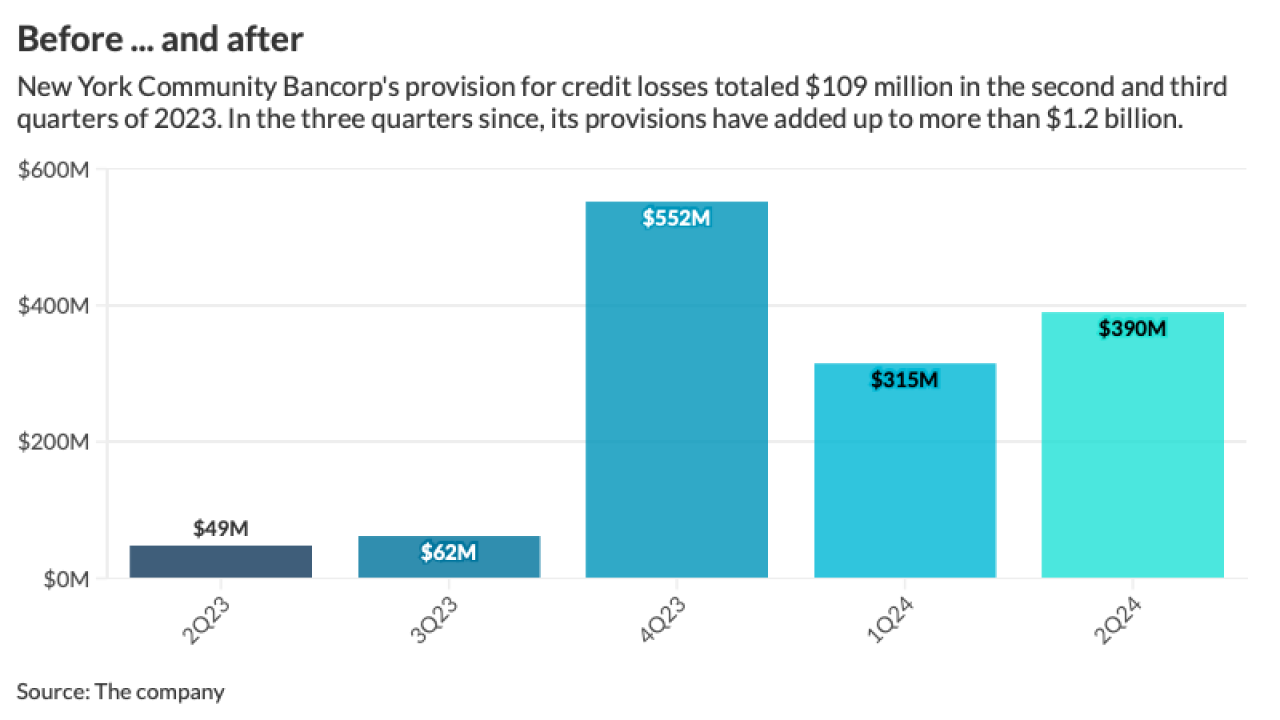

The parent company of Flagstar Bank reported a net loss of $323 million for the second quarter after boosting loan-loss provisions and recording a steep increase in net charge-offs. Still, it says it's making progress on a turnaround plan, including by agreeing to the sale of its mortgage servicing business.

July 25 -

The $72.8 billion-asset bank lowered its guidance for net interest income, explaining that while business prospects on the island are relatively rosy, its stateside opportunities for loan growth look weaker.

July 24