-

BNY Mellon and State Street have been granting millions of dollars in discounts to ensure investors in money market mutual funds stay in the black. Recent moves by the Fed are expected to relieve the pressure.

July 19 -

Mortgages and wealth management generated fees that gave top midtiers an edge, as the pandemic halted most lending outside of the Paycheck Protection Program.

July 19 -

A strong showing by the North Carolina bank’s insurance arm helped to overcome lower interest rates and sluggish lending in the second quarter.

July 15 -

PNC, Regions and TD are among the banks that have taken steps to reduce their reliance on charges that disproportionately hit consumers living paycheck to paycheck. The changes come at a time when the Biden administration is expected to take a tougher stance on overdrafts.

July 13 -

Executives at Citizens Financial and Regions Financial said they plan to make policy changes that will reduce their reliance on the controversial but already dwindling charges.

June 15 -

Ally and Huntington are the latest banks to take steps that will reduce revenue from customers who spend money they don’t have. The moves come at a time when technological, regulatory and social forces are converging to encourage change.

June 3 -

The online bank's decision to stop charging the fees is part of a broader reassessment across the industry. Ally had waived overdraft fees early in the pandemic and has historically been less reliant on them than many other institutions.

June 2 -

With rock-bottom rates suppressing interest income, some buyers are looking beyond traditional M&A and striking deals for asset managers, insurance firms and other businesses that generate the bulk of their revenue from fees.

May 25 -

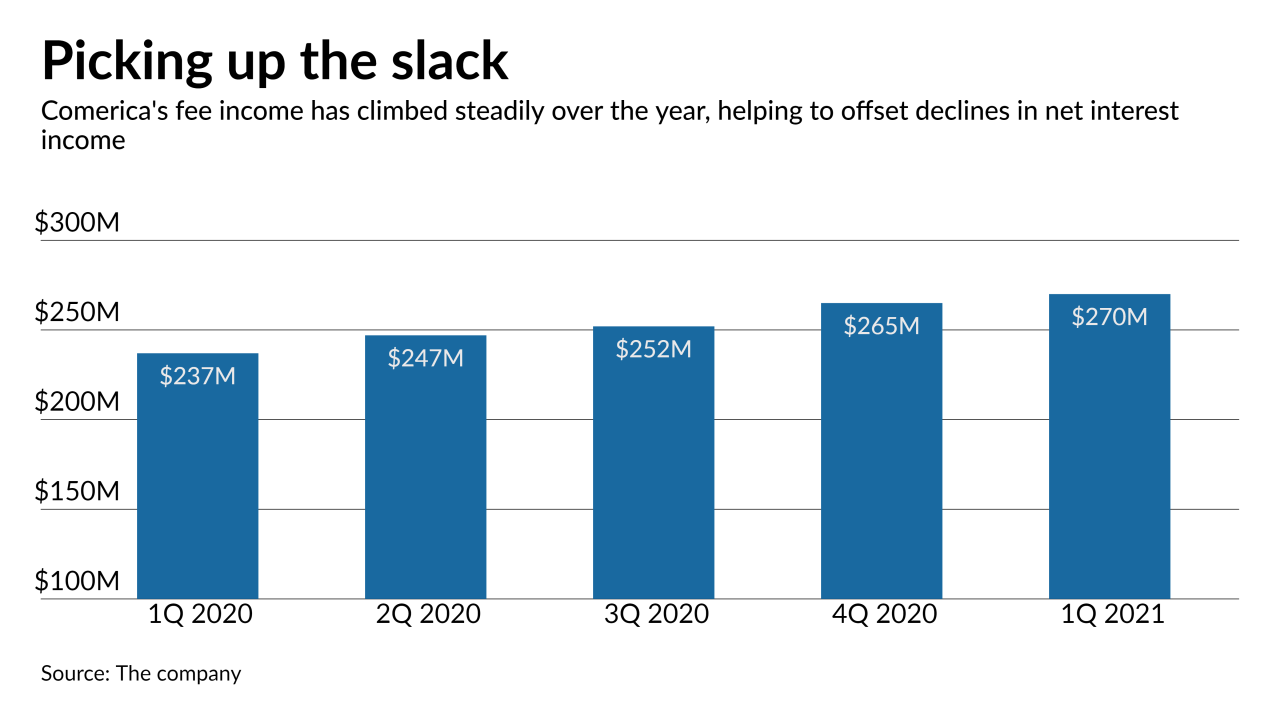

At Comerica and Synovus, higher fees from cards, mortgage banking and other sources helped to offset declines in net interest income.

April 20 -

Some institutions for more than a year have reduced or eliminated overdraft and funds transfer fees to help members hard hit by the economic downturn, but it's unclear how much longer they can keep coasting on other sources of noninterest income.

April 15