-

The Kansas-based institution saw growth in a number of areas last year, though increased staffing costs.

March 5 -

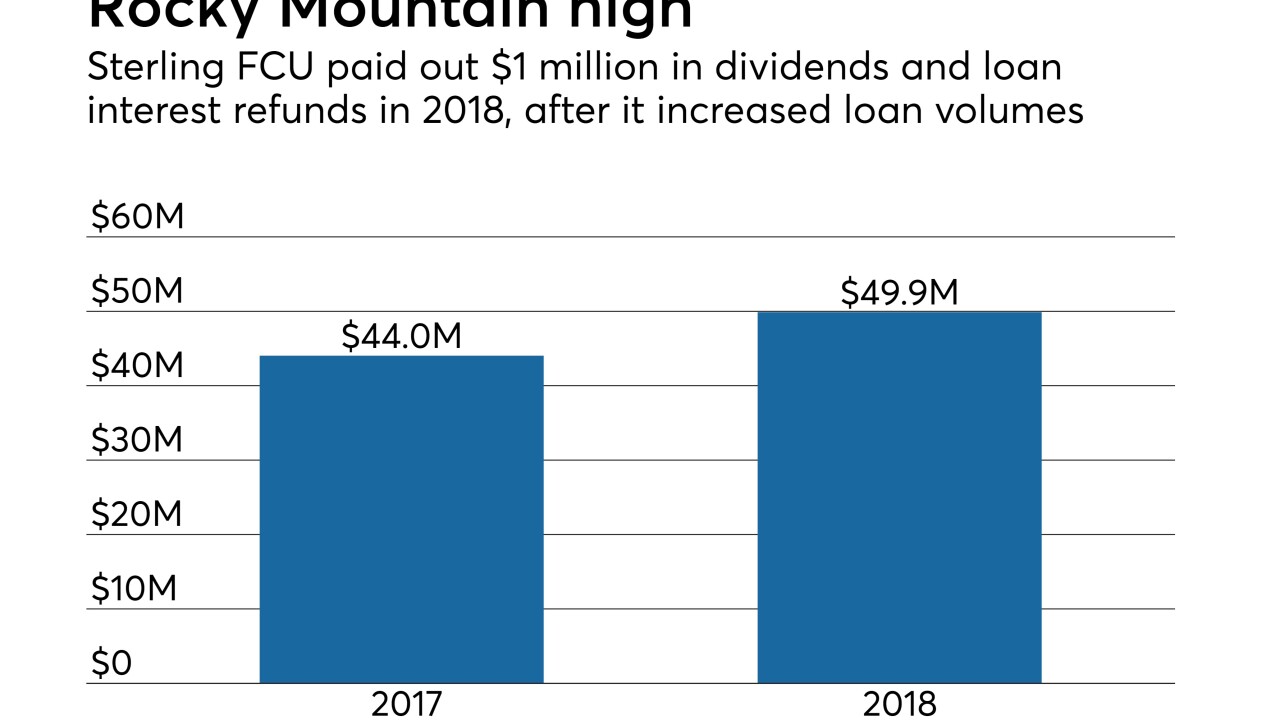

The payout included bonus dividends and a 7 percent refund of loan interest paid by members.

March 5 -

Credit unions are getting better at using data analytics to pitch loan refinancing options to members, though there are still some pitfalls with the strategy.

March 4 -

The latest Credit Union Trends Report from CUNA Mutual Group shows strong performance in membership growth and delinquencies, but lending is beginning to slow and could slow further by next year.

March 1 -

Year to date Sep. 30, 2018. Dollars in thousands.

February 19 -

Credit unions tout their readiness to assist with a variety of life stages, but a loan product for one of the most difficult potential life experiences is virtually nowhere to be found.

