-

As banks begin to use artificial intelligence in their businesses, they’ll need to consider the potential for bias as well as the impact new technologies will have on workers.

December 31 CCG Catalyst

CCG Catalyst -

Readers this year responded to Mick Mulvaney's leadership at the Consumer Financial Protection Bureau, the banking industry's role in the national gun debate, Rep. Maxine Waters' upcoming leadership of the Financial Services Committee, the influence of tech companies like Facebook and Amazon on financial services and much more.

December 27 -

More traditional players interested in creating a safer market for digital assets have issued a checklist that cryptocurrency firms can follow to build confidence among banks, consumers and regulators.

December 26 -

Prometheum may succeed whether others have failed because it has attempted to work closely with regulators.

December 21 -

The promotion of “insured” accounts by nonbanks and fintechs is a worrying trend, because it could leave customers falsely believing their accounts are just as safe as FDIC-insured ones.

December 21 Consumer Bankers Association

Consumer Bankers Association -

The Office of the Comptroller of the Currency has gotten the ball rolling for financial technology firms trying to operate a national platform, but the FDIC and Federal Reserve should act to remove other policy roadblocks.

December 20

-

Good Money just raised $30 million and is a year away from launching, but already is raising concerns for its trash-talking of established players.

December 19 -

The payments processor was among numerous firms earlier this year to withdraw an ILC charter application over questions about its plan.

December 19 -

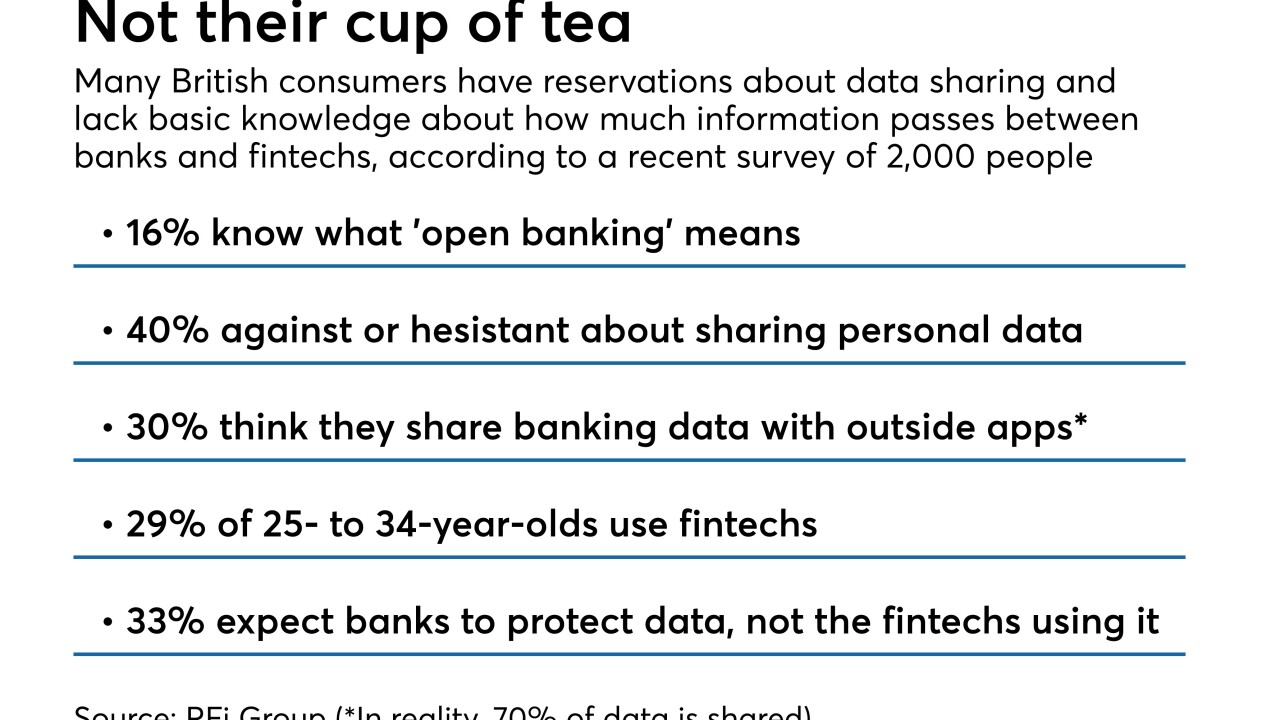

Though it became official in January in the U.K., most people there don't know what it is, according to a new survey that offers many insights for U.S. banks.

December 19 -

Fabrice Coles, who was the CBC's executive director, will work on consumer and fintech policy issues at the Bank Policy Institute.

December 18 -

The Office of the Comptroller of the Currency has gotten the ball rolling for financial technology firms trying to operate a national platform, but the FDIC and Federal Reserve should act to remove other policy roadblocks.

December 17

-

Robinhood Financial has rebranded its service, deleted tweets about its launch and scrubbed the page from its website.

December 15 -

The fintech's new products may violate several banking and securities regulations and could mislead the public about the differences between coverage on banking and investment accounts, industry officials say.

December 14 -

More acquainted with the quick decision-making style of the banking world, the comptroller of the currency found a policymaking environment in D.C. that moves at a slower pace.

December 12 -

The agency's departing acting director filed a proposal Monday for a new sandbox that would grant firms a legal safe harbor and "exemptive relief" from enforcement.

December 11 -

Executives urged the consumer bureau at a public meeting to keep a closer eye on artificial intelligence innovations developed by fintech firms that are subject to less regulation.

December 6 -

The agency's request for comment about the deposit insurance application process is among a series of actions aimed at streamlining charter applications.

December 6 -

The agency's semiannual report on risks in the industry focused heavily on the high volume of commercial loans as well as banks' exposure to nonfinancial corporate debt, which is near a record share of GDP.

December 3 -

To convince skeptical bankers about the benefits of distributed ledger technology, some suggest it needs to be separated from the volatile digital currency it underlies.

November 30 -

The North Carolina lawmaker had been considered for a potentially bigger House leadership position if Republicans had held on to their majority.

November 30