-

If they don't have them in place already, financial services firms need to provide digital budgeting tools, mobile payment and banking services before young consumers flee to other providers, says Chris Koeneman, senior vice president of strategic solutions for MOBI.

December 17 MOBI

MOBI -

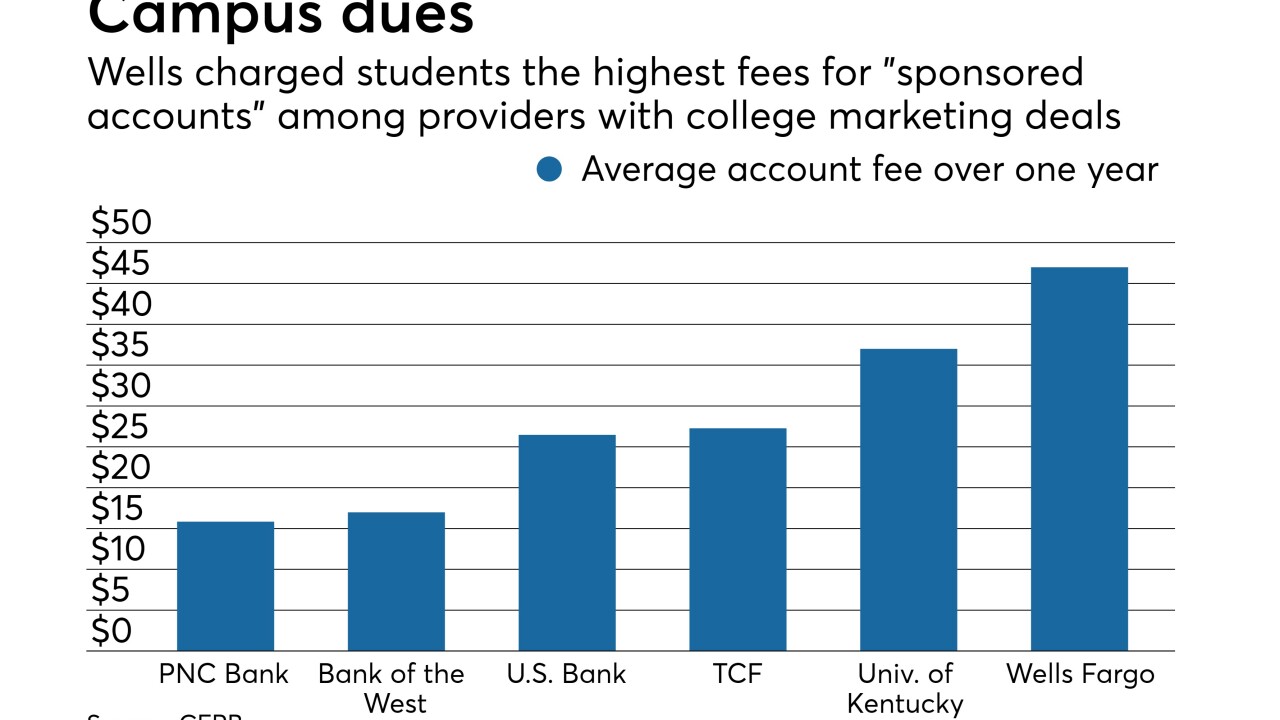

Wells Fargo charges students nearly four times as much in fees as banks without college marketing agreements, according to an internal report by the Consumer Financial Protection Bureau.

December 10 -

The online lender has acquired NextGenVest, which uses AI and text messaging to advise high school and college students about getting loans. CommonBond’s goal is to better understand the distinctly different demographic group rising behind millennials.

December 4 -

Adults ages 18 to 29 may have a hard time getting a mortgage, but they are not shying away from other forms of consumer debt, according to a report by the New York Fed.

November 16 -

The bank has long had a program in place to train new employees, but now it’s testing a pilot to help retrain existing staff for different careers at the institution.

November 15 -

Credit unions enjoyed a boost to membership as consumers fled the big banks in the wake of the financial crisis. But they can't wait for the next global disaster to drive younger members into their arms.

October 30 FIS

FIS -

Trade associations and other industry groups are partnering with universities and colleges to create more degree programs and special courses that prepare young people to work for banks — especially small ones.

October 29 -

Financial institutions need to adapt their offerings to meet the preferences of these young consumers or they risk losing ground to fintechs and other nontraditional players.

October 18 CCG Catalyst

CCG Catalyst -

College prospects cite the financial crisis as one reason they are passing on community bank jobs to join fintechs.

October 15 -

Millennials are targeting homeownership within the next few years, but many are buying into certain house-purchasing myths, according to Bank of America.

October 10 -

When it comes to attracting millennials, mortgages could be the key to capturing this demographic for the long haul – provided CUs are willing to put in the work.

September 26 -

Gen Z recruits add a fresh perspective and provide a talent pipeline for the future, bankers say.

September 25 -

For businesses that serve a predominantly millennial audience, knowing the age group’s tolerance toward online security measures is an important lesson that coincides with customer retention, according to David Britton, vice president of industry solutions of global fraud and identity at Experian.

September 21 Experian

Experian -

A new study from Pentagon Federal Credit Union finds a sizable portion of consumers will be shopping for a mortgage within two years, but it also revealed some major misconceptions surrounding the process.

September 18 -

By combining different types of structured and unstructured online data with the traditional offline data and applying data science to it, we can much more reliably discern whether a person's identity is real, according to Sunil Madhu, founder and chief strategy officer of Socure.

September 18 Socure

Socure -

The broadening of JPMorgan's Sapphire Reserve brand is emblematic of the niche expansion megabanks must rely on since bank M&A is not an option.

September 13 -

Cape Cod Five Cents Savings Bank has transformed its summer intern program so that it is more structured and attracts students who could see themselves staying in the industry.

September 13 -

The head of commercial banking at Citizens Financial urged bankers and other financial professionals to step out of their traditional roles and guide clients through corporate governance, data and other challenges that they themselves have dealt with.

September 6 -

How the 'Best Banks to Work For' get employees to love their jobs; Comerica works to address fraud in prepaid benefits program; how to tell if you're banking a pot business; and more from this week's most-read stories.

August 31 -

Savings Bank of Walpole loosened up internal policies that had limited body art and cellphone use, and it created the position of community engagement coordinator, to connect with younger workers.

August 30