-

This is the first time since 2014 that the regulator won't penalize credit unions that file within 30 days of the deadline.

April 20 -

-

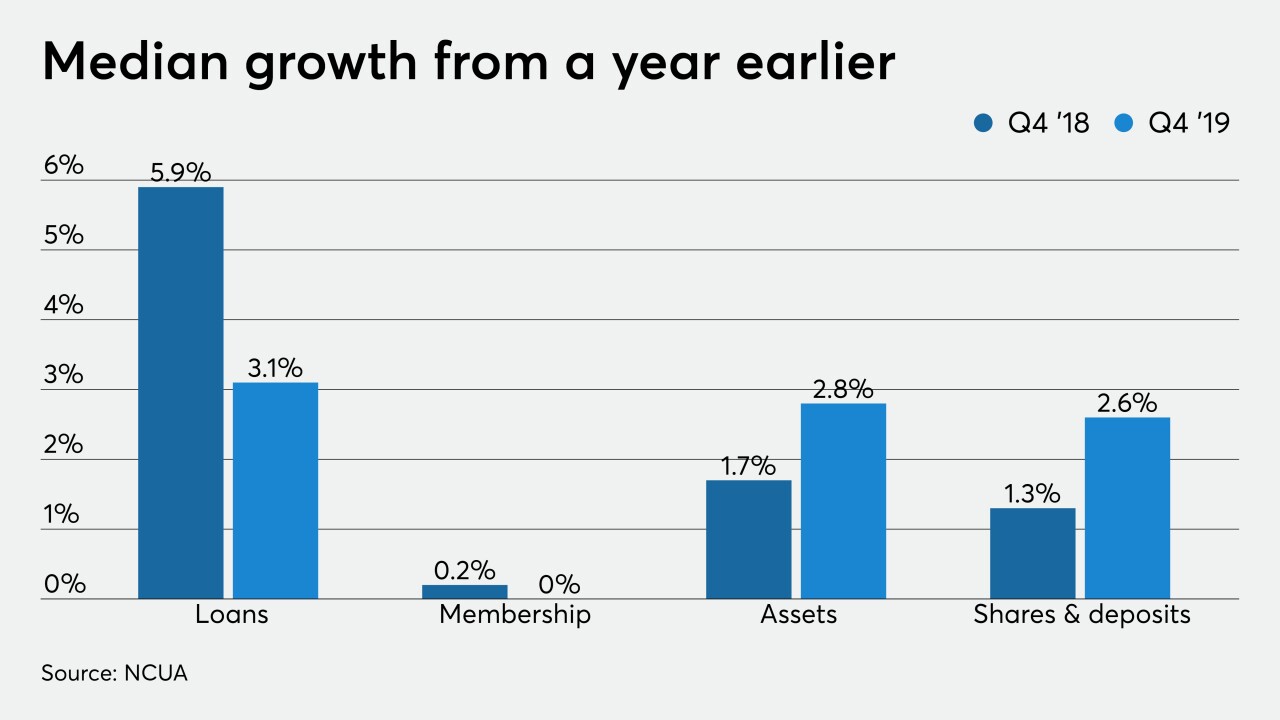

While loans continued to increase, growth was slower than one year previously and membership was flat.

March 25 -

Big picture the industry is doing well, but at the median, lending and membership are flagging even as deposits and assets rise.

December 18 -

From rising incomes and expenses at credit unions to an ever-widening gap between large and small shops, here's a look at how the regulator's third-quarter numbers break down.

December 9 -

This is the second time in five years the California-based credit union has issued a giveback, for a total of $38 million.

November 20 -

The National Credit Union Administration will meet this week to discuss its proposed budget while the Senate and House work to avoid a government shutdown.

November 18 -

The Wisconsin-based institution has returned more than $11.7 million to members over the past six years.

November 14 -

The credit union retains a strong net worth position and saw a nearly 5% increase in members during the first three quarters of this year.

November 8 -

The Honolulu-based credit union saw a nearly 7% increase in new members, thanks in part to an expanded branch presence in West Oahu.

November 7 -

As the Federal Reserve prepares for its October meeting, many institutions are waiting to see how the board's actions might impact the ongoing war for deposits.

October 28 -

A regulatory proposal to ease the initial margin buffer on certain derivatives trading could be harmful to the economy.

October 18 Better Markets

Better Markets -

CUs in the Great Lakes State continue to see positive growth, but several key metrics are increasing at a slower pace.

September 30 -

At the median, credit unions saw growth slacken in several key areas during the year ending at June 30.

September 12 -

Loans and net income continued to rise while delinquency rates improved. Other major trends continue, including ongoing consolidation amid sustained membership growth.

September 4 -

Institutions in the Badger State reported that lending was up by almost 6% and delinquencies remained at historic lows.

August 28 -

Lending at credit unions in the Peach State increased by just 0.2%, down from 0.8% growth recorded a quarter earlier.

July 26 -

The Michigan-based institution also recorded increases in earnings, deposits and membership.

July 25 -

The half-dozen institutions all hold less than $50 million in assets – some less than a half-million – and will collectively pay a total of about $5,000 to the U.S. Treasury.

July 12 -

The CFPB is giving trade groups and consumer advocates another three months to comment on its proposal to change what data is collected under the Home Mortgage Disclosure Act.

June 27