Fraud

Fraud

- PSO content

The Trump administration has dismantled digital campaigns by al-Qaeda and other terrorist groups that used social media to obtain cryptocurrency for carrying out terrorist attacks, the Justice Department said Thursday.

August 13 -

The rapid move online boosts false positives, false negatives and actual fraud, says Adara's Nguyen Nguyen.

August 13 -

The complexity of the migration is an opportunity to examine other elements of the payment experience, says TNS' Brian DuCharme.

August 12 -

The rapid move online boosts false positives, false negatives and actual fraud, says Adara's Nguyen Nguyen.

August 12 -

Chargeback requests have surged since the start of the coronavirus pandemic, as airlines have canceled flights, performers have postponed concerts and supply chain disruptions have delayed the delivery of many goods.

August 12 -

A good security strategy is a lot like a healthy lifestyle for small businesses, says Sysnet's Sandra Higgins.

August 11 -

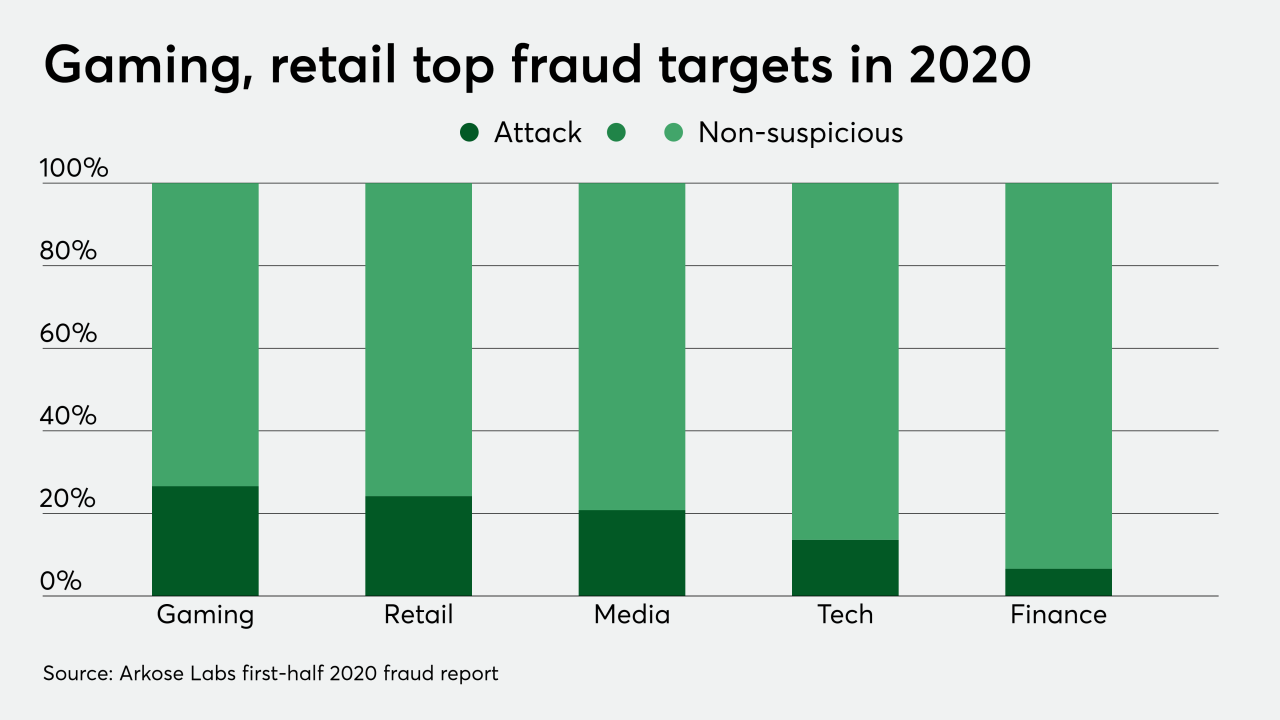

Video games provide a rare escape to locked-down consumers, and many modern games are so sophisticated that they support their own digital storefronts — with the potential for real-world losses if fraudsters find a way in.

August 7 -

It’s likely that our dependence on digital channels will have become the norm, which means that security protocols like EMV 3-D Secure should also become part of the new status quo, says Entersekt's Simon Armstrong.

August 5 -

Scams have ranged from false, pseudo-scientific charities raising money for “cures” or “medical research," to fraudsters preying on individuals who want to donate to medical and emergency staff in hospitals or care facilities, says The ai Corporation's James Crawshaw.

August 4 -

EventBot is a particularly frightening development since it hides in an altered version of an app that seems legitimate and steals unprotected information in banking, wallet, payment and cryptocurrency mobile apps, says Appdome's Tom Tovar.

August 4 -

The key word is "temporary" with the FHA's quality control waiver expiring and not likely to be renewed.

July 30 -

TransUnion is expanding the geographic reach of its instant Document Verification service in response to the pandemic, with more users requiring ID confirmation from remote locations as fraud risks hit new highs.

July 22 -

The biggest takeaway from this hack should be large digital media companies reworking their admin controls

July 22 -

The “new normal” of COVID-19-influenced retail is actively being exploited by fraudsters, as LexisNexis Risk Solutions finds fraud costs for U.S. retailers rising in 2020 by 7.3% over last year’s data.

July 21 -

Fraudsters hit U.S. banks and merchants hardest with bogus credit card applications in April, while most consumers were in full pandemic lockdown, according to new data from Socure.

July 16 -

While the use of behavioral biometrics such as keystroke patterns has become commonplace for web-based security, this has less applicability to mobile commerce given the different form factor and interface of a smartphone, says Incognia's André Ferraz.

July 16 -

Banks' fear of big penalties, the changing tactics of nimble criminals and a greater openness among regulators to new approaches are among the factors driving big investments.

July 15 -

Ashton Ryan, the New Orleans bank's CEO, and two other officers are accused of disguising the financial condition of certain borrowers before the bank's 2017 collapse.

July 14 -

Payment fraud remains a credible threat and unfortunate reality for the majority of businesses, something that is unlikely to go away as fraud methods continue to evolve, says JPMorgan Chase's Alec Grant.

July 14 -

The bank is expected to report a small net profit for the second quarter next week; shareholders are challenging the government's 2012 decision to appropriate nearly all of the agencies' profits.

July 10