-

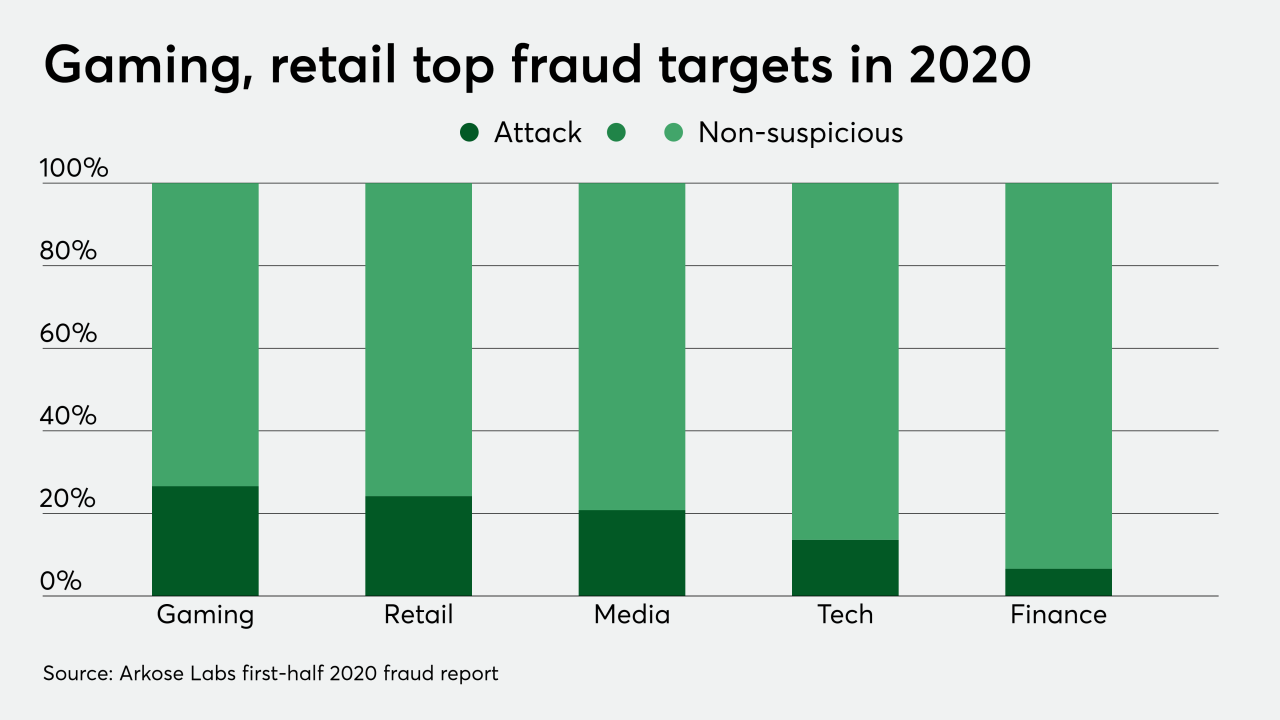

Video games provide a rare escape to locked-down consumers, and many modern games are so sophisticated that they support their own digital storefronts — with the potential for real-world losses if fraudsters find a way in.

August 7 -

Rep. Carolyn Maloney, D-N.Y., was finally declared the winner weeks after election day, while Rep. Lacy Clay of Missouri was defeated by a progressive challenger.

August 5 -

It’s likely that our dependence on digital channels will have become the norm, which means that security protocols like EMV 3-D Secure should also become part of the new status quo, says Entersekt's Simon Armstrong.

August 5 Entersekt

Entersekt -

Scams have ranged from false, pseudo-scientific charities raising money for “cures” or “medical research," to fraudsters preying on individuals who want to donate to medical and emergency staff in hospitals or care facilities, says The ai Corporation's James Crawshaw.

August 4 The ai Corporation

The ai Corporation -

EventBot is a particularly frightening development since it hides in an altered version of an app that seems legitimate and steals unprotected information in banking, wallet, payment and cryptocurrency mobile apps, says Appdome's Tom Tovar.

August 4 Appdome

Appdome -

The regulator banned a former employee of a Florida-based credit union from working at any federally insured financial institution.

July 31 -

Democrats Elizabeth Warren of Massachusetts and Brian Schatz of Hawaii have sent a letter to CEO Charlie Scharf demanding a response to news reports that the bank has been placing borrowers into forbearance plans without their consent.

July 30 -

Lexicon Bank in Las Vegas, whose chairman was a professional gambler, is actively courting poker players to open deposit accounts for their tournament winnings.

July 30 -

The key word is "temporary" with the FHA's quality control waiver expiring and not likely to be renewed.

July 30 ACES Risk Management Corp.

ACES Risk Management Corp. -

The complaint filed by New York, California and Illinois argues that the regulation, issued in response to the 2015 Madden decision, undermines state laws intended to protect consumers.

July 29 -

Legislation that would force transparency around company ownership would be better than another burdensome anti-money-laundering rule.

July 29

-

After the House passed a defense spending bill that included the provision ahead of negotiations with the Senate, industry representatives are optimistic Congress will finally shift the burden of reporting true-owner information from banks to their business clients.

July 27 -

The regulation allows banks to add employees with past convictions for trivial crimes after the industry complained the prior rules were too severe.

July 24 -

The Nashville bank had sued Gaylon Lawrence in 2017 over allegations that he was pursuing an illegal takeover, but the two sides announced terms of a settlement.

July 24 -

Quantexa, which uses artificial intelligence to detect money laundering and other financial crime, is already being used by HSBC and Standard Chartered Bank.

July 23 -

TransUnion is expanding the geographic reach of its instant Document Verification service in response to the pandemic, with more users requiring ID confirmation from remote locations as fraud risks hit new highs.

July 22 -

The National Defense Authorization Act, approved in a vote late Tuesday, includes measures to require companies to disclose their true owners at the point of incorporation and to improve information-sharing between banks and the government.

July 22 -

The biggest takeaway from this hack should be large digital media companies reworking their admin controls

July 22 LunarCrush

LunarCrush -

The “new normal” of COVID-19-influenced retail is actively being exploited by fraudsters, as LexisNexis Risk Solutions finds fraud costs for U.S. retailers rising in 2020 by 7.3% over last year’s data.

July 21 -

Mortgages taken out to fund business operations can now be modified in bankruptcy. That’s a relief to borrowers — particularly with business failures expected to increase as the pandemic drags on — but a possible headache for banks and investors that hold the loans.

July 20