-

While borrowing activity increased from a year ago, seasonal patterns and economic concerns suggest near-term slowing, the Mortgage Bankers Association said.

October 16 -

President Donald Trump is set to announce changes to the tariffs on Canada and Mexico he slapped on earlier this week, with potential relief for automobiles and other sectors, according to Commerce Secretary Howard Lutnick.

March 5 -

The manufactured home loan lender, a unit of Berkshire Hathaway subsidiary Clayton Homes, was accused of ignoring red flags that sent many borrowers into bankruptcy, default and ultimately out of their homes.

January 6 - AB - Policy & Regulation

The administration will release $100 million in grant funds focused on slashing red tape at the state and local levels, and will advance other programs to increase home construction.

August 13 -

The state lost almost 48,000 people by mid-2022 from two years before, according to Census Bureau estimates, spurring concern about outmigration that will curb long-term economic growth.

May 12

-

The availability of some loans used to build homes dried up due to the coronavirus. Opening up the economy may help if it doesn't lead to a spike in infections, and if consumer demand persists.

June 16 -

The company is buying a homebuilder finance portfolio with $47 million in loans and $80 million in commitments.

February 24 -

A number of banks have stepped up efforts to lend to residential developers, though they are mindful of missteps made before the financial crisis.

August 20 -

Umpqua Bank has hired veteran lender Tom Farrell to help it grow its homebuilder finance group in California.

June 5 -

A House Republican tax proposal that infuriated housing groups and sent homebuilder stocks sliding would only have a modest impact on the market for new homes and could end up being a net positive for the industry, according to Keefe, Bruyette & Woods analysts.

November 3 -

While the House disaster relief bill would provide $16 billion in debt relief for the National Flood Insurance Program, it does not include a Trump administration proposal to ban new construction in flood-prone areas.

October 12 -

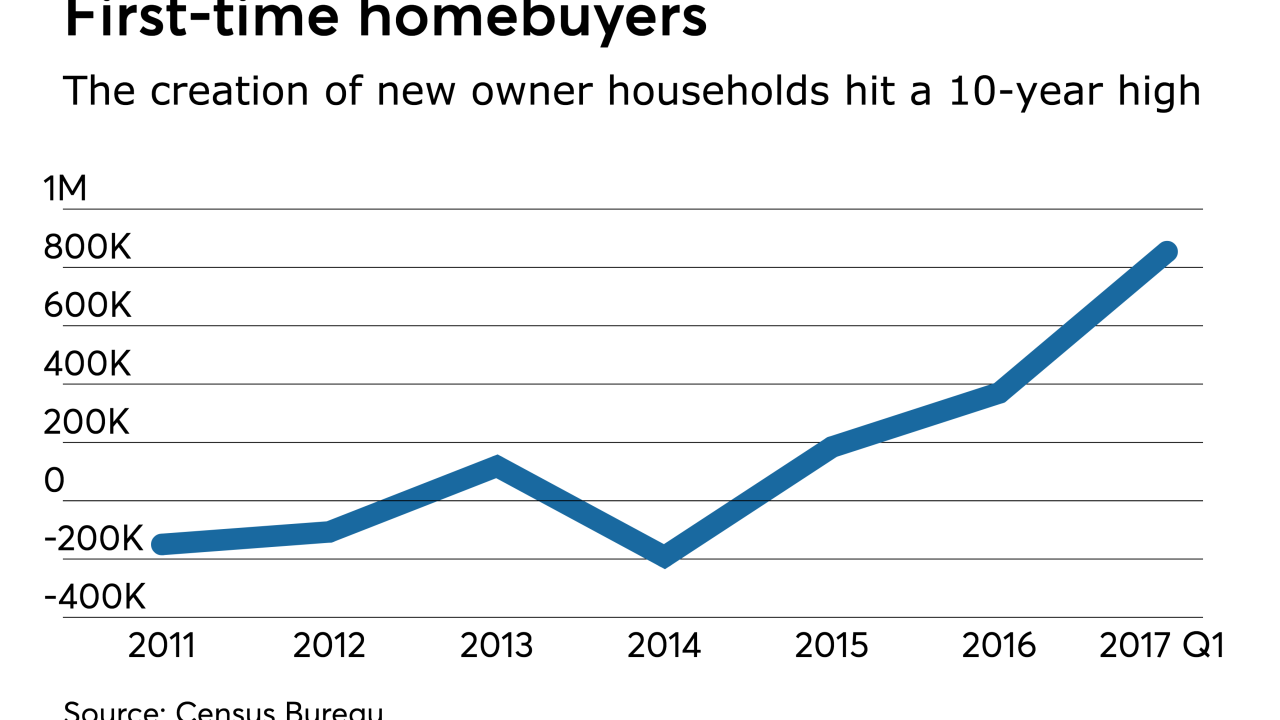

For the first time in a decade, new-owner households created in the first quarter were higher than the creation of renter households.

June 2 -

A new tariff on Canadian lumber threatens to further disrupt homebuilding at a time when lenders are increasingly concerned about a purchase mortgage resurgence that has failed to materialize.

June 1 -

Homebuilders looking for single-family construction loans may have better luck with small and midsize banks than larger ones, according to a report by the National Association of Home Builders.

April 18