-

In the new role, Kenneth Montgomery will lead the Fed’s efforts to reduce fraud risk and improve the security and resiliency of the U.S. payments system

December 8 -

Tether's $31 million hack gave bitcoin skeptics plenty to crow about. But experts say bad security is to blame, not digital assets.

December 8 -

The president wrote Friday on Twitter that penalties against the San Francisco bank will be maintained, or possibly strengthened. The comments are likely to fuel a growing controversy about the independence of federal financial regulators.

December 8 -

Credit unions tend to have strong anti-harassment policies in place, but they're meaningless if they're written down and then forgotten.

December 8 -

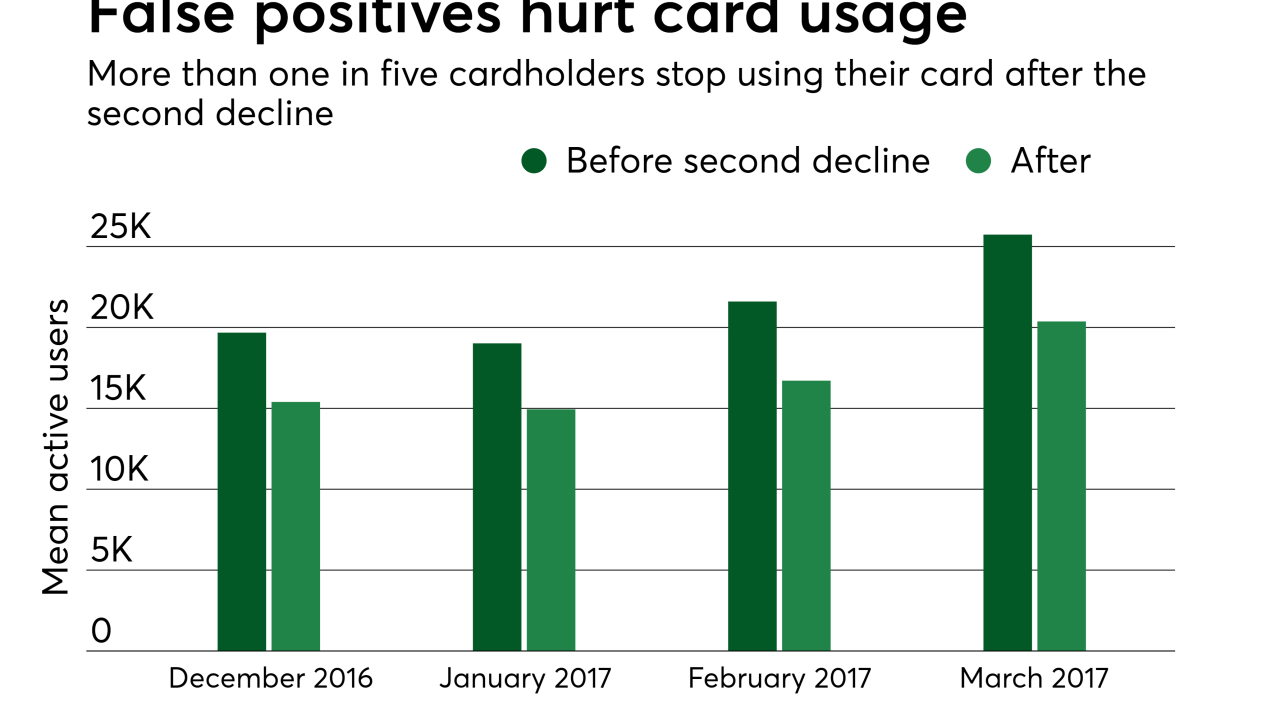

Card usage drops off fast after a false positive. In many cases, two false positives cause consumers to abandon a card permanently.

December 8 -

The agency has suffered a series of setbacks over the past two months, from a rollback of its arbitration rule to a legal battle over its leadership. Here's what happened — and where the agency might lose next.

December 6 -

A federal judge said Tuesday that he will hear motions Dec. 22 in a case that seeks a preliminary injunction against acting Consumer Financial Protection Bureau Director Mick Mulvaney and would instead install Deputy Director Leandra English as interim head of the agency.

December 5 -

The Office of Financial Research warned that a cyberattack could "disrupt the operations of one or more financial companies and markets and spread through financial networks and operational connections to the entire system."

December 5 -

Most merchant processors’ current point of sale software allows you to send the credit card information once and you capture a token versus the actual credit card number, writes Michael Lewis, CIO of Copper State Communications.

December 5 Copper State Communications

Copper State Communications -

Five years have passed since M&T agreed to buy Hudson City, only to be tripped up by anti-money-laundering issues. With a clean bill of health from regulators and Hudson integrated, management is again talking about its interest in deals.

December 1 -

The former heads of the House and Senate banking committees argued Thursday that the Dodd-Frank Act clearly intended to allow the CFPB's deputy director to serve as acting director after the full-time head of the agency departed.

November 30 -

Those issued a prohibition order are barred from participating in the affairs of any federally insured financial institutions.

November 30 -

Neither the acquirer processing the payment, nor relevant regulatory bodies ever know that these payments are actually for illicit goods, making transaction laundering particularly dangerous and far-reaching, writes Ron Teicher, CEO of EverCompliant.

November 30 EverCompliant

EverCompliant -

For remaking East West Bank from a small savings institution into a $36.3 billion-asset player with a seat on the front lines of U.S.-China relations — all while churning out record earnings year after year — American Banker is recognizing Ng for being a "Consistent Performer" as part of our 2017 Banker of the Year awards.

November 28 -

District Judge Timothy J. Kelly ruled Tuesday that Office of Management and Budget Director Mick Mulvaney was the legal interim head of the Consumer Financial Protection Bureau, denying a request by Deputy Director Leandra English to block the appointment.

November 28 -

United Nations Federal Credit Union and two others have consented to pay $1.47 million for offering, marketing and underwriting unlicensed credit and debit card-based life insurance programs.

November 28 -

The trade group wants Equifax to reimburse community banks for costs tied to the massive data breach at the credit bureau this year. The ICBA also wants a court to order Equifax to improve its security measures.

November 28 -

Nearly half of the cardholders in the U.S. have had at least one card reissued in the past year, with those experiencing fraud multiple times saying they have had nearly five cards reissued.

November 28 -

The right platform can detect unusual behaviors and block fraudulent transactions as they occur, while still allowing real customers to make legitimate transactions without interruptions, writes Dave Excell, CTO and co-founder of Featurespace.

November 28 Featurespace

Featurespace -

Bay Bancorp shareholders will get the added payouts if the Maryland bank's management settles a lawsuit and addresses a number of bad credits.

November 27