-

The first day of CU Direct's annual Drive conference included insights from dealers, executives at online car-buying platforms and more.

May 16 -

As evidenced by a Senate hearing, Republican and Democratic lawmakers still live in alternative universes when it comes to financial regulatory policy.

May 15 -

At a Senate Banking hearing focusing primarily on predatory lending practices, NCUA Chairman Rodney Hood offered insight into the agency's priorities under his leadership.

May 15 -

Everything from phone bills to utility payment histories could help credit unions expand lending opportunities to consumers without a credit score.

May 15 Urjanet

Urjanet -

Ask 453 bankers their forecasts on loan demand and the economy, or their feelings about the BB&T-SunTrust merger, pot banking as well as other hot issues, and a clear picture emerges. Promontory Interfinancial Network recently did just that, and here our five takeaways from the results.

May 15 -

It's not likely most lenders or credit card issuers would jump at the chance to give more money to a customer having trouble making payments. But for some borrowers, that may be the best solution to this problem.

May 8 -

The Odon, Ind.-based credit union also grew its membership to over 50,000, up more than 9% from a year earlier.

May 6 -

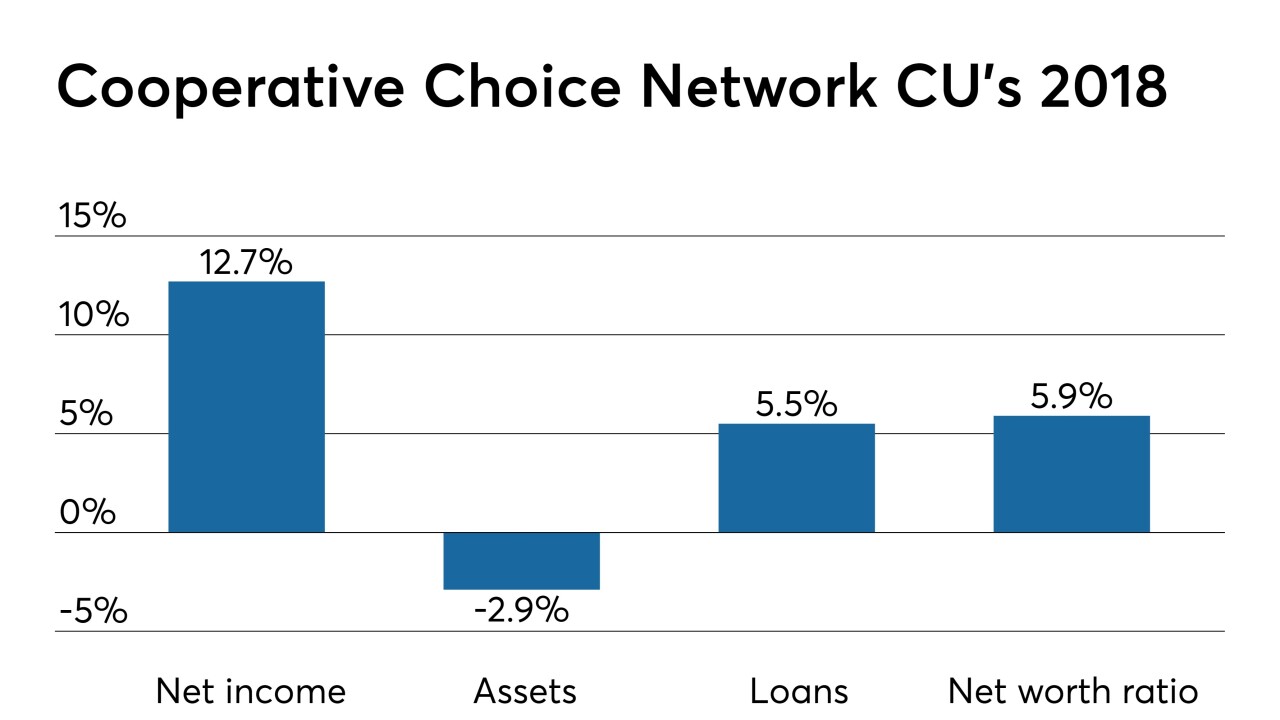

On Dec. 31, 2018. Dollars in thousands.

May 6 -

Community banks in the state have struggled to attract the funds to meet surging loan demand, but that could change now that a new law has made it easier for them to accept government deposits.

May 3 -

Las Vegas-based institution said its first-quarter net income was down about 21% from a year earlier.

May 3 -

The Honolulu-based credit union said its earnings dropped by more than 37% from a year earlier.

May 2 -

The nation's first credit union saw an 88.5% increase in net income for 2018 thanks to a variety of factors, including a one-time payout from the National Credit Union Administration.

April 25 -

Credit union share of the credit card market is at a record high but there are concerns that this debt could begin to sour if the economy turns.

April 25 -

The British startup OakNorth sees U.S. community and regional banks as good prospects for its lending technology.

April 23 -

The Raleigh, N.C.-based institution said it also has more than 500 employees.

April 23 -

During the National Credit Union Collections Alliance conference, experts shared best practices on several topics, including navigating member bankruptcies and positioning auto loans for a downturn.

April 18 -

CUNA Mutual Group's February trends report showed that growth in auto loans, mortgages and membership had slowed.

April 17 -

The Peoria, Ill.-based institution also saw increases in lending and net worth.

April 16 -

By Mastercard’s own reckoning, the point-of-sale financing space is a $1.8 trillion market in the U.S. alone, making its Vyze acquisition a natural way to pursue an opportunity that’s being gobbled up by fintechs and card alternatives.

April 16 -

The Illinois-based credit union, which recently announced an expanded field of membership, saw loans rise by nearly 7% in 2018.

April 12