-

Scandal, business models gone awry, missing money and executive shake-ups — 2016 had it all. Here are the financial services executives or groups of them who took the heat and will be looking for better times in 2017.

December 21 -

Opes Advisors shows would-be borrowers how purchasing a house fits into their total financial picture, now and years into the future. Many of its loan officers are licensed investment advisors.

December 20 -

The National Association of Realtors is warning House Republicans leaders that their tax reform plan would marginalize two long-standing tax incentives for owning a home, which could hurt the housing market.

December 20 -

So now what? New York Community Bancorp and Astoria Financial have been mum about why they nixed their merger agreement, or where they go next, but the companies have a surprising number of options in the current climate.

December 20 -

Citizens Financial Group in Providence, R.I., said Tuesday that it expects to start offering digital small-business loans in mid-2017.

December 20 -

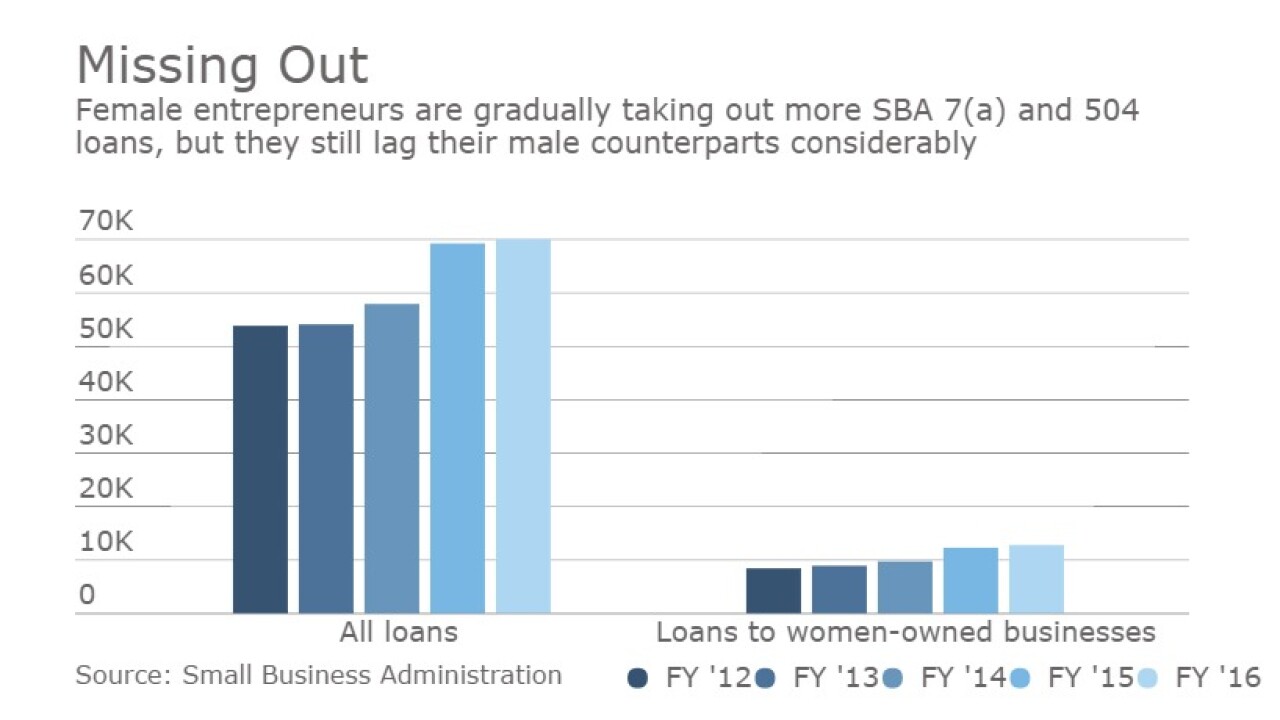

Female entrepreneurs who apply for loans online and are evaluated by an automated system get a bigger share of online credits than they do traditional in-person bank loans. It could be a sign that automated credit decisions are fairer.

December 20 -

Following the passage of the November ballot initiative, it is hugely important that cannabis businesses in the nation's largest state be able to secure bank accounts, at a minimum.

December 20 Harris Bricken LLP

Harris Bricken LLP -

The banking system ultimately needs a balanced approach to capital, which allows banks to efficiently function while also maintaining financial stability.

December 20 Brookings Institution

Brookings Institution -

Republicans say they will roll back regulators' ability to oversee nonbanks once they take full control of the government in January. But what does that mean for agencies' oversight into the eight financial market utilities that operate a key part of the financial system?

December 19 -

Radius Financial Group worked for years to achieve an end-to-end digital closing process, finally doing so this fall. Here's how the Massachusetts lender got it done.

December 19