-

The Wisconsin Supreme Court upheld a "narrow interpretation" of a state-level consumer-protection law that maintains lenders' rights to collect debts without fear of being sued for damages.

April 24 -

The settlement comes as Navy makes history by becoming the world’s first credit union to exceed $100 billion in assets.

April 22 -

While NCUA lawyers fielded questions about the possibility of redlining, a three-judge appeals panel showed skepticism about other elements of the ABA's arguments against changes to credit union membership rules.

April 16 -

Last-minute arguments from the American Bankers Association have put the National Credit Union Administration on the back foot in advance of an appeal hearing more than a year in the works.

April 15 -

Last-minute arguments from the American Bankers Association have put the National Credit Union Administration on the back foot in advance of an appeal hearing more than a year in the works.

April 15 -

The bank said it will look outside the company for a replacement; HUD alleges the social media giant allowed real estate firms to target groups in their advertising.

March 29 -

Prosecutors working for Special Counsel Robert Mueller raised the prospect that a $1 million loan to Paul Manafort in 2017 from an "opaque" Nevada company might have been a "sham transaction" in which no repayment was ever expected.

March 25 -

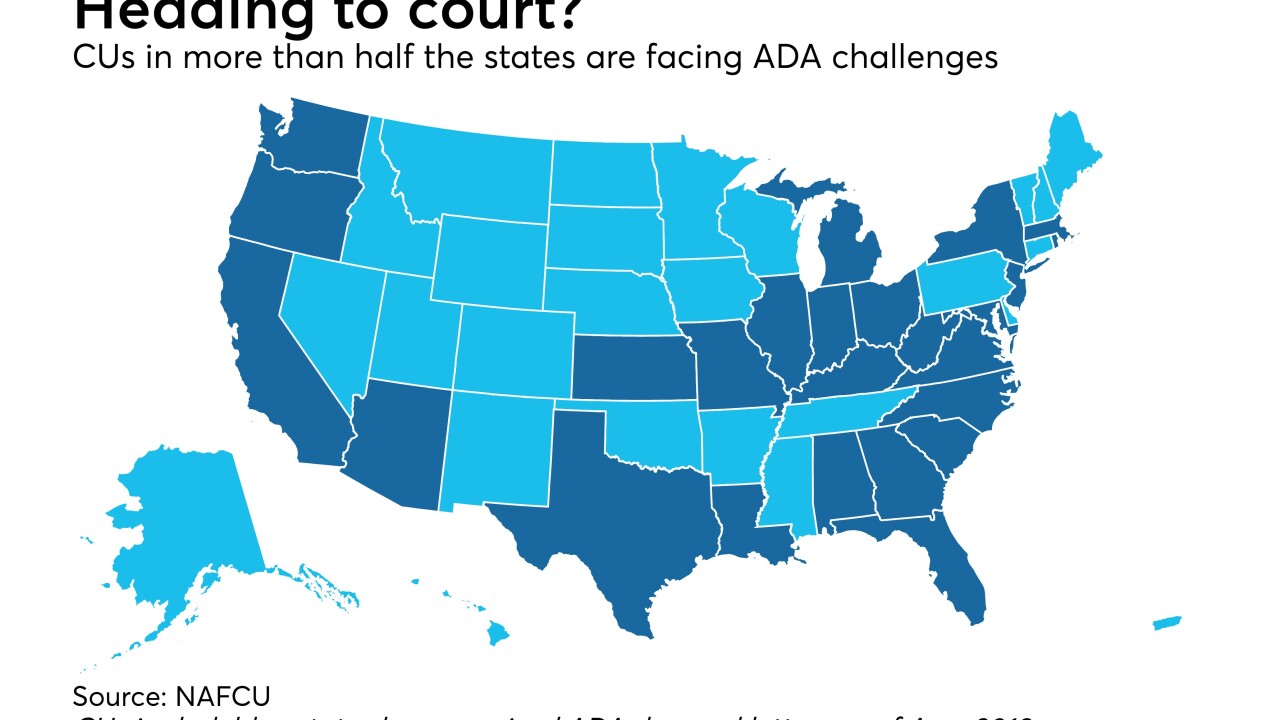

A number of credit unions have faced lawsuits alleging their websites failed to meet the standards of the Americans with Disabilities Act.

March 18 -

American National Bankshares is trying to force the proposed American Bank & Trust to change its name.

February 28 -

Victor Karpiak stepped down as CEO of First Financial in 2013 after years of wrangling with a prominent activist investor.

February 28 -

The Credit Union National Association and several institutions sued the fast food business after a data breach in 2016.

February 14 -

A lawsuit alleging Wells Fargo improperly compensated its California-based mortgage loan officers could have broader ramifications now that it has been granted class certification.

February 8 -

Wells says it's made progress but needs to do more to rebuild trust with customers and regulators; despite rate hikes by the Fed, big banks continue to effectively pay nothing in interest to savings customers.

January 31 -

More credit unions are offering members who are federal employees going without pay relief while industry trade groups urge Washington to end the closure.

January 22 -

Federal regulators should consider applying guidance that is nearly two decades old to end uncertainty about the legality of particular bank partnerships.

January 17 Pepper Hamilton

Pepper Hamilton -

The U.S. Supreme Court turned away a broad challenge to the structure of the Consumer Financial Protection Bureau, the agency that Republicans say has stifled economic growth through over-regulation.

January 14 -

A Colorado businessman's request for a preliminary injunction to stop the bank from using the name “Erica” has been denied. The overall case could still go to trial, but skeptical comments by the judge suggest BofA will likely prevail.

December 31 -

Linda Levy, CEO of Lower East Side People's Federal Credit Union, has no regrets about suing President Trump when he appointed Mick Mulvaney to run the CFPB, despite some negative reactions from her credit union colleagues.

December 28 -

The settlement of a fight with an insurance company over officer and director coverage yielded a $6 million payout for FNCB in Dunmore.

December 24 -

The industry spent a good portion of 2018 fighting ADA and overdraft lawsuits, and experts say despite some progress, next year could hold more of the same.

December 20