-

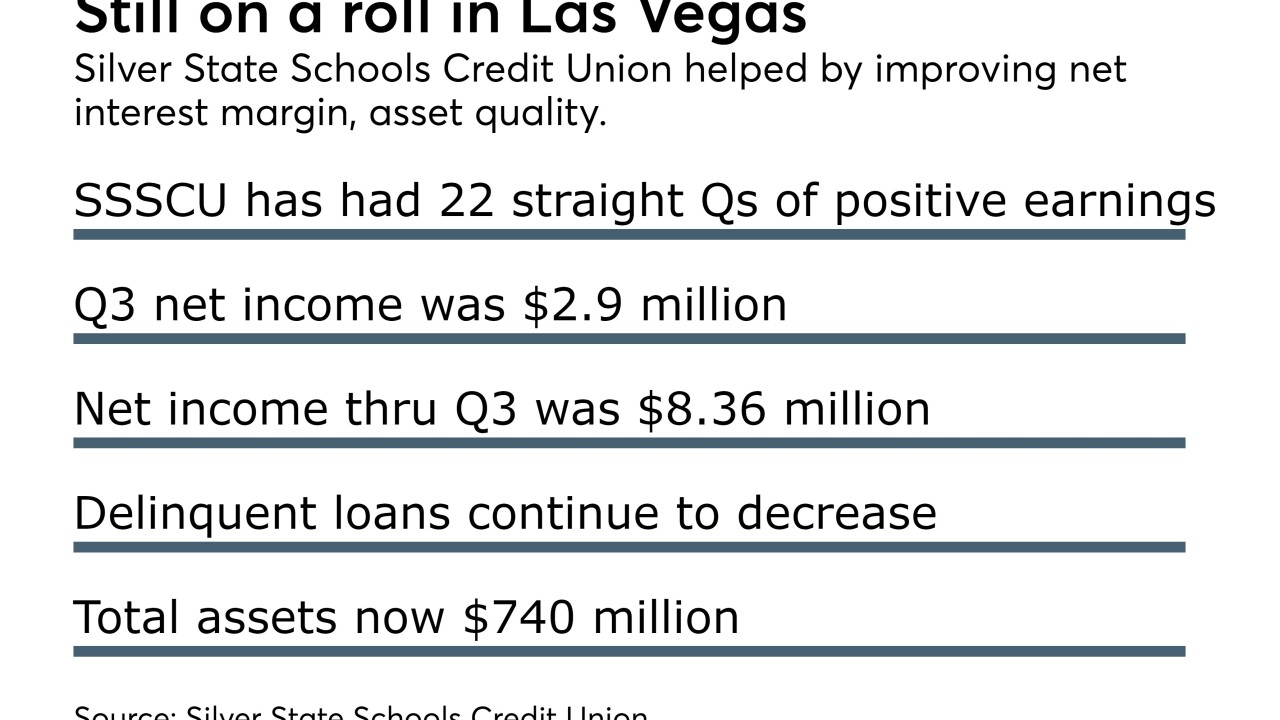

Las Vegas-based credit union has posted 22 consecutive quarters of positive earnings.

November 17 -

SDCCU’s member base increases 10.4 percent in one year, total assets up to $8.2 billion.

November 13 -

Goshen, Ind.-based CU reports both membership, asset milestones.

November 3 -

Study released by Louisiana CU League touts direct, indirect benefits to members.

October 20 -

Oregon-based CU increased its loan portfolio by $40 million, membership continues climb.

October 13 -

New report provides info on how credit unions in the two states are growing, offering key market intel as they head into strategic planning.

September 21 -

SDCCU’s member base increased nearly 10 percent in one year, as total assets rose to $8.2 billion.

August 30 -

Las Vegas-based credit union has posted 21 consecutive quarters of positive earnings.

August 14 -

California-based CU grew loans by 16.3 percent, adding 1,000 new members per month.

August 10 -

Along with asset and membership milestones, the credit union celebrated its 100th anniversary in 2016.

May 16 -

Las Vegas-based credit union has rolled 20 consecutive quarters of positive earnings.

May 4 -

In addition to strong membership growth, the CU now boasts $8.1 billion in assets, up by more than 8 percent from last quarter.

April 27 -

Oregon-based CU increased its loan portfolio by $17.5 million.

April 25 -

A number of small banks have disclosed material weaknesses in loan-loss accounting and other procedures. Reasons vary, but a common thread appears to be that accounting firms are facing pressure to beef up their scrutiny of internal controls in financial services.

March 9 -

The federal agency released data culled from fourth quarter 2016 call reports that showed the "great divide" between large and small credit unions continues to widen.

March 6 -

Lamar Cox is accused of understating losses tied to the sale of foreclosed properties in 2009.

February 8 -

The New York credit union is touting double-digit growth for 2016.

January 24