-

In a candid, in-depth exit interview, Ted Tozer discusses Ginnie Mae's growth during his seven years at the agency's helm, the need for comprehensive housing finance reform, big banks' retreat from mortgages, counterparty risk management and more.

January 18 -

Rising interest rates typically cause lenders to relax underwriting guidelines. The incoming administration promises to deregulate. Sounds like a combustible mix, but there's ample room to loosen credit without returning to the practices that caused the crisis.

January 18 -

Michael Corbat told analysts Tuesday that Citi will no longer report Citi Holdings, its erstwhile "bad bank," as a separate entity.

January 18 -

And the next HUD chief might eventually rescind it altogether.

January 18 -

President-elect Trump has nominated Linda McMahon, a co-founder of the World Wrestling Federation, to run the Small Business Administration for the next four years. If confirmed, McMahon, a Republican, will inherit an agency that has supported record loan volume lately, but that many bankers still view as too bureaucratic and inefficient. We asked bankers and small-business advocates what is working well at the SBA, what they would like to see improved, and what else the Trump administration could do to stimulate small-business growth. Here's what they had to say.

January 18 -

An improving picture in the energy sector helped Hancock Holding in Gulfport, Miss., report a huge jump in fourth-quarter profit.

January 18 -

Northern Trust’s fourth-quarter profit surged due to higher trust fees, improved credit quality and the benefit accrued to its profit margin from an increase in short-term interest rates.

January 18 -

Higher lending for mortgages, construction and commercial real estate boosted Fulton Financial's profit.

January 17 -

Improved credit quality also helped compensate for flat loan growth at the Dallas bank.

January 17 -

TNB Corp., which plans to offer deposits to institutional investors, would not have branches or retail deposits.

January 17 -

Wells Fargo faces an economic environment that may not be particularly suited for the way the bank is structured. Also: are you brave enough to make bitcoin a part of your retirement portfolio?

January 17 -

As president of the secondary marketing agency, Tozer has helped the mortgage market to continue functioning and keep up with changes following the financial crisis.

January 13 -

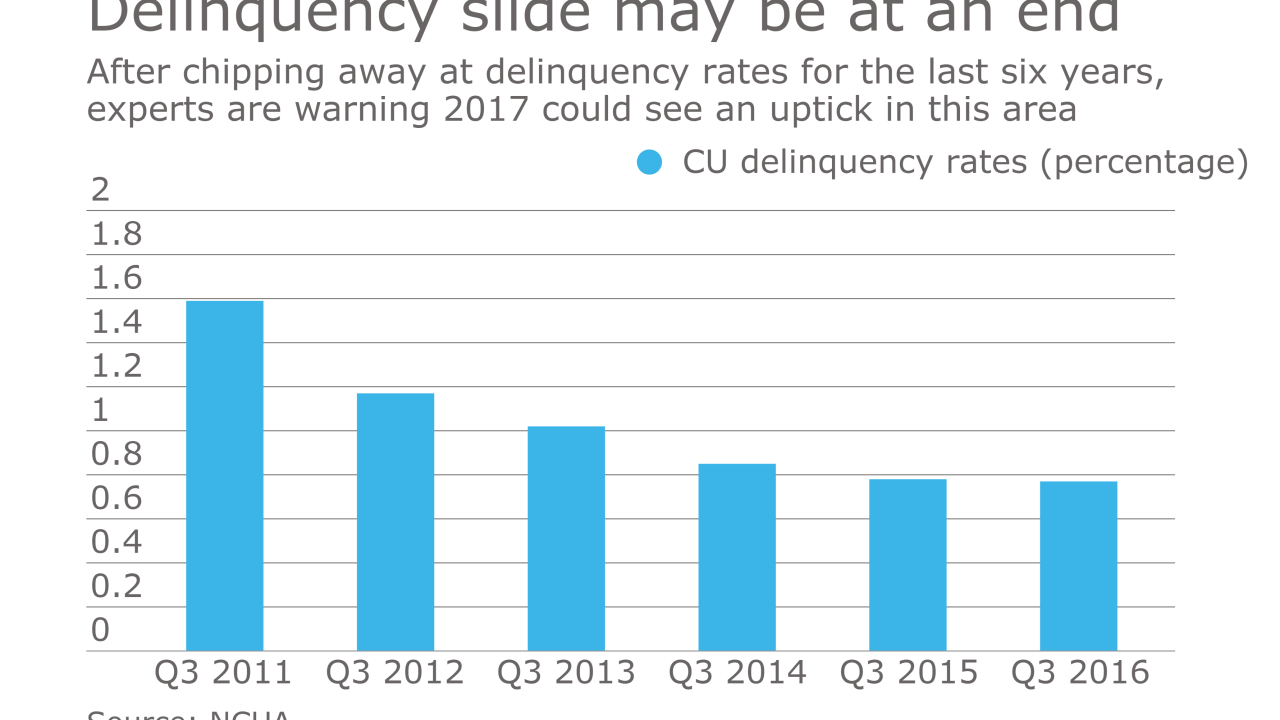

While the rising interest rate environment has gotten a lot of attention, plenty of other factors will play a role in CUs’ financial fortunes in the year ahead, including a potential Dodd-Frank rollback, rising delinquencies and more.

