-

Charging customers $40 for a $10 overdraft “makes no mathematical sense,” Chime CEO Chris Britt says in a critique of traditional banks.

September 8 -

Its latest feature makes it one of several mobile-only challenger banks in the U.S. that charge no overdraft fees of any kind.

August 27 -

Margin expansion may grind to a halt if the Fed holds rates steady or cuts them further. The problem is regionals tend to lack the side businesses that the big banks possess to offset lending slumps. Check out our annual ranking of banks with $10 billion to $50 billion of assets.

August 12 -

The Los Angeles unit of Royal Bank of Canada plans to use FilmTrack to handle more complex transactions for major networks, studios and distributors.

August 6 -

The number of transactions to send money across borders has risen for 36 consecutive months, but this could eventually slow.

July 25 -

Accounts that offer high interest rates can bolster fee income and lower noninterest expenses, though credit unions have to carefully watch these products to ensure they actually make money.

July 24 -

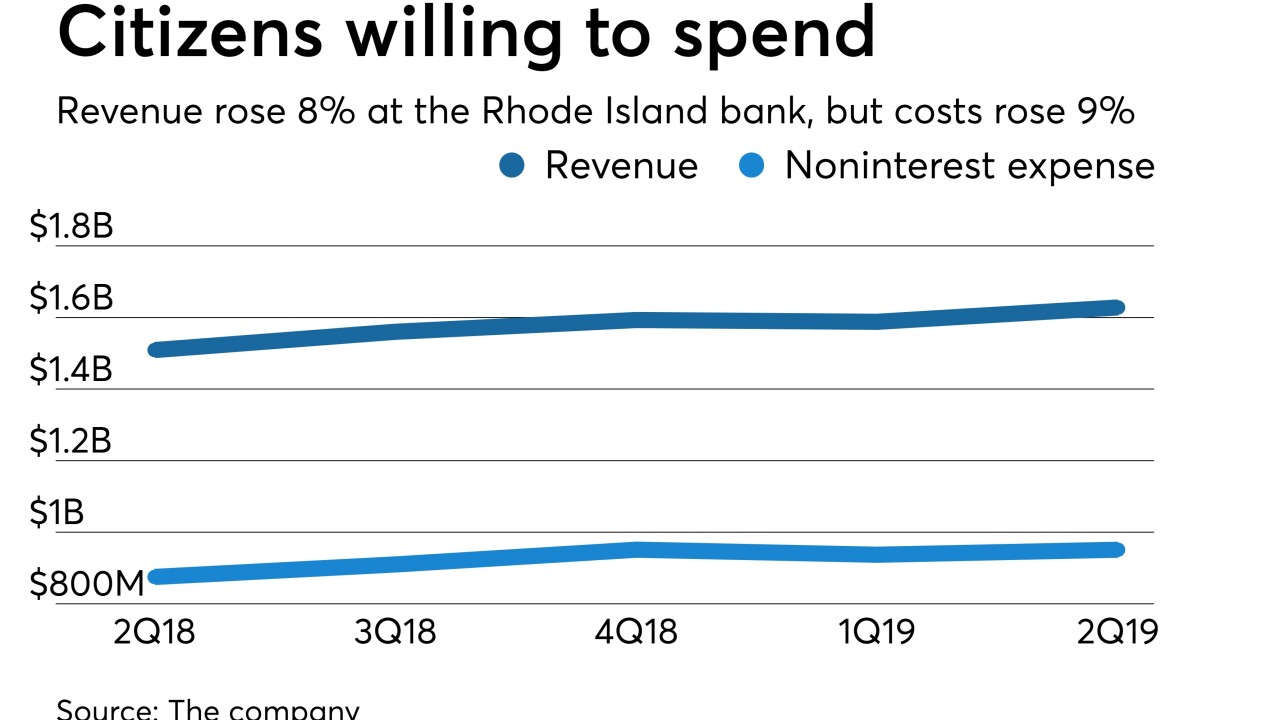

Weighing in on interest rate and other uncertainties facing all banks, Citizens Financial CEO Bruce Van Saun emphasized investments in point of sale, digital banking and other initiatives meant to enhance revenue down the road.

July 21 -

Executives at the Minneapolis bank, who expect two Fed rate cuts this year, said they can rely on growth in noninterest income to soften the blow.

July 17 -

The Minneapolis bank reported growth across several lending and noninterest income categories in the second quarter, which offset net interest margin pressures and declining deposit service fees.

July 17 -

New York Attorney General Letitia James said there is “no basis to believe” that the overdraft rule has harmed small banks and credits unions.

July 2 -

To make a credit card top of wallet and build interchange income, credit unions must develop trust, provide great service and ensure the card works every time.

June 13 Member Access Processing

Member Access Processing -

Credit unions collect more in fee income than their banking counterparts. That could become problematic as the political winds and consumer preferences shift.

June 6 -

The agency launched a review to gauge whether the regulation requiring consumers to opt in to overdraft protection “should be amended or rescinded” to minimize the effects on smaller financial institutions.

May 14 -

The agency launched a review to gauge whether the regulation requiring consumers to opt in to overdraft protection “should be amended or rescinded” to minimize the effects on smaller financial institutions.

May 13 -

Cushion uses AI to help consumers negotiate refunds of overdraft and other fees. But it argues there's a bank play in its technology if bankers take the long view.

May 7 -

The Providence, R.I., bank reported increases in most fee-based lines and loan categories, and it continued to add deposits through its new digital franchise, Citizens Access.

April 18 -

The Minneapolis bank reported mid- to high-single-digit improvement in those categories, but total loan growth was curbed by declines in CRE and other credit types.

April 17 -

Credit unions need to be thinking about pressure on net interest margins and declining revenues.

March 12 Credit Union National Association

Credit Union National Association -

Tatiana Clouthier, one of the most powerful lawmakers Mexico, is backing a campaign that's spread jitters through financial markets: make the banks charge less.

February 27 -

The three large banks banks are joining a number of institutions in agreeing to eliminate fees for Californians who receive benefits via electronic transfer cards. Chase and BofA will also waiving the fees nationwide.

February 8