-

The cost of fighting fraud at financial institutions is up nearly 10 percent from last year. That means credit unions face significant challenges in being ready for the next threat.

October 2 -

A former employee in the VyStar Credit Union mail room has been charged in a case involving mail fraud and millions of dollars in stolen stamps.

September 12 -

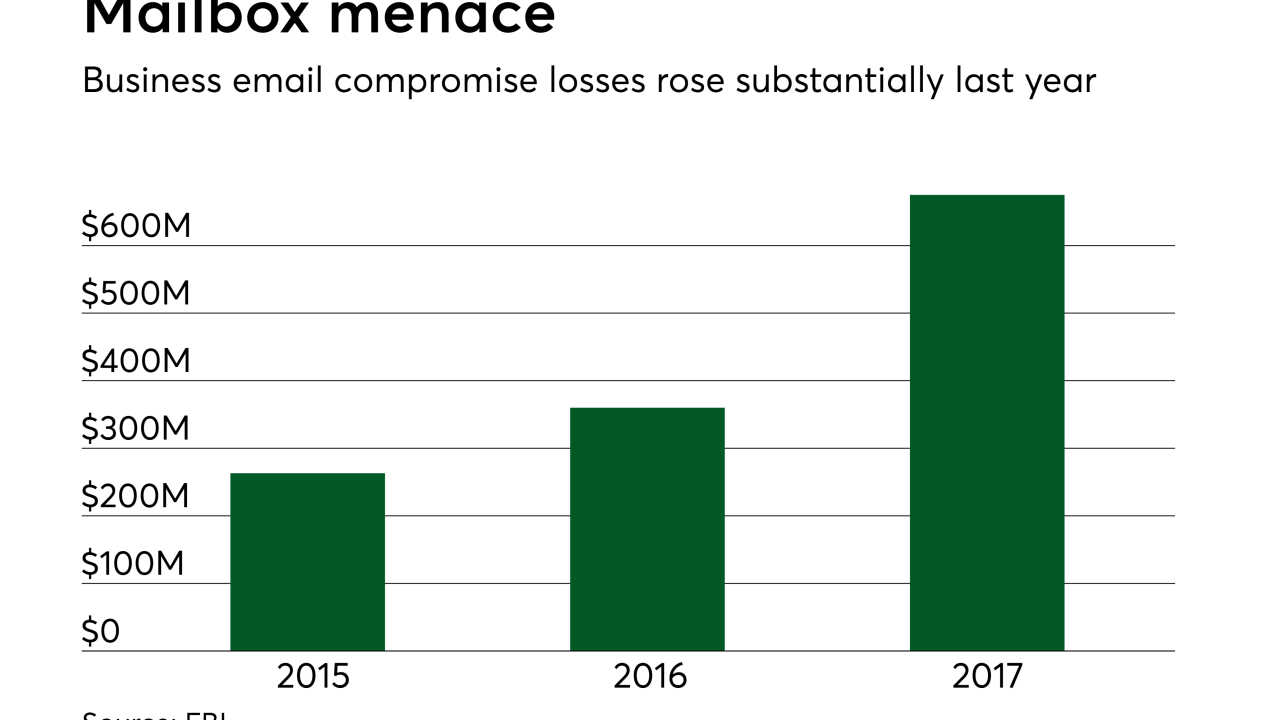

Payments fraud from business email compromise, or BEC, occurs when scammers use phishing tricks and email to fool businesses into making fraudulent payments to perceived suppliers. Experts suggest newer factors are accelerating the trend.

June 27 -

Add S&T Bancorp to the list of lenders that appear to have exposure to a Pennsylvania fuel supplier dealing with alleged employee fraud.

June 1 -

Fulton Financial, Univest Corp. of Pennsylvania and Franklin Financial Services disclosed a total of $75 million in exposure to the commercial relationship.

May 31 -

A federal grand jury in Charlotte, N.C., has indicted a former credit union CEO with fraud in connection with the U.S. government's Troubled Asset Relief Program.

April 20 -

A new kind of ATM fraud has begun to hit U.S. financial institutions. Here's how to protect your credit union.

March 23 -

The company will take a nearly $10 million hit after setting aside funds to cover a case of potential borrower fraud.

March 16 -

Financial companies that derive most of their revenue from online and mobile channels have substantially higher fraud costs than do similarly sized companies that rely less on the internet, according to a new report.

March 1 -

The results suggest that even as financial institutions implement more sophisticated fraud-mitigation techniques, they have not been keeping pace with criminals.

February 6