-

Credit unions are well positioned to serve small businesses, but they'll lose that opportunity if they're not adequately protecting those members' cash flow.

November 16 ACH Alert

ACH Alert -

California-based America's Christian Credit Union's efforts earned it a 2018 Best Practices Award.

November 16 -

Payday lenders argue that banks cut ties with their industry due to pressure from biased and hostile regulators. But the reality, in some cases, may be more nuanced.

November 16 American Banker

American Banker -

The Justice Department is seeking information about potential transactions the banks may have handled for a small Danske branch in Estonia that’s at the center of one of the biggest money-laundering investigations in history, according to two people familiar with the matter.

November 16 -

Prosecutors are unlikely to buy Goldman's rogue banker defense, observers say; survey predicts recession within two years.

November 16 -

Will prosecutors believe a rogue banker was behind Malaysia fraud?; banks that changed standards in Q3 were more likely to ease underwriting.

November 14 -

The bank recently notified an upstate New York man that he was wrongly denied a mortgage modification, and enclosed a $25,000 check. But details of what went wrong have been hard to come by.

November 13 -

With fraud rising alongside mobile deposit usage, credit union executives needed a way to solve the problem without making the process burdensome to employees and members.

November 13 -

A judge dismissed two of the six counts against the Mass.-based credit union, meaning DFCU will join several other CUs nationwide facing similar suits.

November 12 -

Top executives at Advance America acknowledged that anti-money-laundering concerns at banks were likely the cause of account terminations, even as they publicly blamed a stealth regulatory campaign.

November 12 -

What the Democrats' House takeover means for banks; Synchrony has a lot to lose in fight with Walmart; should industry fear Waters-led banking panel?; and more from this week's most-read stories.

November 9 -

PNC is piloting IDEMIA’s motion code card which offers a dynamic CVV2 security code for its commercial clients in an effort to combat card not present fraud.

November 9 -

A new group aims to foster collaboration between fintechs and state and federal officials in the fight against crime — without hindering legitimate business innovation.

November 9 -

HSBC is the latest bank to be hit with this type of attack, in which hackers take stolen usernames and passwords from one site and attempt to reuse them to login to banks.

November 9 -

The Nashville, Tenn., company had opposed a request by Gaylon Lawrence to boost his ownership to 15%.

November 9 -

The former Goldman CEO is said to be the unnamed executive at a meeting with Asian financier; the bank faces multibillion-dollar penalties in two countries.

November 9 -

UBS Group sold tens of billions of dollars' worth of residential mortgage-backed securities by "knowingly and repeatedly" making false and fraudulent statements to investors about the loans backing those trusts, the U.S. Justice Department said in a civil suit filed Thursday.

November 8 -

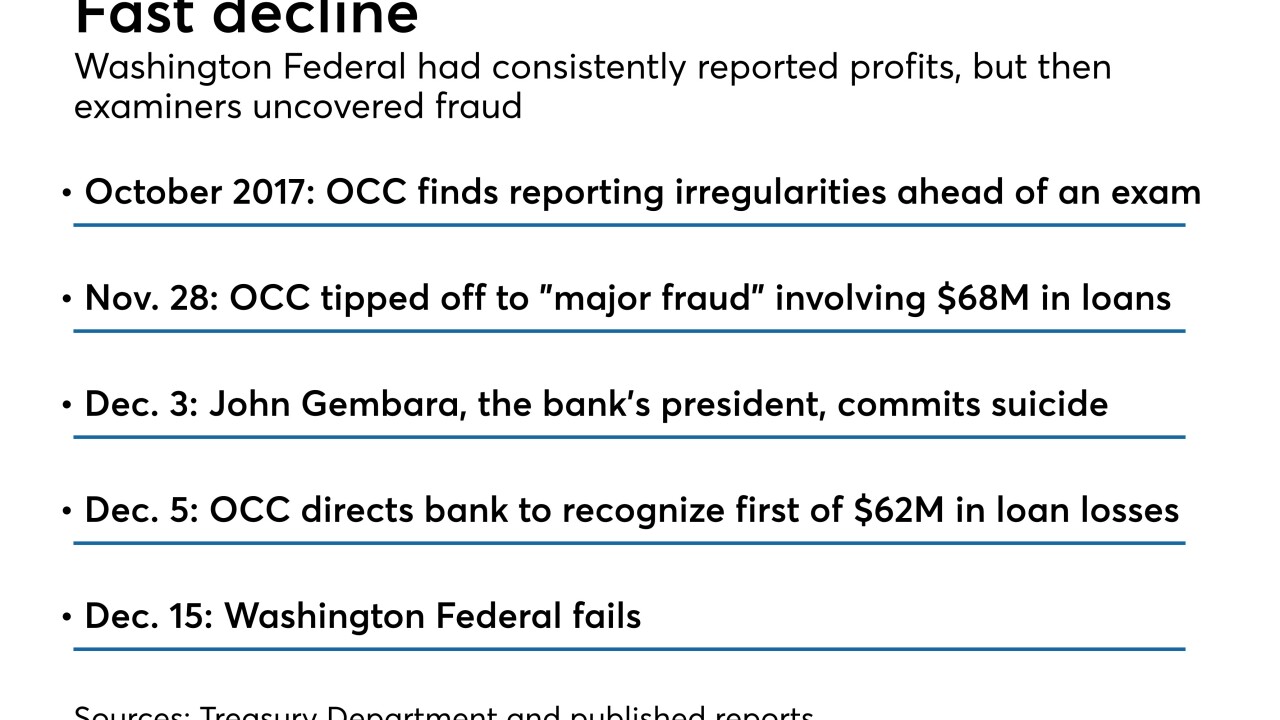

Examiners could have done more to minimize the brunt to the Deposit Insurance Fund from Washington Federal Bank for Savings, which hid fraudulent loans and will cost the fund more than $80 million, according to a report from the Treasury’s inspector general.

November 8 -

The Swiss banking giant has been accused of helping wealthy French clients hide assets from tax authorities.

November 8 -

Payday lenders argue that banks cut ties with their industry due to pressure from biased and hostile regulators. But the reality, in some cases, may be more nuanced.

November 8 American Banker

American Banker