-

The company is approaching kiosks and other unstaffed payment terminals, which have lagged behind in the chip migration and in some cases are using NFC payments to bypass chips entirely.

January 23 -

Achieving the coveted “top of wallet” status is tough for banks, not least because their own credit and debit cards often compete with one another for priority status with the same customers.

January 18 -

Achieving the coveted “top of wallet” status is tough for banks, not least because their own credit and debit cards often compete with one another for priority status with the same customers.

January 17 -

2017 promises to be a defining year for many in the payments industry. Here's a look at what to expect.

January 17 -

ATM maker Diebold Nixdorf plans to unveil its smallest EMV-enabled payment terminal yet, a self-checkout unit that’s designed to fit into small retail spaces and supports cash, cards and contactless payments, but lacks a magnetic stripe reader, the company said in a Jan. 9 press release.

January 9 -

Banks such as TCF Financial and Citigroup are adding Near Field Communication to their EMV cards to address consumers' displeasure.

January 6 -

Prior to the October 2015 EMV chip-card liability shift in the U.S., various merchant groups expressed concerns about factors that would keep them from meeting that deadline — some of which remain beyond their control.

January 5 -

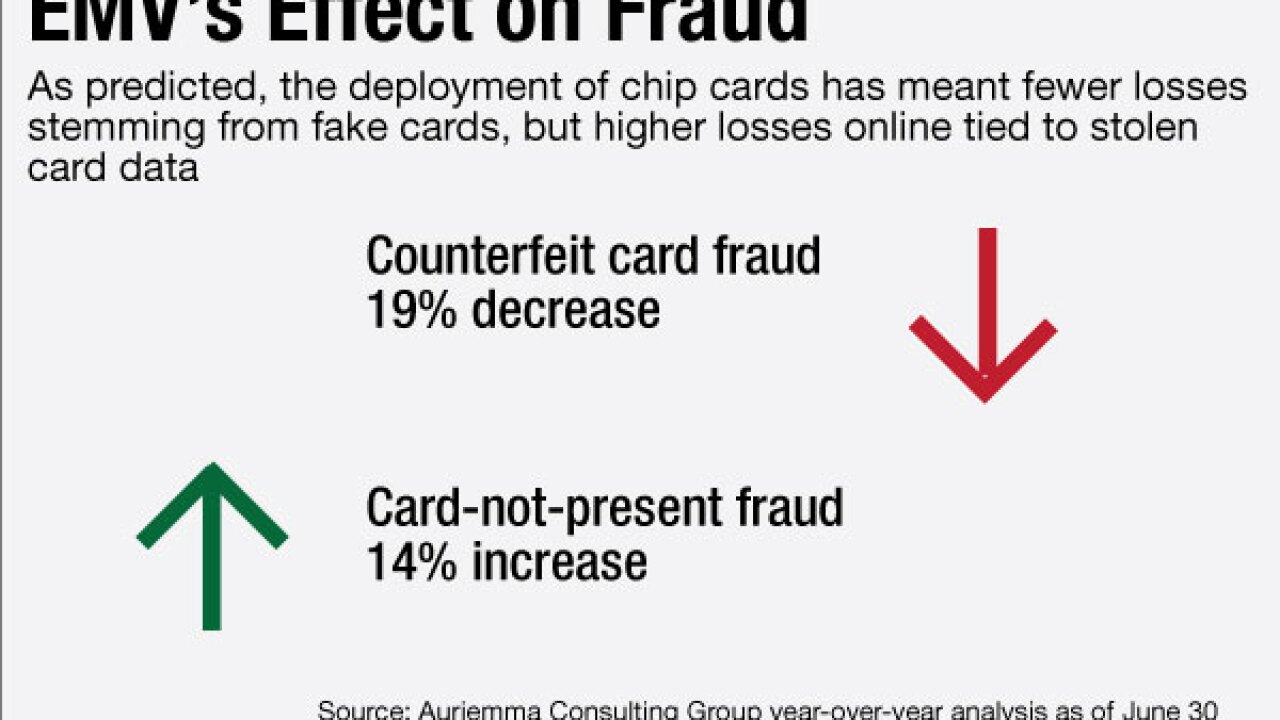

The EMV migration, online marketplaces and e-banking are giving crooks lots of places to commit fraud. Security strategy has to be more dynamic to keep up.

January 3 Simility

Simility -

2017 promises to be a defining year for many in the payments industry. Here's a look at what to expect.

December 30 -

The large scale of the U.S. payment card market prompted many issuers to keep things simple by sticking with contact-only chip cards when they finally moved to support EMV, but now certain issuers are taking a new tack by adding Near Field Communication technology to their chip-enabled cards.

December 27 -

The migration has been slow, but COOP Financial Services says there's momentum for adoption and usage. There are also signs that card fraud risk is improving.

December 22CO-OP Financial Services -

The Federal Reserve and Federal Trade Commission investigated Visa for debit practices, a move that enhances competition in the marketplace for merchants.

December 21 National Association of Convenience Stores

National Association of Convenience Stores -

Online shoppers can expect fraudsters to be at the height of their creativity during the 2016 holiday season.

December 16 -

The chip card migration is drawing more attention to card not present fraud. Account takeover risk is also on the rise.

December 16 LexisNexis

LexisNexis -

The percentage of EMV transactions in the United States is miniscule compared to other parts of the world, but the migration to chip cards in the U.S. is lifting the technology's global growth — now at 42.4% of all card transactions.

December 14 -

As online shopping and card fraud increase, startups offering easy-to-use “burner” cards could see strong traction.

December 13 -

As online shopping and card fraud increase, startups offering easy-to-use "burner" cards could see strong traction.

December 13 -

Both major brands are accelerating a move away from traditional checkout, and all retailers need to make adjustments for the future.

December 13 Judo Payments

Judo Payments -

The opening of the 2016 holiday season, which marks the first full year since the country's major EMV fraud liability shift, is proving what data security experts feared all along.

December 6 -

With Visa and Mastercard extending their EMV compliance deadline to 2020 for fuel pumps, EMV is less likely to overshadow anti-fraud technology that is faster and more practical to implement.

December 1