Fraud

Fraud

-

Despite advancements in AI for transaction monitoring, financial institutions share little in the way of fraud data, undermining efforts to combat crimes including check fraud.

April 2 -

Preliminary rulings by a Pennsylvania judge will allow a jewelry company that claimed it lost $1.1 million to fraud to move forward with suing individual bank employees.

March 26 -

Wars in Ukraine and the Middle East. Fiercely polarized U.S. politics. Rapidly multiplying payments options on social media networks and elsewhere. Those factors and more are making it harder than ever for banks to combat illicit financial transactions.

March 25 -

Specialized large language models should be harnessed to help financial institutions identify and halt fraudulent activity. The best model would involve regulator-approved pooling of anonymized customer data.

March 25 -

The American Bankers Association and U.S. Postal Inspection Service have launched a public awareness campaign on ways to protect checks sent in the mail.

March 20 -

Companies lose an estimated 5% of their revenue each year due to fraud, according to a report from the Association of Certified Fraud Examiners.

March 20 -

The attack is one of three major incidents the lender has suffered in the past three years.

March 12 -

Banks must work closely with technology companies, regulatory authorities and each other to develop comprehensive strategies to combat deepfake fraud.

March 12 -

- AB - Technology

Later this month, a federal judge will hear arguments over whether an animal rights group may proceed with its lawsuit that says an industrial ag company violated state and federal animal-protection laws and as a result must repay its Paycheck Protection Program loan.

March 11 -

-

False transaction disputes and other individual-level financial fraud cost the industry billions. It's time to join forces and even the odds.

March 5 -

A report reveals Heartland Tri-State Bank's failure last year was due to its CEO being ensnared in a sophisticated investment scam that is taking more victims.

February 19 -

-

When customers are targeted directly with fake text messages that lead to account takeover, artificial intelligence, and in some cases generative AI, can play a role in fighting the fraud, experts say.

February 5 -

-

The megabank failed to adequately protect and reimburse customers who were victims of wire-transfer fraud, according to a lawsuit by the New York Attorney General. Citi said that it follows all relevant laws and regulations.

January 30 -

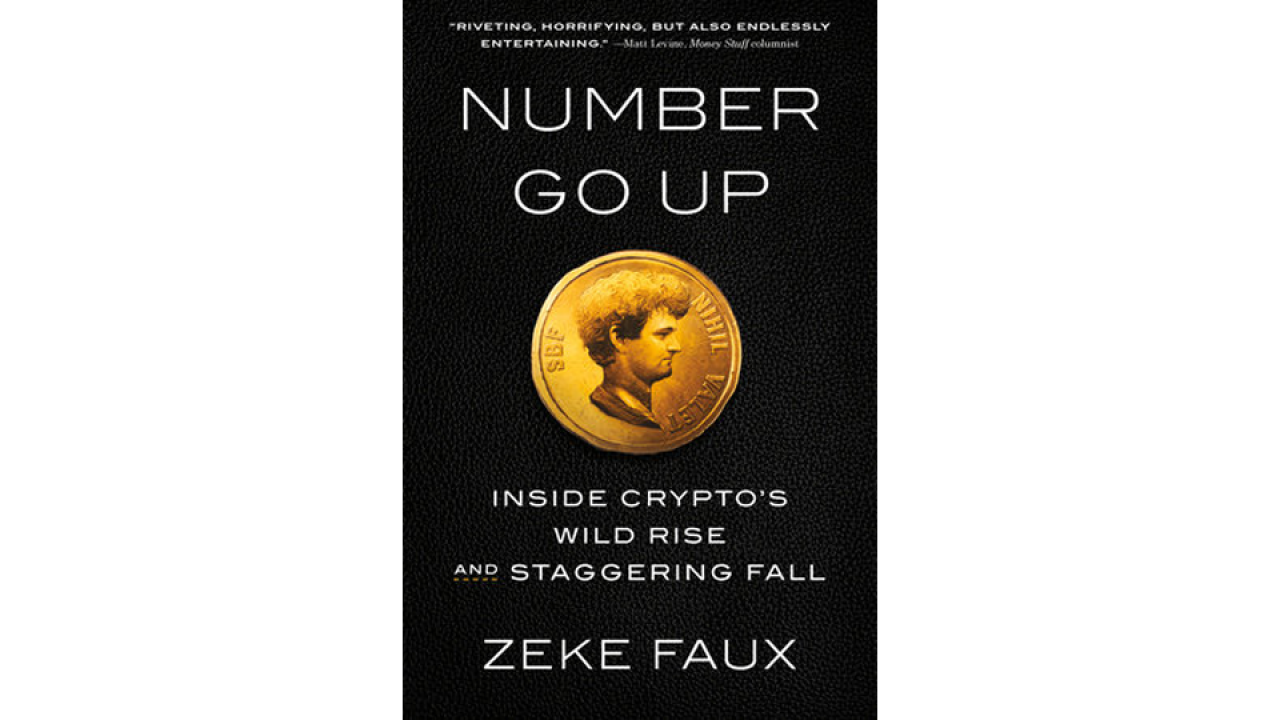

Zeke Faux, a Bloomberg journalist, describes his two-year odyssey to better understand cryptocurrencies in his book "Number Go Up." His work proves to be an entertaining deep dive into an industry riddled with scams.

January 30 -

Payments fraud is the most expensive kind, at $450B; anti-financial-crime execs are the most worried about real-time payments, a survey from Nasdaq and Oliver Wyman found.

January 16 -

The agency plans to restrict access to a system that provides borrower tax returns to mortgage lenders beginning June 30. Left out of the loop, small-business lenders say getting credit to borrowers will become more difficult as a result.

January 10