-

Bigger credit unions present a formidable challenge for banks in areas such as business lending.

May 16 -

The credit union’s members want products to help with cash flow, working capital and business expansion

January 30 -

Lending -- and particularly member business lending -- in the two states continues to rise, according to new data.

November 20 -

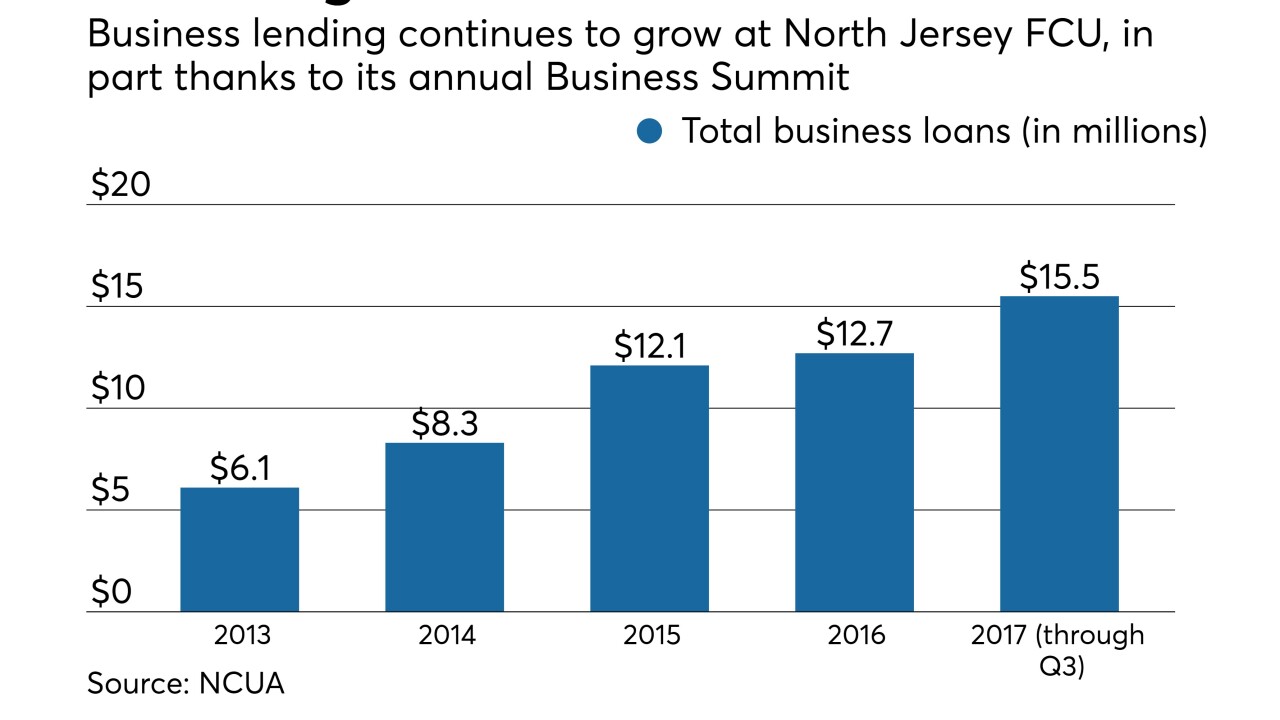

The credit union has hosted its annual Business Summit for the last seven years, and the event continues to grow in popularity.

November 17 -

Well-known in the industry for its business lending prowess, Royal Credit Union was looking for a way to streamline its MBL process.

October 26 -

Best Practices Awards offer a wealth of field-tested ideas to improve your credit union.

October 16 -

H.R. 3866 would remove veteran’s loans from the CU member business loan cap

September 29 -

Points about various exam and regulatory credit union issues were raised

September 29 -

The designation allows the $1 billion credit union to process SBA loans within 36 hours and to approve them without sending them to the agency first.

August 29 -

The National Association of Federally-Insured Credit Unions defended the credit union tax exemption and called for other financial reforms during a meeting Tuesday with Treasury Secretary Steven Mnuchin.

August 22 -

Natasha Merz, VP of commercial lending at Langley FCU, testified before a House small business subcommittee on ways Congress can help credit unions and the SBA better fulfill a common mission.

June 29 -

Four key areas examiners will be looking at related to the new rule that CUs should brush up on today.

June 20 nCino

nCino -

To capitalize on the current market environment, CUs need a solid auto-decisioning strategy in place to manage the increased volume of MBL applications while mitigating risk and delivering top-notch service to members.

May 30 Baker Hill

Baker Hill -

With new rules in place, experts offer tips on how to be the MVP of MBLs.

May 16 -

NCUA’s updated rule offers new freedom to grow but also comes with additional responsibilities. Here’s what some credit unions have learned in the first few months.

May 12 -

With their big-picture view across multiple portfolios, some CUSOs are reporting an increased appetite for business loans and participations.

May 11 -

The $1.2 billion-asset credit union was recently approved for conversion to a federal trade, industry and professional charter, making it the first firefighters’ credit union in the nation chartered specifically for business lending.

May 8 -

The $1.8 billion-asset institution converted to a federal charter out of a desire to broaden its member base and make member business loans.

April 25 -

Sens. Ron Wyden, D-Ore., Lisa Murkowski, R-Alaska, Elizabeth Warren, D-Mass., and Ed Markey, D-Mass., introduced a bill Wednesday that would allow credit unions to increase their business lending.

April 5 -

In addition to 11.5 percent loan growth and membership rising at its fastest rate since 1987, membership at Michigan's CUs is growing faster than the state's population.

March 31