February 15 -

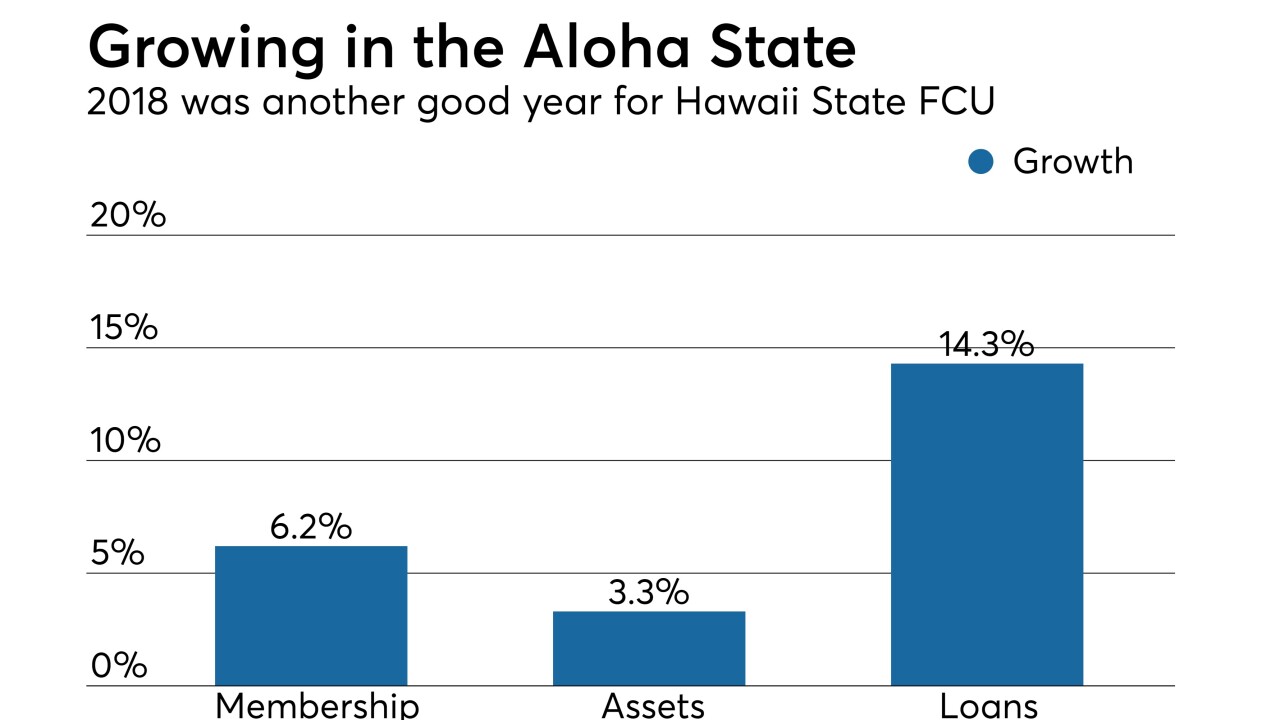

Among the 2018 highlights for the Honolulu-based credit union were a 108% rise in net income.

February 11 -

Banks that gather deposits through branches generally pay lower deposit premiums than those that solicit deposits online. So what happens if long-standing restrictions on brokered deposits are relaxed?

January 30 -

After struggling during the Great Recession, the Las Vegas-based credit union has now posted 27 consecutive quarters of positive results.

January 29 -

On Sep. 30, 2018. Dollars in thousands.

January 28 -

Loan demand is finally picking up after several lackluster quarters. Banks' big challenge is finding cheap deposits to fund all those new loans.

January 18 -

President Trump has threatened that the closure may go on for a prolonged period. This could lead to higher loan delinquencies at credit unions that serve federal workers.

January 10 -

Now the third-longest shutdown in history, there are few signs the government will reopen anytime soon, and that's causing problems for lenders.

January 7 -

With the government shutdown set to extend into 2019, a growing number of credit unions are putting together offers to aid members impacted by furloughs.

