-

The Federal Savings Bank has been under a spotlight since it was revealed that it provided $16 million in mortgages to onetime Trump campaign manager Paul Manafort.

May 1 -

The National Credit Union Administration has banned seven former credit union employees from participating in the affairs of any federally insured financial institution.

April 30 -

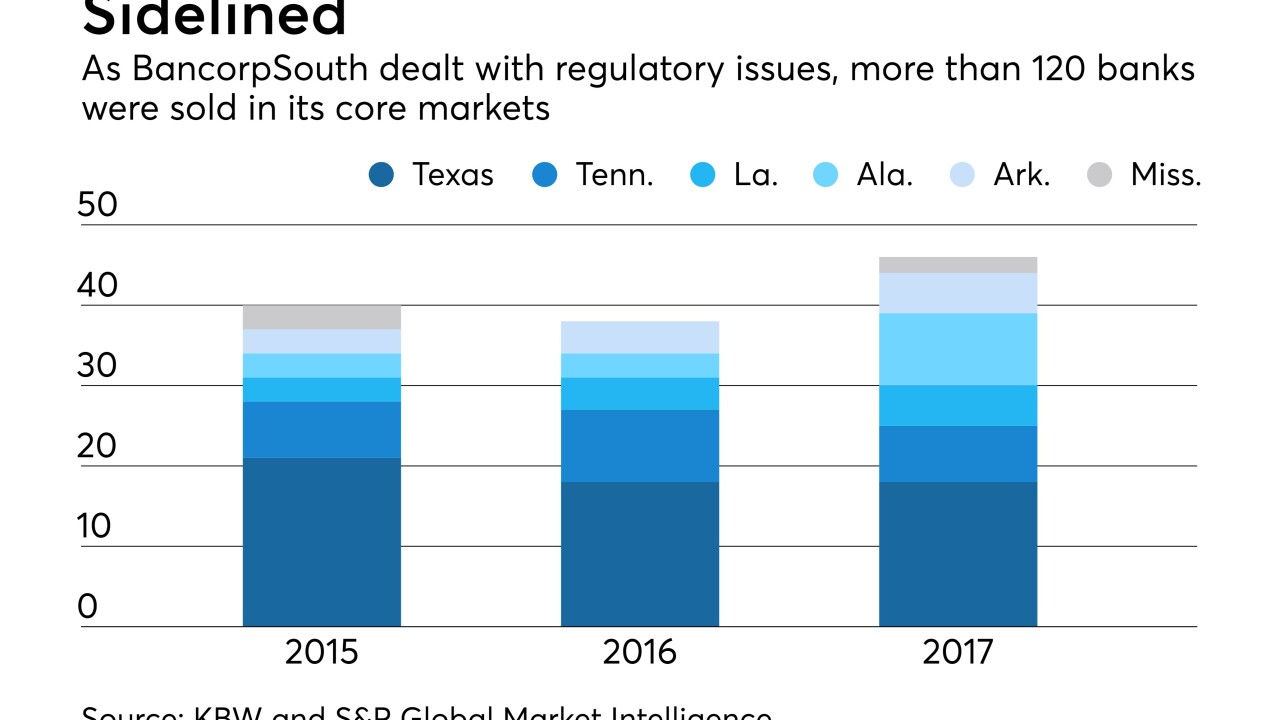

Dan Rollins engineered nearly a dozen deals while at Prosperity Bank. Now CEO at BancorpSouth, he has returned to M&A after spending four frustrating years dealing with compliance issues.

April 26 -

When regulators recognize ICOs as securities offerings, they will likely require issuers to fully comply with standard Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, increasing compliance pressure, according to Ron Teicher, CEO of EverCompliant.

April 25 EverCompliant

EverCompliant -

CEO Tim Sloan and board chair Elizabeth Duke fielded tough questions Tuesday on everything from the embattled bank’s culture to its ties to the private prison industry.

April 24 -

A federal grand jury in Charlotte, N.C., has indicted a former credit union CEO with fraud in connection with the U.S. government's Troubled Asset Relief Program.

April 20 -

Comptroller of the Currency Joseph Otting took office only late last year, but he is wasting little time in tackling a series of hot-button topics, including easing anti-money laundering regulations and lowering national bank fees.

April 15 -

Reps. Elijah Cummings and Stephen Lynch sought records related to a banker's communications with former Trump campaign manager Paul Manafort and the Trump campaign, and about his bank's loans to Manafort.

April 12 -

The Seattle bank's improved loan yields offset higher expenses tied to Bank Secrecy Act remediation. Washington Federal had to delay a pending acquisition after issues emerged with its anti-money-laundering compliance.

April 11 -

The comptroller said he is looking to capitalize on the industry's strong profits and high capital reserves to reduce costs and lower exam fees next year.

April 10 -

British banks that deal with the Russian oligarchs and companies on a new American sanctions list will face "consequences," according to a senior U.S. Treasury official.

April 10 -

Comptroller of the Currency Joseph Otting laid out an ambitious regulatory reform agenda Monday, telling a group of community bankers that he is committed to CRA upgrades, new flexibility in BSA compliance and other measures.

April 9 -

GSE reform a likely scratch from this year’s to-do list; banks’ difficulties in speaking emoji; reactions to Mick Mulvaney’s plans for the CFPB; and more.

April 6 -

Efforts by financial institutions to track "beneficial ownership" data in advance of a regulatory deadline next month is complicated by the challenge of getting customers to cough up the information.

April 4 -

Washington Federal, which is working through Bank Secrecy Act issues, also allowed Anchor to consider offers from other potential buyers.

April 2 -

The trio of former credit union employees all pleaded guilty to various charges of fraud and theft.

April 2 -

Two Democrats on the House Oversight Committee asked the panel's Republican chairman to issue a subpoena for documents related to Stephen Calk, whose bank made loans to former Trump campaign manager Paul Manafort.

March 28 -

Attorney General Jeff Sessions made headlines in January when he tightened federal marijuana enforcement. But the good news for financial institutions looking to service the pot industry is that the rest of the government has responded with a shrug.

March 23 -

Wells Fargo gets tipped off by OCC on investigation; HSBC is wading back into U.S. mortgage waters; a bank uses artificial intelligence to combat money laundering; and more.

March 16 -

The measure easily passes with a two-thirds majority; Wells Fargo CEO's pay up by a third, but no cash bonus.

March 15