January 13 -

Banks have traditionally used consumer products to serve small businesses. The growth of alternative payment options means banks may lose customers, particularly among young business owners.

January 13 Bill.com

Bill.com -

Banks have started reconsidering how much they are willing to pay for low-income housing tax credits.

January 12 -

People's United is taking its efforts to raise awareness of financial exploitation to a new level.

January 12 -

An international regulatory body outlined a series of recommendations for reducing risks posed by the asset management industry, particularly increasing liquidity and reducing leverage posed by derivatives positions.

January 12 -

Mnuchin to divest; fintech firms may be able to get bank charters

January 12 -

Treasury Secretary-designate Steven Mnuchin will divest himself of his investments and interests in a number of companies and funds once confirmed, including a fund that has bet on Fannie Mae and Freddie Mac being recapitalized and released from government control.

January 11 -

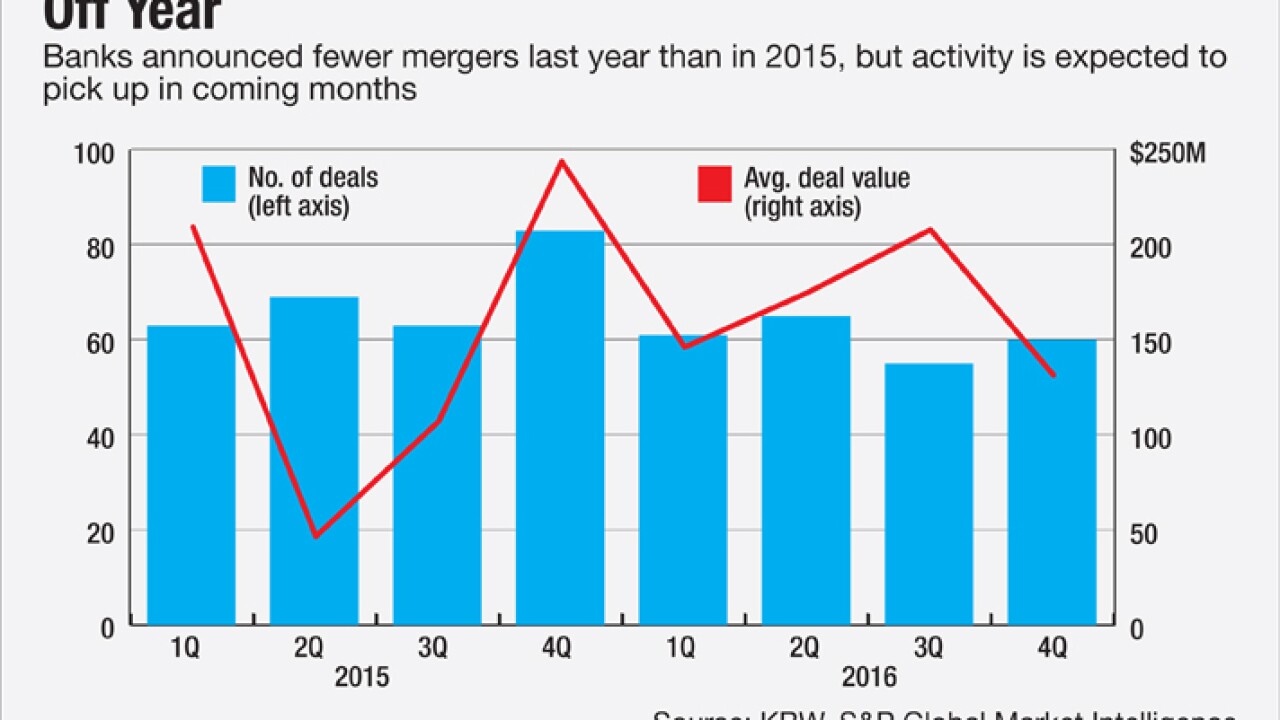

There is optimism that consolidation could bounce back from a lackluster 2016 as bank stocks rally. At the same time, expectations of regulatory easing and tax reform could entice more banks to stay independent, at least in the short term.

January 11