December 28 -

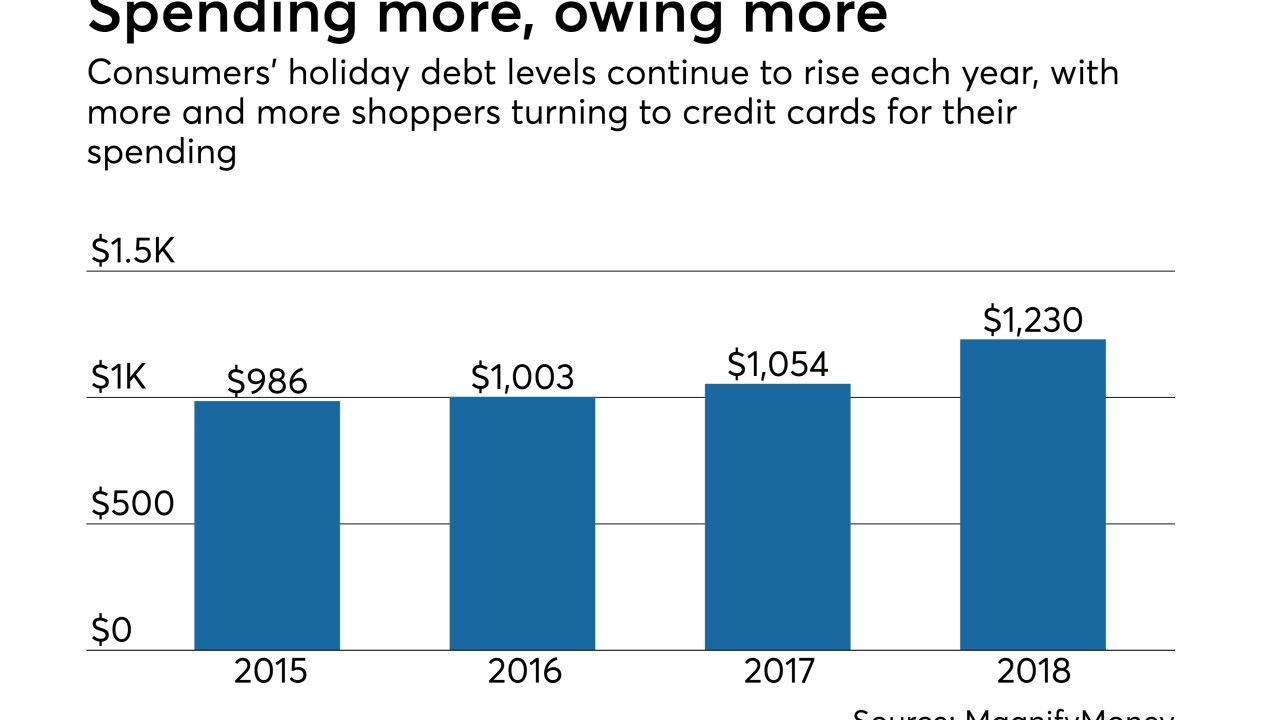

A pair of studies released Thursday show consumers once again added to their debt burden during the holiday season even as they admit to needing more financial education.

December 27 -

Recent data from NCUA showed a lot of positives for the industry, but it also revealed some potentially worrisome trends.

December 18 -

Regulatory and demographic shifts have altered the path to credit for younger American consumers. Those shifts have opened up lending opportunities, particularly at the digital point of sale. Merchants, startups and financial institutions are all vying for a share of this (potentially very) lucrative business.

December 14 -

With Brexit on the horizon, the volatility of the U.K. financial market has created an increased demand for more flexible financing among small and medium-sized enterprises. But a decade on from the 2008 financial crisis, the loans available for SMEs are still restricted by regulations on the total amount of capital that banks must hold.

December 12 -

Fintechs and banks are both pursing the market, which much adjust to handle the larger volume, according to Nufar Segal Bareket, a general manager at Jifiti.

December 12 Jifiti

Jifiti -

KKR , which has a substantial financial services portfolio, has made a $75 million equity investment in Cross River Bank, part of an overall $100 million capital raise. Cross River will use the funds to expand the technology and compliance infrastructure that it provides to fintech organizations.December 10