-

Unlike some of its expansion-minded regional bank peers, Montana-based First Interstate is reconfiguring its business model to be smaller and more focused on relationship banking. The blueprint is the work of CEO Jim Reuter, who joined the bank 15 months ago.

February 5 -

Treasury Secretary Scott Bessent is slated to testify in the House Financial Services Committee Wednesday morning as part of the committee's regular oversight of the Financial Stability Oversight Council.

February 4 -

WomenVenture, a Minneapolis-based Community Development Financial Institution, was already under strain from stalled federal CDFI funding. The recent immigration crackdown added significant uncertainty for its customers as well.

February 4 -

The buy now/pay later lender is seeking to create Affirm Bank, a Nevada-chartered industrial loan company.

January 23 -

The Federal Deposit Insurance Corp.'s approval of industrial loan company charter applications for General Motors and Ford Motor Company generated only moderate pushback from banks as crypto, debanking and credit card rate caps dominate the industry's attention.

January 23 -

Though fourth-quarter net charge-offs reached a level not seen since the financial crisis, the Little Rock, Arkansas-based regional bank is forecasting better results in 2026 and an even stronger recovery in 2027.

January 21 -

During the fourth quarter, the Buffalo, New York-based bank reported its lowest ratio of nonperforming loans to total loans since 2007.

January 16 -

David Turner has overseen Regions' finance function since 2010. The Birmingham, Alabama-based company tapped Controller Anil Chadha to replace him.

January 13 -

The custody bank reported a strong fourth quarter, as it continued to push forward with its new operating model. The momentum contributed to the bank's decision to lay out new financial targets, including a goal to achieve a return on tangible common equity of 28% in the next three to five years.

January 13 -

Top executives at the nation's largest bank spoke Tuesday about shifting dynamics in the credit card business, Federal Reserve independence, the bank's plan to increase spending in 2026 and its large portfolio of loans to nonbank financial institutions.

January 13 -

President Trump said he would prohibit large institutional investors from buying single-family homes. While the executive couldn't bar such investments on its own, a legislative ban could gain bipartisan support.

January 7 -

Just a handful of de novo banks opened in 2025. But there are signs of renewed activity, with eight banks currently actively in formation and more than 10 charter applications on file with the FDIC.

January 5 -

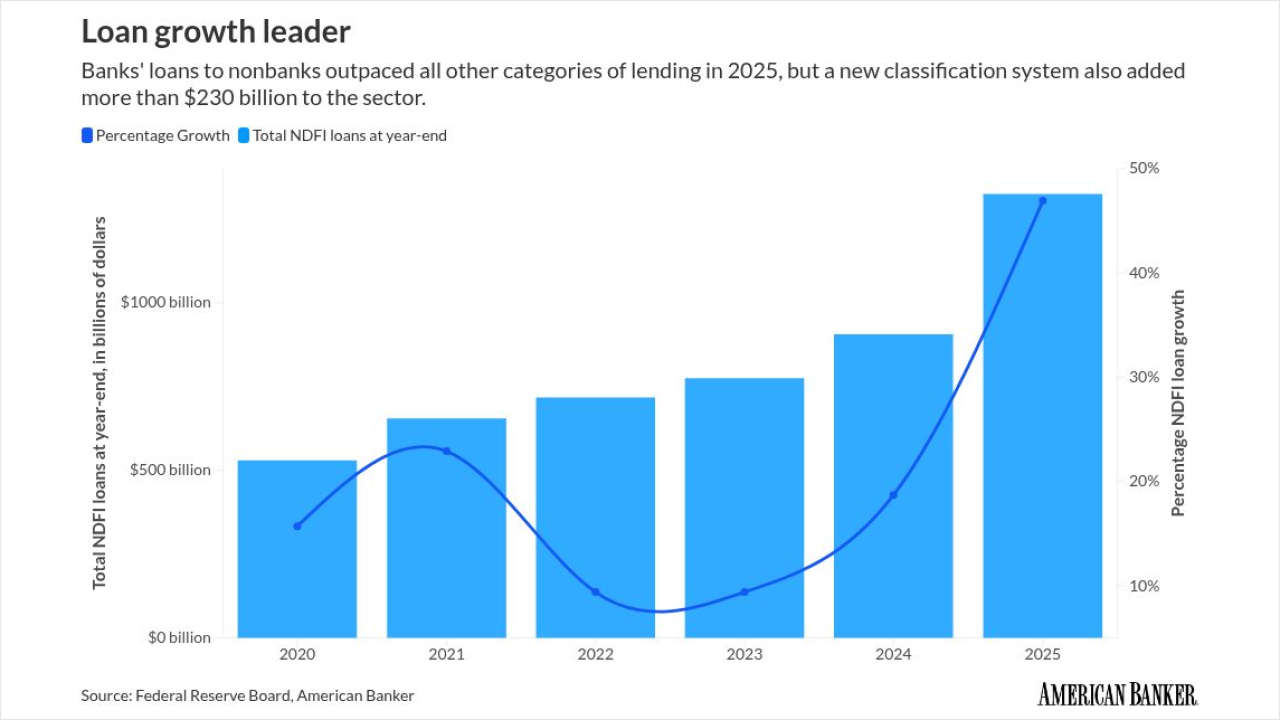

Last year highlighted the risks for banks in lending to nondepository financial institutions. A new approach by Trump-era regulators could change the playing field.

January 2 -

The Birmingham-based lender is opening its first branch in Houston, following a wave of banks rushing into the Lone Star State as its economy continues to boom.

December 16 -

A new report from the Basel, Switzerland-based Financial Stability Board found that nonbank financial institutions grew considerably faster than banks in 2024 and now control more than half of the world's financial assets.

December 16 -

The payments company submitted applications to the Utah Department of Financial Institutions and the Federal Deposit Insurance Corp. to create PayPal Bank. If approved, Mara McNeill, the former president and CEO of Toyota Financial Savings Bank, will serve as PayPal Bank's president.

December 15 -

-

A bipartisan housing provision has emerged as a critical negotiating point for passage of an uncommonly bank-relevant defense authorization bill.

December 4 -

Comptroller of the Currency Jonathan Gould said in an exclusive interview with American Banker Monday that regulators must bring more new entrants into the banking industry, establish a level playing field between banks and fintechs, and shore up supervision amid mounting legal scrutiny.

November 25 -

Federal Reserve Gov. Stephen Miran reiterated his view that monetary policy has become more restrictive than economists think, but expressed increased urgency that the central bank take strong corrective action.

November 20