-

Deadlines imposed by U.S. and EU regulators are giving banks intercontinental whiplash.

May 18 -

A long-anticipated financial rule could help law enforcement root out illegal activity, but it requires banks to keep extra-close tabs on certain business clients. That won't be easy.

May 16 Promontory Financial Group

Promontory Financial Group -

A long-anticipated financial rule could help law enforcement root out illegal activity, but it requires banks to keep extra-close tabs on certain business clients. That won't be easy.

May 11 Promontory Financial Group

Promontory Financial Group -

Prometheum wants to win the SEC’s approval of its own token offering, paving the way for others shortly afterward.

May 2 -

Efforts by financial institutions to track "beneficial ownership" data in advance of a regulatory deadline next month is complicated by the challenge of getting customers to cough up the information.

April 4 -

Everytown for Gun Safety says that its recommended guidelines are similar to banks' know-your-customer principles.

April 4 -

A startup called Spring Labs has launched a blockchain network with the goal of getting lenders and data providers to share data to help verify customers' identity.

March 27 -

Aspiration Bank relies on software tools to pull data from diverse sources to prevent fraud in account applications.

February 27 -

Foreign operatives' alleged use of fraudulent financial accounts to try to influence the U.S. political system shows again how difficult it is for banks to truly know their customers.

February 20 -

The people-helping-people model proffered by LendingClub and others quickly foundered, but several startups aim to bring it back with the help of distributed ledger technology.

January 4 -

The Senate Banking Committee's first hearing of 2018 will focus on anti-money-laundering efforts and counter terrorist financing, which could be a precursor to legislative reforms.

January 3 -

The federal banking regulators should create a working group that, rather than propose new rules and regulations, would clarify the application of existing rules to blockchain technology.

November 22 Baker Donelson

Baker Donelson -

A U.S. alcohol maker's $191 million investment in Canadian cannabis could raise difficult questions for the banks that have lent big sums of money to the company.

November 21 -

A U.S. alcohol maker's $191 million investment in Canadian cannabis could raise difficult questions for the banks that have lent big sums of money to the company.

November 20 -

The federal banking regulators should create a working group that, rather than propose new rules and regulations, would clarify the application of existing rules to blockchain technology.

November 17 Baker Donelson

Baker Donelson -

As more startups turn to initial coin offerings to raise capital, financial institutions will seek reassurance that their blockchain and other fintech partners are aboveboard.

November 1 -

Banks that find true innovation hard to accomplish can take heart — it’s no picnic for startups either. To hear both sides share their challenges is an argument for collaboration.

October 3 -

By replacing human judgment with other identity technologies, higher levels of verification accuracy can be achieved in a fraction of the time, writes Romana Sachová, co-chair of the Security and Biometrics Workgroup at Mobey Forum.

September 14 Mobey Forum

Mobey Forum -

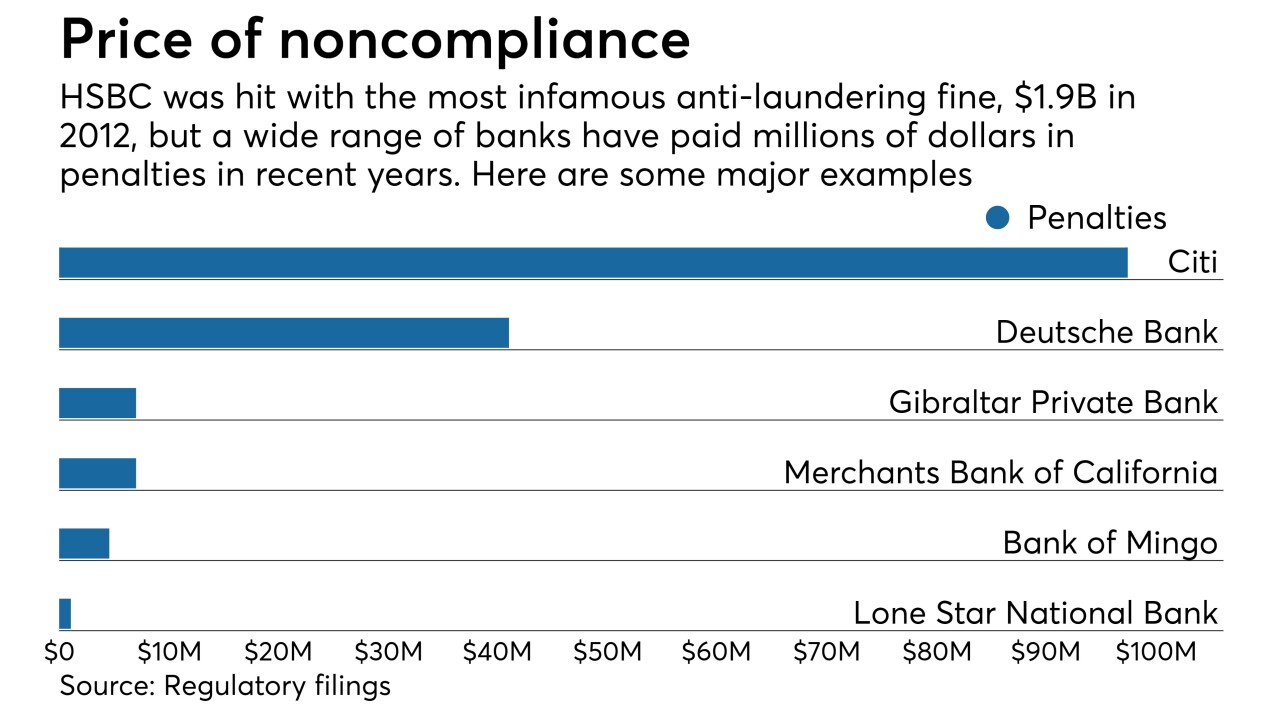

Nothing like revelations of a client’s Ponzi scheme that lead to your bank paying $4 million in anti-money-laundering fines. That’s what happened at Gibraltar Private Bank & Trust, but its CEO argues its compliance overhaul has given the bank a competitive advantage in cosmopolitan New York and South Florida.

September 5 -

GlobalID stands out from scores of similar companies and projects by attempting to wed self-sovereignty with regulatory compliance. If its technology works, it could alleviate a major cost for banks.

July 28