-

The accord is the latest development in investigations by governments across the globe into banks’ manipulation of benchmark interest rates.

October 25 -

The president of the St. Louis Fed said that regulators should go back to the pre-Dodd Frank framework for small banks, while warning about changes to the system as fintechs expand their presence.

October 17 -

The embattled company has begun offering cash bonuses to certain customers who open accounts, but at least for now pricey deposit rates would not ensure that customers stick around, executives said Friday.

October 13 -

The Pittsburgh company benefited from loan growth and higher interest rates, though fee income fell and expense rose in the third quarter.

October 13 -

Total revenue rose less than 1% to $21.8 billion, but expenses declined 2.5% to $13.1 billion. That computed to the highest profit at Bank of America in six years.

October 13 -

Facing persistently low loan yields, increased competition and higher regulatory costs, many community banks are at risk of becoming irrelevant unless they rethink their business models.

October 6 -

A slight decline in core deposits in the second quarter stoked worries that tighter liquidity is around the corner. Bankers are exploring responses beyond the typical CD rate special if third-quarter results show the trend is continuing.

September 22 -

With the deadline for a federal-debt-limit renewal nearly a month away, bankers are dreading the prospect of higher funding costs, strained liquidity, weaker commercial loan demand and other ramifications if Washington does not act.

August 24 -

A Fed committee studying Libor’s replacement has dwelled heavily on the potential impact to the derivatives market. Loans may become a bigger part of the conversation later this year, but the panel plans to leave a lot of the specifics up to lenders.

August 17 -

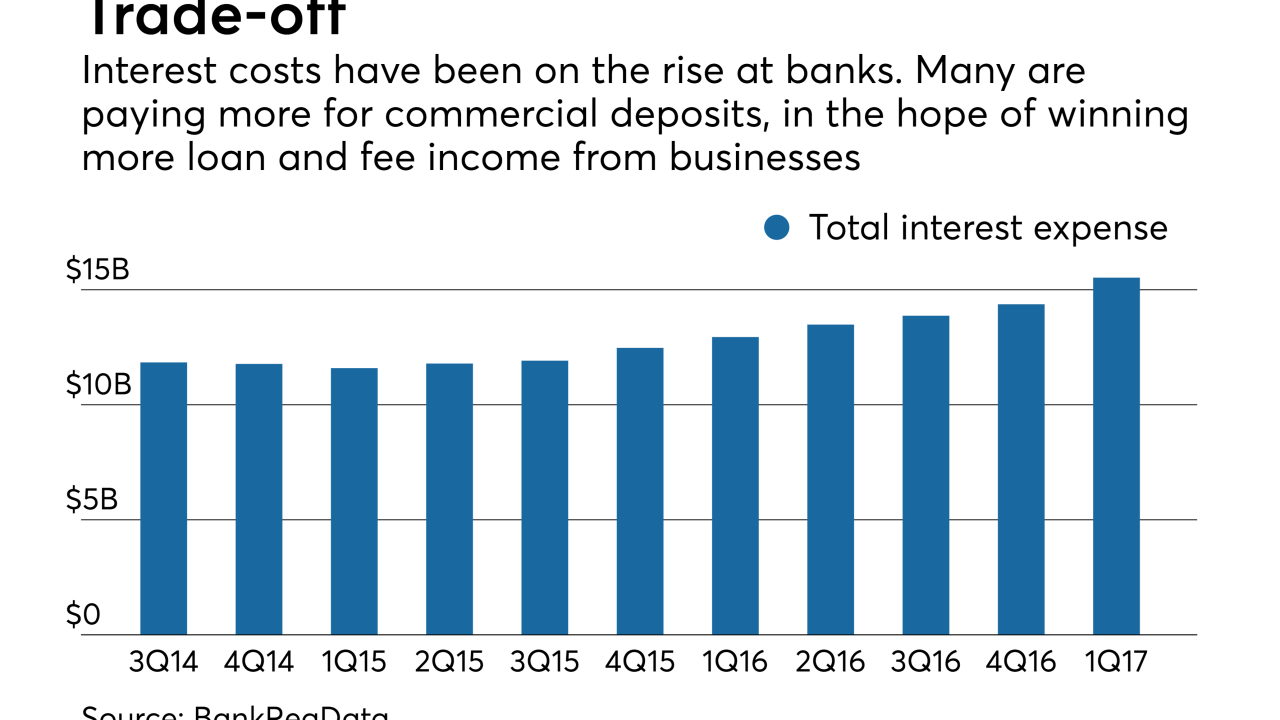

Many banks are adopting an “it takes money to make money” approach, paying more interest on deposits in exchange for loan growth, fee income and customer retention.

August 7