Earnings

Earnings

-

Citigroup's earnings topped analysts' estimates as corporations tapped markets for financing and consumers leaned on credit cards.

April 12 -

The company reported net interest income that slightly missed analyst estimates, a sign the benefit of higher interest rates may be waning amid pressure to pay out more to depositors. Costs rose on higher compensation and an FDIC assessment.

April 12 -

The company missed estimates for net interest income in the first quarter, a sign that muted loan growth and increased pressure to pay out more for deposits are eating into the benefit of higher rates.

April 12 -

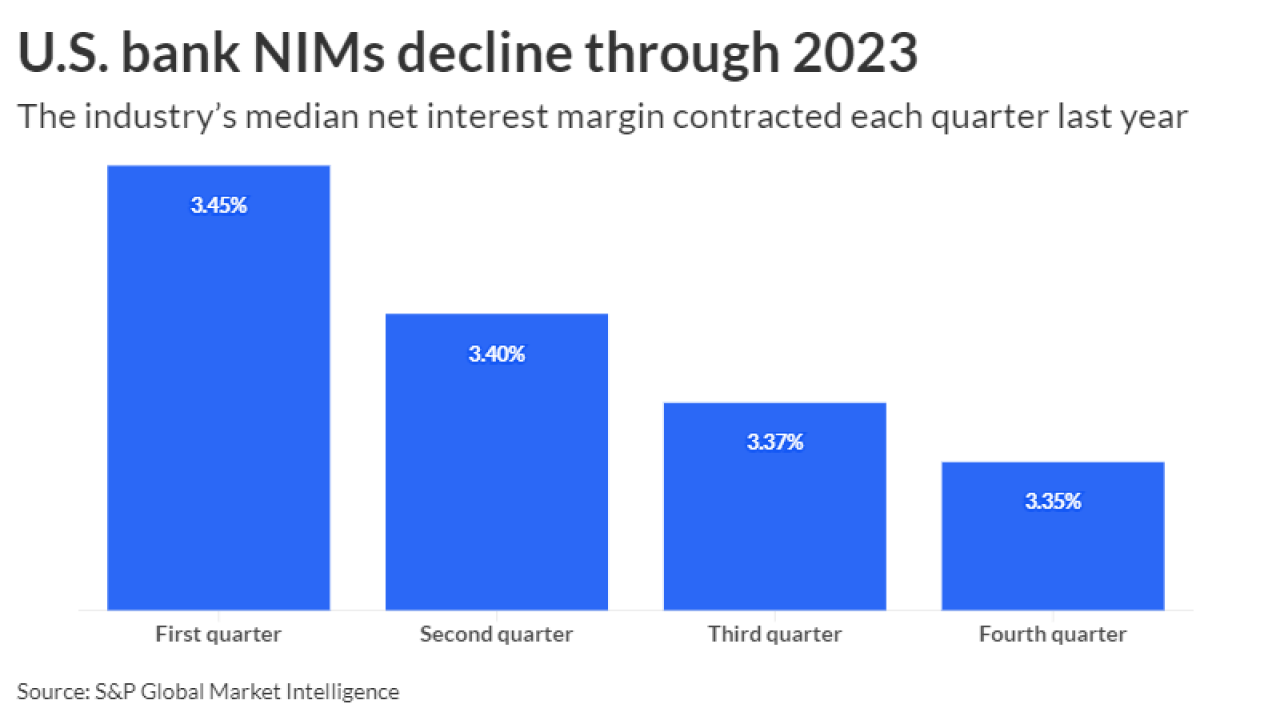

With high deposit and borrowing costs persisting amid the Federal Reserve's campaign against inflation, lenders face stress on their net interest margins and the potential of troubled loans ticking up.

April 2 -

Each spring during the rush of annual meetings, a handful of financial institutions take heat from shareholders who demand new strategies, management shakeups and, at times, even a sale of the company.

March 26 -

Bank of America, Citi and Navy Federal are among banks and credit unions to recently manage through unforeseen challenges.

March 11 -

MoneyLion saw continued financial growth in 2023, achieving four straight quarters of positive earnings. In 2024, it plans to develop a partnership with EY to bolster its enterprise services.

March 7 -

The fintech has grown its way into the black for the first time since going public in January 2022, CEO Jason Wilk says, capitalizing on AI-underwritten cash advances of up to $500.

March 5 -

The Toronto bank has been under investigation by U.S. and Canadian supervisors for alleged shortcomings in anti-money-laundering compliance. CEO Bharat Masrani pledged "comprehensive enhancements" but declined to pinpoint the exact fixes and their costs.

February 29 -

Canadian Imperial Bank of Commerce benefited from growth in its domestic retail business even as it set aside more money than analysts expected for potentially sour loans.

February 29 -

Royal Bank of Canada is optimistic that new U.S. leadership, including former Fifth Third CEO Greg Carmichael, can rejuvenate its struggling City National Bank.

February 28 -

The Toronto-based company wrung out $800 million USD in cost savings in connection with last year's acquisition of Bank of the West, a bright spot in an otherwise tough quarter across most business segments.

February 27 -

After his aggressive cost-cutting raised profits above analysts' expectations, Block's CEO aims to retool several features of Square and Cash App to enable them to operate like a "social bank."

February 23 -

Community Bank System in Syracuse faced claims it failed to properly pay some branch-level employees, making it one of a growing number of banks forced to confront compensation-related disputes in recent months.

February 16 -

The company was able release credit reserves because of actual and forecasted prices that boosted net income, CEO Priscilla Almodovar said.

February 15 -

The lending fintech is increasing its reliance on third-party funding arrangements as its revenue slides. Analysts are wondering how much risk is embedded in the deals.

February 14 -

The government-sponsored enterprise financed 955,000 mortgages last year, down from the 1.8 million loans it backed in 2022.

February 14 -

CEO Alex Chriss told analysts the company's AI-heavy product rollouts won't improve financial results in the near-term.

February 7 -

Ant, the company that operates Alipay, saw its quarterly profit fell 92% as the fintech pioneer founded by Jack Ma struggles to revive a business wracked by an economic downturn and more than a year of regulatory scrutiny.

February 7 -

A day after the regional bank's stock tumbled on tough fourth-quarter results and some austerity moves, observers debated whether management just needs time to build enough capital to catch up with growth or if it is still too overexposed in multifamily lending.

February 1